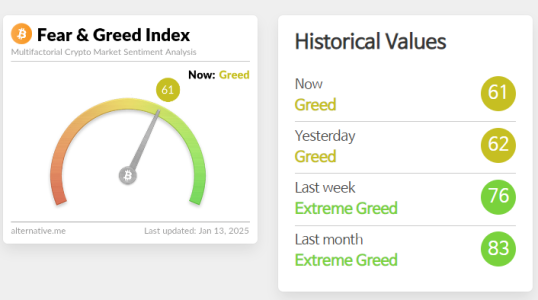

The Crypto Fear & Greed Index, a widely used metric for gauging market sentiment, fell to 61 on January 13, 2025, down by one point from the previous day. Despite the slight decline, the index remains in the ‘Greed’ zone, indicating continued optimism among investors.

The index, provided by Alternative, uses a range of data points to score sentiment from 0 (Extreme Fear) to 100 (Extreme Greed). With a current score of 61, the market sentiment remains bullish but shows signs of softening, reflecting cautious optimism amid fluctuating market conditions.

How the Crypto Fear & Greed Index Works

The index aggregates six factors to measure the market’s emotional state:

- Volatility (25%)

- High volatility reflects fear, while lower volatility indicates confidence.

- Market Momentum/Volume (25%)

- Increased momentum and trading volume signal optimism.

- Social Media (15%)

- Social media activity and sentiment provide insights into public perception.

- Surveys (15%)

- Investor surveys offer additional data on market mood.

- Bitcoin Dominance (10%)

- A higher Bitcoin dominance suggests conservative sentiment, while lower dominance points to risk-taking behavior.

- Google Trends (10%)

- Search trends for cryptocurrency-related terms reflect interest and sentiment.

Significance of the Current Score: 61

1. Remaining in the ‘Greed’ Zone

- The index indicates ongoing confidence in the cryptocurrency market, with investors displaying a willingness to take risks.

2. Weakened Sentiment

- The one-point drop suggests slightly reduced enthusiasm, potentially driven by short-term market fluctuations.

3. Implications for Investors

- While optimism persists, the decline serves as a reminder for investors to remain cautious and avoid overexposure.

Factors Influencing the Decline

1. Market Volatility

- Fluctuations in major cryptocurrency prices, such as Bitcoin and Ethereum, may have contributed to the slight dip.

2. Profit-Taking Behavior

- Increased profit-taking after recent rallies could signal cautious sentiment among some investors.

3. Macroeconomic Uncertainty

- Broader economic concerns, such as interest rate policies or regulatory developments, may impact market confidence.

Historical Context: Fear & Greed Index Trends

| Date | Index Score | Zone | Market Sentiment |

|---|---|---|---|

| January 10, 2025 | 69 | Greed | Strong optimism, minor pullbacks. |

| January 12, 2025 | 62 | Greed | Sustained confidence, slight caution. |

| January 13, 2025 | 61 | Greed | Ongoing optimism, slight decline in sentiment. |

The consistent position in the ‘Greed’ zone reflects overall market confidence, though the gradual decline indicates emerging caution.

Investor Strategies for the Current Market

1. Manage Risk

- Avoid over-leveraging investments in a market dominated by greed to mitigate potential losses during corrections.

2. Diversify Holdings

- Allocate investments across multiple assets, including both established cryptocurrencies and emerging projects.

3. Monitor Key Indicators

- Keep an eye on Bitcoin dominance, trading volumes, and volatility to anticipate sentiment shifts.

4. Prepare for Volatility

- Stay ready for sudden market movements, as greed often precedes corrections.

FAQs

1. What does the Crypto Fear & Greed Index measure?

The index measures market sentiment using factors like volatility, momentum, social media activity, surveys, Bitcoin dominance, and Google search trends.

2. What does a score of 61 indicate?

A score of 61 places the market in the ‘Greed’ zone, reflecting confidence and risk-taking behavior among investors.

3. Why did the index drop by one point?

The slight decline may result from short-term volatility, profit-taking, or external macroeconomic factors.

4. How should investors respond to the current index score?

Investors should remain cautiously optimistic, managing risks while capitalizing on market opportunities.

5. How often is the Crypto Fear & Greed Index updated?

The index is updated daily to provide an accurate reflection of market sentiment.

Conclusion

The Crypto Fear & Greed Index dropping to 61 highlights ongoing optimism in the market, though the slight decline suggests a cautious shift in sentiment. Investors should view this as an opportunity to evaluate their strategies, balancing confidence with risk management.

By monitoring key metrics and staying informed, market participants can navigate the current environment effectively, capitalizing on opportunities while preparing for potential corrections.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.