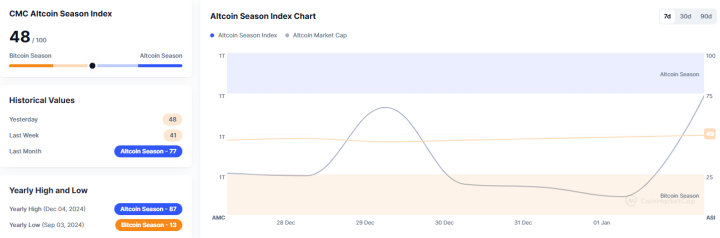

The Altcoin Season Index 2025, tracked by CoinMarketCap (CMC), remains steady at 48 as of January 2. This unchanged reading indicates that the crypto market is currently in Bitcoin Season, where Bitcoin continues to outperform the majority of altcoins. To transition into Altcoin Season, 75% of the top 100 cryptocurrencies need to outpace Bitcoin’s performance over the last 90 days. This article delves into the implications of the index, its methodology, and what this means for investors navigating the current market dynamics.

Understanding the Altcoin Season Index

1. What Is the Altcoin Season Index?

The Altcoin Season Index measures the relative performance of altcoins against Bitcoin. The index uses the following criteria:

- Altcoin Season: If 75% of the top 100 coins outperform Bitcoin over 90 days.

- Bitcoin Season: If 25% or fewer outperform Bitcoin.

2. Index Score Range

- 1-24: Strong Bitcoin Season

- 25-49: Bitcoin Season

- 50-74: Transition Zone

- 75-100: Altcoin Season

3. Exclusions in the Index

Stablecoins and wrapped tokens are excluded from the calculation, as their values are pegged or derivative-based, providing no competitive performance against Bitcoin.

Key Insights from the Current Index Reading

1. A Steady Bitcoin Season

At 48, the index reflects Bitcoin’s dominance over the crypto market. While close to the transition zone, the current reading still leans towards Bitcoin outperforming a majority of altcoins.

2. Limited Altcoin Momentum

Despite recent surges in select altcoins, the broader altcoin market has yet to demonstrate the collective strength required to enter Altcoin Season.

3. A Neutral Market Sentiment

The index’s stability suggests that the market is neither heavily favoring Bitcoin nor altcoins, indicating a period of relative equilibrium.

What Keeps the Market in Bitcoin Season?

1. Bitcoin’s Strong Performance

Bitcoin’s price stability and resilience have bolstered its dominance. As the crypto market’s benchmark, Bitcoin often captures a larger share of liquidity during periods of uncertainty or consolidation.

2. Lack of Broad Altcoin Rally

For Altcoin Season to emerge, multiple altcoins need to significantly outperform Bitcoin. Recent altcoin gains have been isolated, preventing a collective shift.

3. Macroeconomic Factors

Improved liquidity and potential interest rate cuts in 2025 favor Bitcoin as a safer bet for institutional investors compared to the riskier altcoin market.

Historical Context: Altcoin vs. Bitcoin Seasons

1. Previous Altcoin Seasons

- Altcoin seasons typically follow extended Bitcoin rallies, as capital flows into higher-risk altcoins for potentially greater returns.

- For instance, the 2021 Altcoin Season saw Ethereum and DeFi tokens reach record highs after Bitcoin peaked at $64,000.

2. The Role of Bitcoin Seasons

- Bitcoin seasons are often associated with market consolidation or renewed interest in Bitcoin as a “safe haven” asset during volatility.

- Bitcoin’s dominance in such periods can slow the momentum for altcoins.

Investor Strategies During Bitcoin Season

1. Focus on Blue-Chip Cryptocurrencies

- Prioritize investments in established cryptocurrencies like Bitcoin and Ethereum, which are more likely to retain value during Bitcoin-dominated periods.

2. Diversify into Emerging Altcoins

- While the broader market remains in Bitcoin Season, select altcoins with strong fundamentals and utility can still offer substantial returns.

3. Monitor Bitcoin Dominance

- Watch Bitcoin’s market cap relative to the total crypto market cap for early signs of a shift toward Altcoin Season.

Outlook for Altcoin Season in 2025

1. Potential Catalysts for Altcoin Season

- Bitcoin Consolidation: If Bitcoin stabilizes or experiences reduced growth, investors may rotate capital into altcoins.

- Technological Innovations: Breakthroughs in Layer 2 solutions, DeFi, or NFTs could trigger renewed interest in altcoins.

- Increased Retail Participation: Altcoins often attract retail investors seeking higher returns, which could drive a collective rally.

2. Challenges Ahead

- Market Sentiment: Skepticism or caution among investors may limit altcoin gains.

- Regulatory Risks: Uncertainty in global crypto regulations could disproportionately impact altcoins.

Conclusion

The Altcoin Season Index 2025 holding at 48 underscores Bitcoin’s continued dominance and the lack of a broad-based altcoin rally. While the index remains in Bitcoin Season, market dynamics could shift as liquidity improves and new innovations emerge. Investors should closely monitor the index, Bitcoin’s dominance, and individual altcoin performance to navigate opportunities in this evolving market landscape.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.