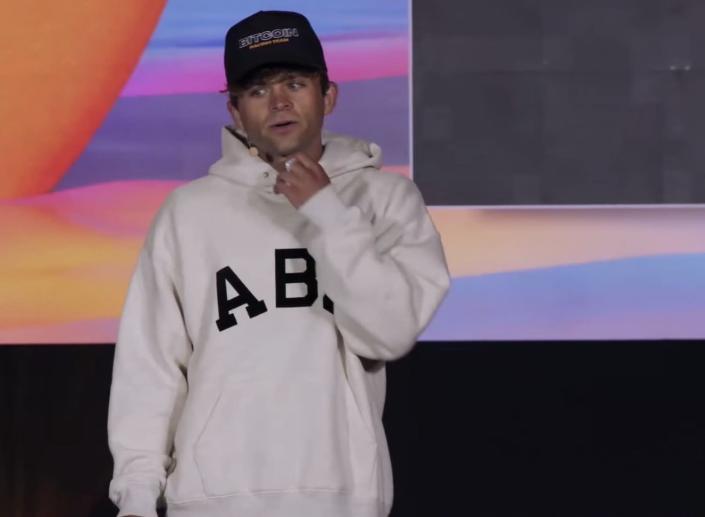

Jack Mallers was almost unrecognisable from the crowd of baseball cap and hoodie-wearing young guys advocating Bitcoin just a few months ago. However, now venture capitalists are lining up to invest in him.

The Rise of Zap

In June, El Salvador’s President Nayib Bukele endorsed Bitcoin. That is when the 27-year-old founder of a Bitcoin money-transfer firm Zap Solutions Inc., exploded onto the mainstream. Mallers worked behind the scenes with the administration to make it happen. While on stage at a Miami conference, tears started flowing after making the news through video. According to Mallers, Zap plans to close on a new investment soon.

While not the only Bitcoin payment service in El Salvador, Zap’s Strike app is the most popular mobile app. Zap allows anybody to send or pay with Bitcoin for free.

The Flood Of Investors

The situation drew the attention of investors. In an interview, Mallers said he hopes to raise a fresh fundraising round in the coming months. He refused to say how much the business is looking to raise or comment on a value. Zap raised $3.5 million in April 2020, valuing the company at $16.5 million post-money.

Spending The Funds

The funds will be used to fund a large-scale worldwide deployment. The strike may be accessible in 50 to 100 nations by the end of the year. Additionally, they are planning to go beyond El Salvador and the United States, according to Mallers. The service is now in its trial version in the United Kingdom, Canada, and Australia. Zap aims to have millions of customers by the end of the year, up from the hundreds of thousands it has now, he added.

Zap’s Struggles

Various laws and permits are likely to be obstacles for the firm. For example, Zap does not appear to have a licence in New York, despite being registered with FinCen. Later this year, Zap aims to launch a Visa card. The purpose of the card is to allow consumers to earn rewards in either cash or Bitcoin. Visa, which has forged similar commercial ties with other crypto firms, is a venture partner.