The founder of cryptoexchange Gemini Cameron Winklevoss has suggested that the next Bitcoin Bull run will be different. He precisely noted that their is much more substantially more capital, infrastructure, and better projects.

“The next Bitcoin bull run will be dramatically different. Today, there’s exponentially more capital, human capital, infrastructure, and high-quality projects than in 2017. Not to mention the very real specter of inflation that all fiat regimes face going forward. Buckle up!,” he said.

According to some recent data, it hints at significant increase in the amount of capital held by investors in the cryptocurrency market.

A lot of cryptocurrency exchanges have also received more regulatory clarity, improving the infrastructure of the market.

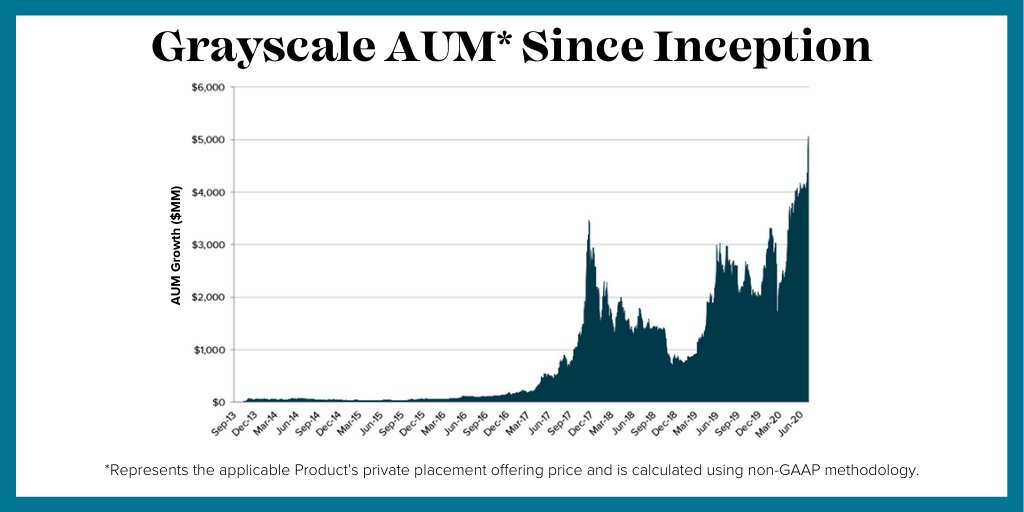

Two metrics primarily show that more money could be involved in the latest Bitcoin rally. First, the market capitalization of Tether (USDT) has surpassed $10 billion. Second, the assets under management (AUM) by Grayscale Investments recently achieved a new high.

To date, Tether is the biggest stablecoin in the cryptocurrency market. Investors, especially in countries with regulatory uncertainty, rely on the stablecoin to trade crypto assets. A rapid rise in the market cap of Tether could indicate more money is waiting to deploy on crypto exchanges.

Grayscale’s crypto-asset trusts are arguably the most widely-utilized investment vehicles by institutions to gain exposure to cryptocurrencies. Within the last quarter, the assets under management in Grayscale’s suite of products hit an all-time high at $5.1 billion.