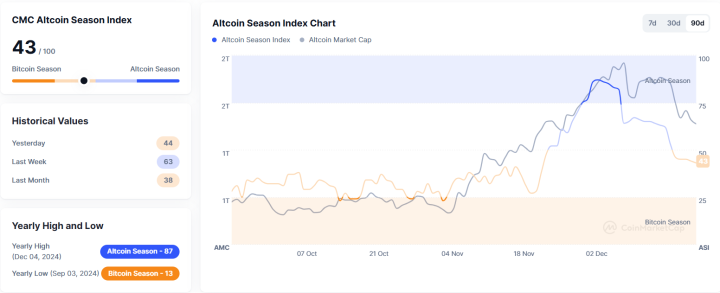

Altcoin Season Index Falls to 43, Indicating Bitcoin Season

As of December 23, 2024, the Altcoin Season Index registered a score of 43, marking a one-point decline from the previous day. This shift signals that the cryptocurrency market is currently in Bitcoin Season, where Bitcoin (BTC) is outperforming most altcoins in terms of price performance. The Altcoin Season Index, tracked by CoinMarketCap (CMC), serves as a valuable metric to gauge the overall sentiment in the cryptocurrency market, particularly in relation to altcoins versus Bitcoin.

What is the Altcoin Season Index?

The Altcoin Season Index is a tool that compares the performance of the top 100 coins listed on CoinMarketCap (CMC) over a 90-day period, excluding stablecoins and wrapped tokens. The index uses this data to determine whether the market is in Bitcoin Season or Altcoin Season based on how the top altcoins are performing relative to Bitcoin.

For the market to be considered in Altcoin Season, at least 75% of the top 100 coins must outperform Bitcoin. Conversely, if Bitcoin outperforms 75% or more of the top 100 coins, the market is in Bitcoin Season. The index score ranges from 1 to 100, with scores closer to 100 indicating a stronger Altcoin Season, while scores closer to 1 reflect a dominance of Bitcoin in the market.

Current Market: Bitcoin Season

With the Altcoin Season Index now at 43, it indicates that Bitcoin has regained the upper hand in the market. This is consistent with the idea of Bitcoin Season, where Bitcoin’s dominance continues to outpace the performance of altcoins. At this score, Bitcoin is outperforming altcoins, and this can be attributed to various factors such as institutional interest, market uncertainty, or Bitcoin’s status as a store of value during volatile market conditions.

The shift into Bitcoin Season often means that investors are turning their attention to Bitcoin as a more stable and safe haven asset, especially when there is market turbulence or unfavorable conditions for altcoins. Bitcoin’s dominance in the market can lead to increased capital inflows into Bitcoin while altcoins experience more volatility and price corrections.

How the Altcoin Season Index Works

The Altcoin Season Index is updated daily, reflecting the latest market conditions. The index’s primary purpose is to provide cryptocurrency investors with insight into the performance trends of Bitcoin and altcoins, offering a gauge of whether altcoins are gaining traction or if Bitcoin continues to dominate. The index is calculated based on the performance of the top 100 coins by market capitalization, making it a broad indicator of market sentiment.

The key threshold for Bitcoin Season is when 25% or fewer of the top 100 coins outperform Bitcoin. In this current scenario, with the index score at 43, it is clear that the altcoins are lagging behind, and Bitcoin continues to maintain its dominance.

Factors Influencing Bitcoin Season

Several factors could be contributing to the ongoing Bitcoin Season as reflected in the Altcoin Season Index. Some of the key reasons include:

- Institutional Adoption of Bitcoin – As more institutional investors integrate Bitcoin into their portfolios, the demand for Bitcoin continues to rise. This drives Bitcoin’s price performance higher, overshadowing altcoins.

- Market Sentiment and Economic Uncertainty – During times of economic uncertainty or market volatility, investors often flock to Bitcoin as a safe-haven asset. Bitcoin’s perceived stability compared to altcoins leads to greater capital flows into Bitcoin.

- Regulatory Developments – Regulations and legislative changes surrounding cryptocurrencies can affect altcoins more than Bitcoin, causing investors to shift their focus back to Bitcoin during uncertain regulatory periods.

- Bitcoin’s Historical Performance – Bitcoin has a long history of outperforming altcoins during periods of strong market growth or economic stress. Its first-mover advantage and established market dominance make it the preferred choice for many investors.

What’s Next for the Altcoin Market?

Despite the dominance of Bitcoin, the Altcoin Season Index can shift quickly, especially if there is a major surge in altcoin performance relative to Bitcoin. Altcoins can experience periods of explosive growth driven by new technological advancements, protocol upgrades, or market trends that favor specific altcoins.

For instance, if the DeFi (Decentralized Finance) space continues to expand, or if there is a breakthrough innovation in blockchain technology that benefits altcoins, the Altcoin Season could return. Similarly, if Ethereum or other major altcoins experience significant price rallies or adoption increases, we could see a shift back toward Altcoin Season.

Conclusion: A Period of Bitcoin Dominance

Currently, the Altcoin Season Index at 43 indicates that the market remains firmly in Bitcoin Season, with Bitcoin outperforming the majority of altcoins. While Bitcoin’s dominance continues to rule the market, altcoins will likely need additional catalysts to make a strong comeback. Investors should remain mindful of the market sentiment and track the Altcoin Season Index for signs of a potential shift in the coming months.

As the cryptocurrency market evolves, the relationship between Bitcoin and altcoins will continue to be shaped by technological developments, regulatory changes, and market dynamics. Whether the market will shift back to Altcoin Season or remain in Bitcoin Season will depend on the broader market trends and the performance of individual cryptocurrencies.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.