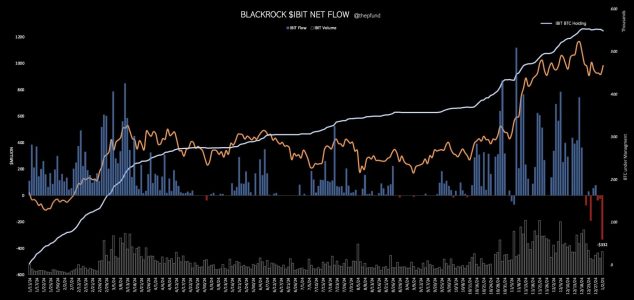

BlackRock’s spot Bitcoin ETF (IBIT) experienced a significant $331 million net outflow on January 2, 2025. According to data from Trader T (@thepfund) on X, this is the largest outflow the ETF has faced since its inception. The previous record, a $188 million outflow, occurred just days earlier on December 24, 2024.

This milestone raises critical questions about investor sentiment and the broader market’s trajectory. Could this signal a shift in confidence towards Bitcoin ETFs, or is it merely a seasonal fluctuation?

BlackRock’s Bitcoin ETF: An Overview

The IBIT ETF was designed as a gateway for institutional and retail investors to gain exposure to Bitcoin without holding the cryptocurrency directly. Launched to much fanfare, the ETF quickly became a benchmark for institutional adoption of digital assets.

Key Features of BlackRock’s Bitcoin ETF

- Regulated Exposure: Provides a safer, more accessible way to invest in Bitcoin.

- Custody Solutions: Offers secure storage of Bitcoin, minimizing the risks associated with direct ownership.

- Market Impact: As one of the largest asset managers, BlackRock’s ETF has been a bellwether for institutional involvement in crypto.

What Caused the $331M Outflow?

Profit-Taking After a Bullish 2024

The crypto market experienced a bullish trend throughout 2024, with Bitcoin reaching multi-year highs. Investors may be locking in profits after substantial gains.

Macroeconomic Concerns

- Interest Rate Hikes: Central banks worldwide are maintaining high interest rates, impacting risk asset performance.

- Economic Slowdown: Uncertainty around global economic growth may have led investors to de-risk their portfolios.

Seasonal Trends

Historically, the end of the holiday season often sees a reallocation of assets, which could explain the outflow.

Comparing December 24 and January 2 Outflows

- December 24, 2024: $188 million outflow, attributed to year-end tax planning and portfolio rebalancing.

- January 2, 2025: $331 million outflow, potentially driven by broader market corrections or shifting investor sentiment.

Impact on the Crypto Market

Bitcoin Price Reaction

Despite the significant outflow, Bitcoin’s price has remained relatively stable, indicating strong support from other market participants.

ETF Performance

BlackRock’s IBIT ETF saw a temporary dip in its net asset value (NAV), but analysts believe it is well-positioned for recovery.

Investor Sentiment

While large outflows might suggest waning confidence, some experts argue that it reflects a healthy reallocation of capital.

The Bigger Picture: Bitcoin ETFs and Market Dynamics

Bitcoin ETFs have been instrumental in mainstreaming cryptocurrency investments. Despite the record outflow, the overall demand for regulated Bitcoin exposure remains robust.

Competing Bitcoin ETFs

Other major players in the ETF space, such as Fidelity and VanEck, are also vying for market share. Comparing their performance can shed light on whether BlackRock’s outflows are an isolated event or part of a larger trend.

Institutional Adoption Trends

Institutions continue to play a pivotal role in Bitcoin’s market dynamics. Even with short-term outflows, the long-term trend points toward increasing adoption.

FAQs

What is the significance of the $331M outflow?

This marks the largest single-day net outflow for BlackRock’s Bitcoin ETF, highlighting potential shifts in investor sentiment or portfolio rebalancing.

Did the outflow affect Bitcoin’s price?

Surprisingly, Bitcoin’s price remained stable, suggesting that other market factors are absorbing the impact.

Is this a sign of declining confidence in Bitcoin ETFs?

Not necessarily. It may reflect profit-taking or strategic reallocations rather than a lack of confidence.

How do BlackRock’s ETF outflows compare to competitors?

While BlackRock saw a record outflow, other Bitcoin ETFs have reported more stable performance, indicating varied investor strategies.

What role do macroeconomic factors play in ETF outflows?

Macroeconomic uncertainties, such as interest rates and economic growth, significantly influence risk asset investments, including Bitcoin ETFs.

Are Bitcoin ETFs still a good investment?

For investors seeking regulated exposure to Bitcoin, ETFs remain a viable option, particularly for those unwilling to manage the complexities of direct cryptocurrency ownership.

Conclusion

BlackRock’s Bitcoin ETF outflow of $331 million on January 2, 2025, is a notable event but not necessarily a cause for alarm. While it underscores shifting investor sentiment and the influence of macroeconomic factors, it also highlights the evolving dynamics of the crypto market. Bitcoin ETFs continue to play a crucial role in bridging the gap between traditional finance and digital assets.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.