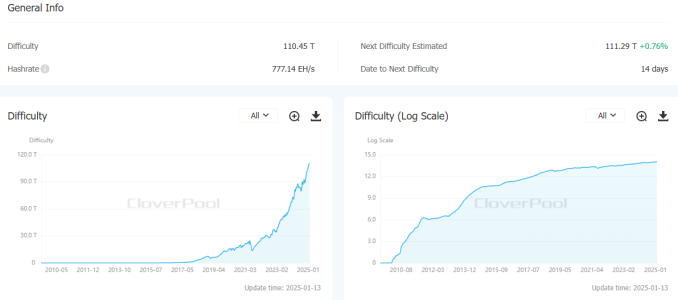

Bitcoin’s mining difficulty has reached a new all-time high of 110.45 T, following a 0.61% increase at block height 878,976 on January 12, 2025, according to CloverPool. This adjustment reflects the growing computational power required to mine Bitcoin and underscores the network’s resilience and security.

The next difficulty adjustment, expected in approximately 14 days, is projected to bring a further increase of 0.76%, potentially setting a new benchmark of 111.29 T. This article explores the implications of this milestone for miners, the Bitcoin network, and the broader cryptocurrency market.

What Is Bitcoin Mining Difficulty?

Bitcoin mining difficulty is a measure of how hard it is for miners to solve the cryptographic puzzles required to add a new block to the blockchain.

Key Features of Mining Difficulty

- Automatic Adjustment: Adjusts approximately every 2,016 blocks (roughly every two weeks).

- Network Security: Higher difficulty enhances the network’s resistance to attacks.

- Hashrate Dependency: Reflects changes in the Bitcoin network’s computational power (hashrate).

Record High: A Closer Look at 110.45 T

1. Increment of 0.61%

- The difficulty adjustment at block height 878,976 reflects a 0.61% increase, setting a record high.

2. Steady Hashrate Growth

- The increased difficulty aligns with the rising network hashrate, driven by expanding mining operations and advanced hardware.

3. Upcoming Adjustment

- The next adjustment is expected to increase difficulty by 0.76%, raising it to 111.29 T if current trends persist.

Implications of Record-High Difficulty

1. Increased Mining Competition

- Miners need more computational power to compete for block rewards, leading to higher operational costs.

2. Network Security Boost

- A higher difficulty level strengthens the Bitcoin network against potential attacks, enhancing its resilience and trustworthiness.

3. Impact on Small-Scale Miners

- Smaller mining operations may face profitability challenges as the difficulty rises, favoring larger mining farms with more efficient hardware.

Mining Difficulty and Bitcoin Price

The relationship between mining difficulty and Bitcoin price is complex:

| Aspect | Impact |

|---|---|

| Rising Difficulty | Indicates network growth and miner confidence. |

| Higher Costs | May reduce miner profit margins, leading to potential sell-offs. |

| Price Impact | Historically, increased difficulty has coincided with bullish trends in Bitcoin’s price over the long term. |

What Drives Mining Difficulty Increases?

1. Hashrate Growth

- The hashrate has steadily increased due to investments in advanced mining hardware and expanding mining farms.

2. Miner Participation

- As more miners join the network, the competition intensifies, necessitating difficulty adjustments.

3. Bitcoin Halvings

- The reduced block rewards from halvings incentivize miners to maximize efficiency, contributing to higher difficulty levels.

Challenges and Opportunities for Miners

Challenges

- Higher Operational Costs: Increased electricity and hardware expenses.

- Profitability Pressure: Small-scale miners may find it harder to compete.

- Regulatory Risks: Stricter regulations on energy consumption in mining could impact operations.

Opportunities

- Advanced Hardware: Adoption of more efficient mining equipment.

- Energy Innovation: Renewable energy sources can reduce costs.

- Institutional Investments: Increased difficulty signals a robust network, attracting institutional players.

FAQs

1. What is Bitcoin mining difficulty?

Bitcoin mining difficulty measures how hard it is to solve the cryptographic puzzles required to mine new blocks.

2. Why did mining difficulty reach a record high?

The increase is due to growing network hashrate and more miners participating in Bitcoin’s decentralized network.

3. How often does mining difficulty adjust?

Difficulty adjusts approximately every 2,016 blocks, or roughly every two weeks, based on the network’s hashrate.

4. What challenges do miners face with rising difficulty?

Miners face higher operational costs, increased competition, and the need for advanced hardware to remain profitable.

5. What is the significance of mining difficulty for Bitcoin’s security?

Higher difficulty enhances the network’s security by making it harder for bad actors to manipulate the blockchain.

Conclusion

Bitcoin’s mining difficulty reaching a record high of 110.45 T marks a significant milestone, reflecting the network’s robustness and growing adoption. While the rising difficulty poses challenges for miners, it also underscores Bitcoin’s role as a secure and decentralized financial system.

With the next adjustment projected to bring the difficulty to 111.29 T, the network continues to evolve, balancing competition and security. For miners and investors alike, this development highlights the dynamic nature of Bitcoin’s ecosystem and its enduring potential in the global financial landscape.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.