Bitcoin’s Next Peak Expected in Summer 2025 according to on-chain data platform IntoTheBlock, aligning with historical trends from previous halving cycles. In a recent post on X, IntoTheBlock noted that Bitcoin’s price has decreased by approximately 12% from its halving price of $63,900. Historically, Bitcoin has peaked about 480 days after each halving event, which supports the prediction of a new all-time high around mid-2025.

Currently, Bitcoin is trading at $55,008.11, reflecting a 1.28% increase over the past 24 hours, according to CoinMarketCap. This modest growth comes as the market continues to navigate the post-halving phase, with many analysts and traders anticipating the next major price surge.

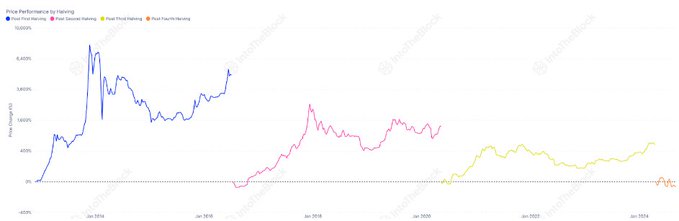

The analysis from IntoTheBlock highlights the cyclical nature of Bitcoin’s price movements, which are closely tied to its halving events. Bitcoin halvings occur roughly every four years and reduce the block reward for miners by 50%, decreasing the rate of new Bitcoin entering circulation. This scarcity-driven mechanism has historically been followed by significant price increases, culminating in peaks approximately 480 days after each halving.

Bitcoin’s Historical Price Peaks After Halving Events

Bitcoin’s price behavior after halving events has been consistent in previous cycles. For example, after the 2016 halving, Bitcoin’s price peaked at an all-time high in December 2017, about 18 months later. Similarly, the 2020 halving was followed by a peak in November 2021, approximately 18 months post-halving.

IntoTheBlock’s analysis suggests that the same pattern is unfolding in the current halving cycle, with the next peak expected around summer 2025, roughly 480 days after the most recent halving in April 2024.

Current Market Overview: Bitcoin Trading at $55,008

As of September 2024, Bitcoin is trading at $55,008.11, which marks a slight recovery from recent lows. The price has increased by 1.28% over the past 24 hours, signaling renewed interest among traders and investors. However, Bitcoin is still down approximately 12% from its halving price of $63,900, a common pattern as the market adjusts to the reduced supply of new Bitcoin.

The ongoing price fluctuations are part of the broader cyclical trend that has characterized Bitcoin’s market behavior in the years following each halving. Many investors view this period as an accumulation phase, with the expectation that prices will rise significantly as Bitcoin approaches its next peak in 2025.

Factors Driving Bitcoin’s Price Movements

Several factors are contributing to Bitcoin’s price dynamics in the current market cycle. The halving’s impact on supply is a key driver, as it reduces the number of new Bitcoins entering the market, creating scarcity and often leading to price appreciation over time. Additionally, macroeconomic factors, including inflation concerns and global economic uncertainty, continue to influence investor behavior and demand for Bitcoin as a hedge against traditional financial markets.

The growth of institutional interest in Bitcoin, along with the development of new financial products such as Bitcoin exchange-traded funds (ETFs), is also likely to play a significant role in the next major price movement. As more institutional capital flows into the cryptocurrency market, Bitcoin’s price could be pushed higher in the months leading up to the anticipated peak in 2025.

Expectations for the 2025 Bitcoin Peak

IntoTheBlock’s prediction of a summer 2025 peak aligns with the broader market consensus that Bitcoin is following its historical price cycle. The next peak is expected to surpass previous all-time highs, potentially reaching levels well above $100,000, depending on market conditions and continued adoption of the cryptocurrency.

Investors are closely watching for signs of an upcoming bull market, particularly as Bitcoin’s price consolidates around the $55,000 range. If the historical patterns hold true, the next major bull run could begin in late 2024 or early 2025, with a peak occurring by mid-2025.

Conclusion

IntoTheBlock’s analysis suggests that Bitcoin’s next major price peak is likely to occur in the summer of 2025, based on historical trends following its halving events. With Bitcoin currently trading at $55,008.11, the market is in the midst of a post-halving accumulation phase, and investors are anticipating a significant price surge in the coming years. As Bitcoin approaches its next peak, the factors of supply scarcity, institutional adoption, and macroeconomic conditions will play a crucial role in shaping the market’s trajectory.

Internal Links for Reference

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.