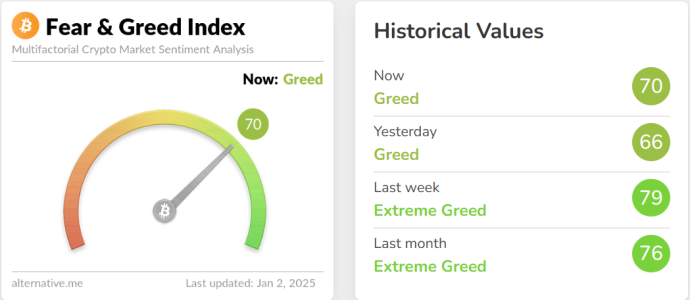

The Crypto Fear & Greed Index 2025 has risen to 70, marking a sustained presence in the “Greed” zone. This level reflects improved market sentiment as investors grow more optimistic about cryptocurrency prospects. Provided by the software platform Alternative, the index is a widely used barometer of market emotion, ranging from 0 (extreme fear) to 100 (extreme greed). As of January 2, the index climbed four points from the previous day, signaling a strengthening bullish outlook.

What Is the Crypto Fear & Greed Index?

1. Understanding the Index

The Crypto Fear & Greed Index measures market sentiment by analyzing six key factors. These include:

- Volatility (25%): Examines current price fluctuations compared to historical trends.

- Market Momentum/Volume (25%): Tracks trading volume and momentum to gauge buying and selling strength.

- Social Media (15%): Considers trends, mentions, and sentiment from platforms like Twitter.

- Surveys (15%): Aggregates investor opinions on the market.

- Bitcoin Dominance (10%): Measures Bitcoin’s market cap relative to the total crypto market cap.

- Google Trends (10%): Monitors search interest in crypto-related terms.

2. How the Scale Works

- 0-24: Extreme Fear

- 25-49: Fear

- 50-74: Greed

- 75-100: Extreme Greed

Key Drivers of the Index’s Rise

1. Market Momentum and Volume

Strong trading activity in major cryptocurrencies like Bitcoin and Ethereum contributed to the rise in the index. Investors are optimistic about sustained growth in prices.

2. Positive Social Media Sentiment

Social media chatter around crypto has increased, with a focus on positive price trends and upcoming blockchain developments. Influencers and analysts have contributed to the optimistic tone.

3. Bitcoin Dominance

Bitcoin dominance remains strong, reflecting investor confidence in the leading cryptocurrency as a safe haven within the volatile crypto market.

Implications of the ‘Greed’ Zone

1. Increased Market Participation

The index’s position in the “Greed” zone suggests heightened market activity, with more investors entering the market or increasing their positions.

2. Bullish Sentiment

A high index score often correlates with bullish sentiment, signaling that investors expect prices to rise further.

3. Risk of Overheating

However, prolonged presence in the “Greed” or “Extreme Greed” zones can indicate overconfidence, raising concerns about potential market corrections.

Historical Performance of the Index

1. Correlation with Market Trends

- Extreme Fear Phases: These typically coincide with market bottoms, offering potential buying opportunities.

- Greed and Extreme Greed Phases: Historically align with price rallies but are often followed by corrections.

2. Examples from Past Cycles

- In 2021, the index reached 95 during the Bitcoin rally to $64,000, shortly before a market pullback.

- In mid-2022, the index fell to 6 amid a crypto market crash, signaling extreme pessimism.

What’s Next for the Crypto Market?

1. Sustained Bullish Sentiment

If the index remains in the “Greed” zone, it could drive further price gains, supported by strong market momentum and increased investor participation.

2. Potential for a Correction

Investors should remain cautious. High levels of greed have historically preceded market corrections as profit-taking increases.

3. Focus on Fundamentals

The market’s ability to sustain growth will depend on fundamental factors, including regulatory clarity, technological advancements, and macroeconomic conditions.

Strategies for Investors in the Greed Zone

1. Exercise Caution

While bullish sentiment is encouraging, it’s crucial to avoid overleveraging or investing based on hype.

2. Diversify Portfolios

Ensure a balanced portfolio that includes a mix of blue-chip cryptocurrencies, altcoins, and stablecoins to mitigate risks.

3. Take Profits Strategically

Gradually taking profits as prices rise can help secure gains and reduce exposure to potential market corrections.

4. Monitor the Index

Use the Crypto Fear & Greed Index as a tool to gauge market sentiment and make informed decisions.

Conclusion

The rise of the Crypto Fear & Greed Index 2025 to 70 signals strong market optimism as the crypto space enters a bullish phase. While the “Greed” zone reflects positive sentiment, investors should approach with a mix of enthusiasm and caution, as heightened greed can precede market corrections. Understanding the drivers behind the index and maintaining a strategic investment approach will be key to navigating this dynamic period in the crypto market.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.