Ethereum’s Total Value Locked Hits 3-Month Low

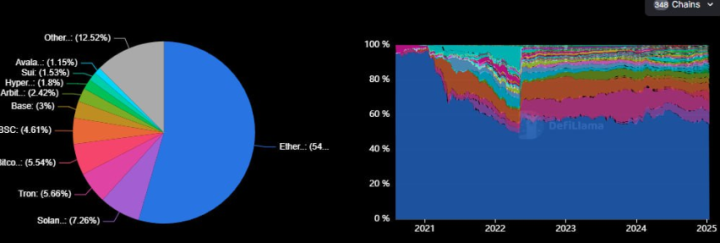

Ethereum’s dominance in decentralized finance (DeFi) continues to face pressure, with its share of total value locked (TVL) falling to 54.51%, marking the lowest level in three months, according to Unfolded on X.

The decline in Ethereum’s TVL reflects shifting dynamics in the DeFi ecosystem, where alternative blockchains like Tron and others are also seeing fluctuations. Notably, Tron’s TVL share dropped from 8.16% to 5.66% over the same period.

Key Metrics on Ethereum’s TVL Decline

1. Ethereum’s Current TVL Share

- 54.51% Dominance: Ethereum remains the leading blockchain for DeFi, but its share has dipped, indicating increased competition.

2. Historical Context

- Previous Highs: Ethereum has historically maintained a dominant position in the DeFi space, often exceeding 60% in TVL share.

- Decline in Momentum: This is the lowest point in three months, highlighting challenges in retaining its market share.

3. Tron’s Decline

- TVL Share Drops: Tron’s share has decreased from 8.16% to 5.66%, further reflecting changing trends in the DeFi sector.

Factors Contributing to Ethereum’s Declining TVL Share

1. Rise of Alternative Blockchains

- Increased Competition: High-throughput chains like Avalanche, Solana, and Polygon are attracting developers and users with lower fees and faster transaction speeds.

- Diverse Ecosystems: These chains are developing robust ecosystems for DeFi, gaming, and NFTs, drawing liquidity away from Ethereum.

2. High Gas Fees on Ethereum

- Cost Barrier: Ethereum’s persistent gas fees continue to drive users toward more cost-effective alternatives, particularly for smaller transactions.

3. Cross-Chain Interoperability

- Liquidity Migration: With improved cross-chain bridges, users can seamlessly transfer assets between blockchains, reducing reliance on Ethereum.

4. Market Volatility

- Impact on TVL: Fluctuating crypto prices have influenced the value of assets locked in DeFi protocols across all blockchains, including Ethereum.

Implications for the DeFi Ecosystem

1. Ethereum’s Role as a DeFi Leader

- Despite the decline, Ethereum retains a majority share of DeFi TVL, reflecting its continued importance as a foundation for decentralized applications (dApps).

2. Growth Opportunities for Competing Blockchains

- Tron’s Decline: Tron’s reduced TVL share suggests that not all Ethereum competitors are benefitting equally.

- Emerging Players: Chains like Arbitrum and Optimism, which are layer-2 solutions for Ethereum, continue to see growing adoption.

3. Impact on Users and Developers

- User Choice: Users now have a wider range of platforms to access DeFi services, increasing competition for Ethereum-based projects.

- Developer Considerations: Developers are diversifying their efforts across multiple blockchains to capitalize on incentives and reach broader audiences.

Ethereum vs. Competing Chains: Current TVL Snapshot

| Blockchain | TVL Share (%) | Change in TVL Share |

|---|---|---|

| Ethereum | 54.51% | Lowest in 3 months |

| Tron | 5.66% | Down from 8.16% |

| Arbitrum | Growing | Significant growth noted |

| Polygon | Growing | Gaining traction in DeFi |

What’s Next for Ethereum in DeFi?

1. Layer-2 Scaling Solutions

- Adoption of Arbitrum and Optimism: Ethereum’s layer-2 networks can help alleviate congestion and reduce fees, potentially retaining users.

2. Upgrades to Ethereum 2.0

- Improved Scalability: The transition to Ethereum 2.0 and the rollout of additional upgrades could restore confidence in Ethereum’s dominance.

3. Strategic Innovations

- DeFi Innovations: Ethereum-based projects may need to introduce unique features and incentives to maintain competitiveness.

Conclusion

The decline in Ethereum’s total value locked to 54.51% signals increasing competition within the DeFi sector. While Ethereum remains a dominant force, the rise of alternative blockchains and user migration due to high gas fees pose challenges to its long-term leadership.

As the blockchain landscape continues to evolve, Ethereum’s focus on scaling solutions and ecosystem improvements will be critical in maintaining its position as the backbone of decentralized finance.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.