- The biggest digital coin, Bitcoin (BTC), still has room to fall, the British firm, Standard Chartered, said in a new report.

If you think the recent dips in the price of Bitcoin is bad, leading financial firm Standard Chartered could further darken your mood, concluding that the biggest cryptocurrency by market cap could fall as far as $50,000.

In a Wednesday note, Geoffrey Kendrick—digital assets researcher at the British company and lead author of the report—said that “the broader macro backdrop has deteriorated for assets like crypto that thrive on liquidity.”

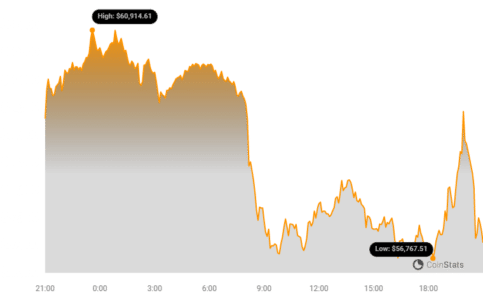

“The driver seems to be a combination of crypto specific and broader macro,” he added, noting that Bitcoin’s break below $60,000 has now reopened a route to the $50,000-$52,000 range.

Bitcoin Will Hit $100K in 2024, Predicts Standard Chartered—Again

Bitcoin will hit $100,000 by next year, British multinational bank Standard Chartered has said. The bank made its first bullish predictions back in April, predicting that the largest digital coin would hit $100,000 by the end of 2024.

See Also: Doge With Hat (DOGEHAT) Will Rally 5,500%, As Shiba Inu And Bonk Lag

In July, its team of analysts projected that Bitcoin could hit $120,000 in the same timeframe. While the protracted bear market that dominated 2023 is only recently showing signs of thawing, the bank is again saying Bitcoin could hit $100,000—and that a Bitcoin…

Just last month, Standard Chartered predicted that Bitcoin could hit $150,000 per coin by the end of the year.

Bitcoin had been on a wild run following the January approval of 11 Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission. At the start of the year, it was trading for a little over $44,000.

Capital flooded the market as investors with typically no exposure to cryptocurrencies were suddenly able to buy shares that track the price of the asset via brokerage accounts.

Record amounts of money hit the products in the months following their launch, and in March, the cryptocurrency reached a new all-time high of $73,737.

But the hype has cooled, and the Federal Reserve has meanwhile signaled it will keep interest rates higher for longer—scaring investors away from “risk-on” assets like Bitcoin.

As a result, the funds have experienced significant outflows.

Despite touching a new record in March, the price of Bitcoin today stands at $56,900, after dropping 13% in seven days. Since April, it has traded well below its 2021 record of $69,044.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN