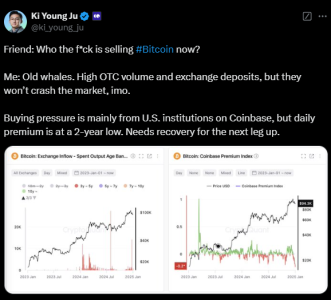

Ki Young Ju, CEO of blockchain analytics firm CryptoQuant, recently shared insights into Bitcoin market activity, noting that old whales are selling significant amounts of BTC. Despite this, he assured investors that the market remains resilient, supported by U.S. institutional buying through Coinbase.

While the influx of over-the-counter (OTC) volume and exchange deposits indicates increased selling pressure, Ju predicts that these actions won’t lead to a market crash. Instead, a recovery phase is necessary to pave the way for Bitcoin’s next uptrend.

Bitcoin Whales: Selling but Not Sinking the Market

What Are Bitcoin Whales?

Bitcoin whales are individuals or entities holding significant amounts of BTC, often capable of influencing market trends through their trades.

Current Whale Activity

- Selling on OTC Markets: Whales are leveraging OTC platforms to offload their holdings, avoiding significant price slippage.

- Exchange Deposits: Increased deposits suggest whales are preparing for further sell-offs.

Why Isn’t the Market Crashing?

- Institutional Buying via Coinbase: U.S. institutions continue to buy Bitcoin, providing a counterbalance to selling pressure.

- Market Depth: The Bitcoin market has matured, with increased liquidity and participation reducing the impact of large trades.

Coinbase Premium at a Two-Year Low

What Is the Coinbase Premium?

The Coinbase premium refers to the difference in Bitcoin’s price on Coinbase compared to other exchanges. A high premium often signals strong institutional buying, while a low premium suggests reduced demand.

Current Status

- Coinbase’s daily premium is at its lowest in two years, signaling subdued institutional activity.

- This could delay Bitcoin’s recovery but doesn’t necessarily indicate bearish sentiment, as other factors support market stability.

Key Indicators to Watch

1. OTC Volume

- High OTC activity suggests that whales prefer discreet transactions, minimizing their impact on exchange prices.

- Increased OTC volume often correlates with major market movements.

2. Exchange Deposits

- A spike in exchange deposits can precede selling pressure, potentially affecting short-term prices.

3. Institutional Activity

- U.S. institutions, despite the low Coinbase premium, remain a vital source of demand. Monitoring their activity will be crucial for gauging market direction.

Bitcoin’s Path to Recovery

Short-Term Challenges

- Market Sentiment: Whale activity may create temporary uncertainty among retail investors.

- Low Premium: Recovery could be slow without a rebound in institutional enthusiasm.

Positive Catalysts

- ETF Approvals: Anticipation of new Bitcoin ETFs could reignite institutional interest.

- Macro Trends: Broader adoption and favorable regulations may bolster Bitcoin’s appeal.

FAQs

Why are Bitcoin whales selling now?

Whales often sell to realize profits, rebalance portfolios, or respond to macroeconomic conditions. The current selling trend coincides with high OTC activity and exchange deposits.

What is the significance of OTC volume?

OTC trades allow large transactions without affecting exchange prices, providing insights into behind-the-scenes market movements.

Will whale selling crash the Bitcoin market?

Unlikely, as institutional buying and market maturity provide a buffer against significant price drops.

What does a low Coinbase premium mean?

A low premium indicates reduced institutional buying activity through Coinbase, which could slow price recovery.

How can Bitcoin recover from this phase?

Recovery may depend on increased institutional participation, ETF approvals, and macroeconomic factors driving renewed demand.

Are whales bearish on Bitcoin?

Not necessarily. Whale selling doesn’t always signify bearish sentiment; it could be strategic profit-taking or portfolio rebalancing.

Conclusion

While Bitcoin whales are currently selling, the market remains stable due to strong institutional support and improved market depth. Although Coinbase’s low premium signals a need for recovery, the broader outlook for Bitcoin remains optimistic. Investors should monitor key indicators like OTC volume and institutional activity to navigate this transitional phase effectively.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.