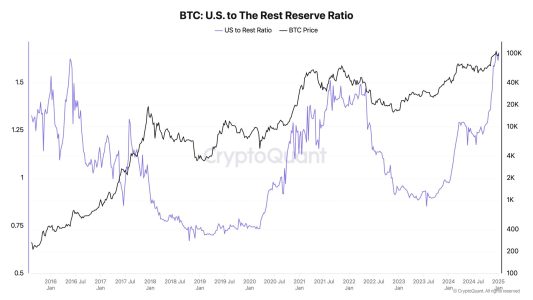

The dominance of U.S. entities’ Bitcoin holdings has reached an unprecedented level, according to Ki Young Ju, CEO of CryptoQuant. As shared on X (formerly Twitter), U.S. entities now control a record-high share of Bitcoin (BTC) reserves, outpacing non-U.S. entities by a staggering 65% margin. This milestone reflects the growing institutional and retail adoption of Bitcoin within the United States, cementing its leadership in the global cryptocurrency market.

Key Highlights of U.S. Entities’ Bitcoin Holdings

Record-High Bitcoin Reserves

U.S. entities now hold the largest share of Bitcoin reserves ever recorded, according to data from CryptoQuant. This dominance highlights the growing appeal of BTC as a strategic asset within the United States.

Surpassing Non-U.S. Entities

The 65% margin over non-U.S. entities marks a significant shift in the global Bitcoin distribution landscape, showcasing the United States as a leader in BTC adoption and accumulation.

Driving Factors Behind the Surge

- Institutional Adoption: Companies like MicroStrategy, Tesla, and Grayscale have played pivotal roles in acquiring large BTC reserves.

- Regulatory Clarity: While still evolving, the U.S. regulatory framework offers more structure compared to many other regions, attracting investors.

- Market Confidence: The U.S. crypto market benefits from established infrastructure, such as spot ETFs and custodial services, boosting investor confidence.

What Does This Mean for the Crypto Market?

Increased Institutional Influence

The rising concentration of Bitcoin reserves among U.S. entities suggests that institutional investors are driving the trend. This could lead to increased market stability, albeit at the cost of potential centralization concerns.

Enhanced Liquidity in U.S. Markets

With more BTC reserves held domestically, the liquidity of U.S.-based exchanges and trading platforms is expected to improve, further bolstering market activity.

Potential Global Rebalancing

The dominance of U.S. entities might shift the focus of Bitcoin-related innovations, mining operations, and policy-making to the United States, influencing global trends.

Challenges and Concerns

Centralization Risks

The concentration of Bitcoin holdings among U.S. entities raises concerns about potential centralization, which runs counter to Bitcoin’s decentralized ethos.

Regulatory Dependencies

The dominance of U.S. entities could make the Bitcoin market more susceptible to U.S. regulatory decisions, creating volatility in case of unfavorable policies.

Global Competition

Other regions, such as Europe and Asia, may accelerate their Bitcoin adoption strategies to regain competitive footing against the United States.

FAQs

What does the record-high Bitcoin holding by U.S. entities signify?

It signifies the growing dominance of U.S. institutions and investors in the Bitcoin market, reflecting increased adoption and investment in the cryptocurrency.

Why do U.S. entities hold more Bitcoin than non-U.S. entities?

Factors include a relatively mature regulatory framework, institutional interest, and robust market infrastructure, such as spot ETFs and custodial services.

Does this concentration pose any risks?

Yes, the concentration could lead to centralization risks and heightened dependency on U.S. regulations, potentially impacting global market dynamics.

How does this impact Bitcoin prices?

While increased U.S. holdings may enhance market stability, they can also create volatility if major entities decide to sell large volumes.

What role do institutions play in this trend?

Institutions like MicroStrategy and Grayscale are key contributors, acquiring Bitcoin as part of their investment strategies and driving market confidence.

How does this affect global Bitcoin adoption?

The dominance of U.S. entities may inspire other regions to strengthen their Bitcoin adoption efforts, fostering healthy competition.

Conclusion

The record-high Bitcoin reserves held by U.S. entities mark a pivotal moment in the cryptocurrency’s journey, emphasizing the United States’ leadership in the digital asset space. While this milestone underscores the growing institutional trust in Bitcoin, it also raises important questions about centralization and global competition. As the crypto market continues to evolve, the influence of U.S. entities will undoubtedly shape Bitcoin’s future trajectory.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.