U.S. Spot Bitcoin ETFs See $463M in Net Inflows, BlackRock IBIT Leads the Pack

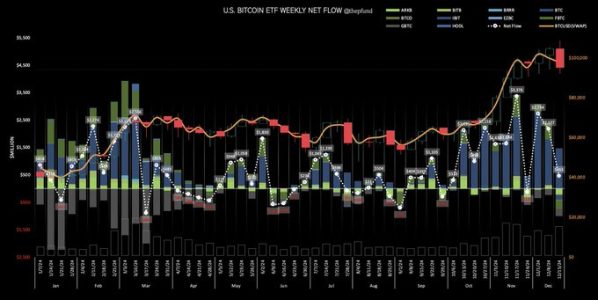

According to recent data shared by Trader T (@thepfund) on X (formerly Twitter), U.S. spot Bitcoin ETFs experienced a combined net inflow of $463 million last week. The data highlights significant developments within the Bitcoin ETF market, with a notable influx of capital into Bitcoin-based exchange-traded funds (ETFs) as institutional and retail investors continue to seek exposure to the cryptocurrency market.

Among these Bitcoin ETFs, BlackRock’s IBIT ETF led the way, recording a substantial net inflow of $1.452 billion. In contrast, when excluding IBIT, the remaining U.S. spot Bitcoin ETFs saw net outflows totaling $989 million. This stark contrast between IBIT’s inflows and the outflows from other ETFs suggests a growing preference for BlackRock’s ETF in the current market environment.

Key Highlights: U.S. Spot Bitcoin ETFs

- Combined net inflows of $463 million for U.S. spot Bitcoin ETFs last week.

- BlackRock’s IBIT ETF saw an impressive net inflow of $1.452 billion.

- Other U.S. Bitcoin ETFs experienced net outflows of $989 million.

- The trading volume for U.S. spot Bitcoin ETFs for the same period reached $26 billion.

- Since the start of the fourth quarter, these ETFs have accumulated a cumulative net inflow of $17.5 billion.

BlackRock’s IBIT ETF Dominates with Record Inflows

The strong performance of BlackRock’s IBIT ETF stands out in the latest data, as it alone accounted for a net inflow of over $1.45 billion. This surge in capital into IBIT underscores the growing institutional appetite for Bitcoin exposure through regulated financial products. BlackRock’s entry into the Bitcoin ETF space has been met with enthusiasm from investors looking to gain exposure to Bitcoin without the complexities of directly holding the cryptocurrency.

The IBIT ETF’s performance reflects the broader trend of institutional adoption of cryptocurrencies, especially as major financial institutions like BlackRock continue to develop Bitcoin-related products. This marks an important milestone for Bitcoin ETFs, signaling that institutional interest in digital assets is gaining momentum and could continue to drive Bitcoin’s price and market legitimacy.

Other Bitcoin ETFs Struggle with Outflows

Despite the success of IBIT, other U.S. spot Bitcoin ETFs have experienced challenges, with net outflows totaling $989 million. This disparity between IBIT’s performance and that of other Bitcoin ETFs may be due to several factors, including investor preference for larger, well-established funds like BlackRock’s IBIT, which benefits from its strong brand reputation and institutional backing.

Moreover, the ongoing market volatility and the complex regulatory environment surrounding cryptocurrencies may have led to a more cautious stance from investors, particularly in the Bitcoin ETF sector. Smaller ETFs may be struggling to maintain investor confidence as a result, while larger funds like IBIT continue to see strong inflows.

Cumulative Net Inflows of $17.5 Billion in Q4

Looking at the broader picture, U.S. spot Bitcoin ETFs have experienced a cumulative net inflow of $17.5 billion since the beginning of the fourth quarter of 2024. This reflects an overall positive trend for Bitcoin ETFs, despite the mixed results among individual funds. The overall growth in inflows indicates that investors are increasingly turning to Bitcoin ETFs as a way to gain exposure to the cryptocurrency market while mitigating some of the risks associated with direct cryptocurrency trading.

Trading Volume and Investor Sentiment

The total trading volume for U.S. spot Bitcoin ETFs for the week was reported at $26 billion. This significant volume suggests that there is robust market activity and interest in Bitcoin-related financial products, particularly in the run-up to year-end. As Bitcoin remains a dominant force in the crypto market, Bitcoin ETFs are likely to continue to play a key role in providing access to digital assets for both retail and institutional investors.

Conclusion: Growing Institutional Interest in Bitcoin ETFs

The $463 million net inflow into U.S. spot Bitcoin ETFs last week, driven largely by the BlackRock IBIT ETF, is a strong indicator of the growing institutional interest in cryptocurrencies. The disparity between IBIT’s inflows and the outflows from other ETFs highlights the preference for larger, more established Bitcoin-backed financial products.

With a cumulative net inflow of $17.5 billion for Bitcoin ETFs in the fourth quarter of 2024, the momentum for institutional Bitcoin adoption is expected to continue into the new year. As more investors turn to Bitcoin ETFs for exposure to the crypto market, these funds will likely play a critical role in the continued growth and maturation of the Bitcoin market.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.