Lawyers argue that the four businesses FTX wants to sell were only recently acquired, which simplifies the sale process.

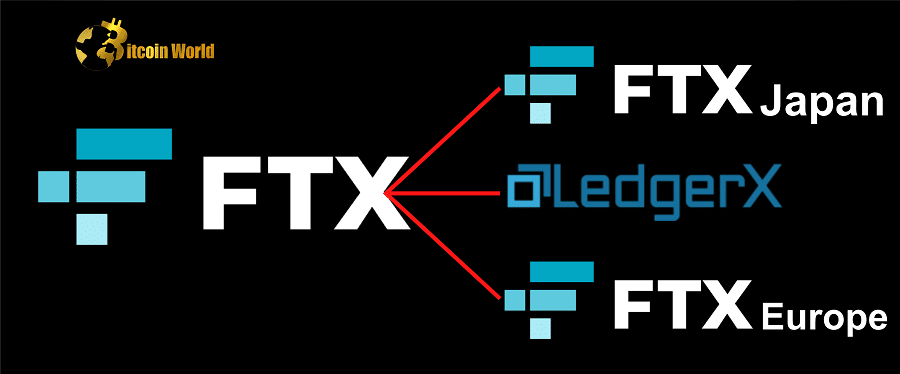

Lawyers for FTX filed a motion with the United States Bankruptcy Court on December 15 seeking permission to sell the firm’s Japanese and European branches, derivatives exchange LedgerX, and stock-clearing platform Embed.

The lawyers note that each of these companies has been under regulatory pressure, which “justifies an expeditious sale process,” adding:

“The longer operations are suspended, the greater the risk to asset value and the risk of permanent license revocation.”

FTX Japan is currently under business suspension and improvement orders, while FTX Europe’s licenses and operations have been suspended.

They also point to the businesses’ loss of customers and employees since FTX filed for bankruptcy on Nov. 11, and believe that selling these businesses now would allow for the resumption of operations and thus maximize value to the FTX estate.

According to the lawyers, these businesses were recently acquired and have been operating relatively independently of FTX, making a potential sale process much less complicated.

More than 110 parties are said to be interested in buying one or more of the 134 companies involved in the bankruptcy proceedings, and FTX has already signed 26 confidentiality agreements with counterparties interested in FTX’s businesses or assets.

During FTX’s bankruptcy proceedings, LedgerX was hailed as a success story, with Commodity Futures Trading Commission Chairman Rostin Behnam noting that the firm had essentially been “walled off” from other companies within FTX Group, and “held more cash than all the other FTX debtor entities combined.”

FTX wants to sell off parts of its failed crypto empire before they lose too much of their value or have their licenses permanently revoked, arguing it is in the best interests of all stakeholders.