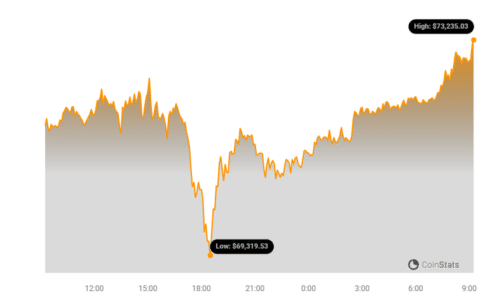

Hold onto your hats, crypto enthusiasts! Bitcoin is on a tear, breaking past the $72,000 mark and setting its sights firmly on a new all-time high of $73,000. It feels like just yesterday we were talking about previous milestones, and now, here we are again, witnessing potentially history in the making.

Bitcoin’s Bullish Momentum: What’s Driving the Surge?

This isn’t just a minor bump; Bitcoin has rocketed nearly 50% this month alone! Weekly peaks are becoming the norm, and the crypto world is buzzing with excitement. But what’s behind this incredible surge? Let’s dive into the key factors pushing Bitcoin to these heights:

- Institutional Adoption Heats Up: The green light from Thailand’s SEC for asset management firms to launch spot Bitcoin ETFs is a significant move. This opens up Bitcoin investment to a broader range of investors in Thailand, signaling growing mainstream acceptance. Bitcoin is no longer a fringe asset; it’s becoming a legitimate part of the financial landscape.

- London Calling Crypto: Across the globe, the London Stock Exchange’s announcement to welcome applications for Bitcoin exchange-traded notes (ETNs) in the coming quarter is another massive win for crypto legitimacy. This move by a major global exchange will likely attract significant institutional capital into Bitcoin.

See Also: Bitcoin Developers Unite To Draft Guidelines for BRC-20 Tokens

- Blackrock’s IBIT ETF Milestone: Speaking of institutional giants, Blackrock’s IBIT ETF has hit a remarkable milestone, accumulating 200,000 Bitcoin under management in just two months since its launch. This rapid growth underscores the immense demand for Bitcoin exposure through regulated investment vehicles. It’s a clear sign that institutional investors are serious about Bitcoin.

The Road to $100,000: Is It Just Hype or Reality?

With all this positive momentum, the bullish sentiment is palpable. Many analysts and investors are now eyeing the $100,000 mark for Bitcoin. Is this wishful thinking, or could it actually happen? The factors we’ve discussed certainly lay a strong foundation for continued price appreciation.

Factors Fueling $100k Optimism:

- ETF Demand: The success of spot Bitcoin ETFs in the US and now potential expansion in Thailand and the UK highlights a sustained and growing demand from institutional and retail investors.

- Halving on the Horizon: The upcoming Bitcoin halving event next month is a critical factor. Historically, halvings, which reduce the rate at which new Bitcoin is created, have been followed by significant price increases due to reduced supply.

- Limited Supply: Bitcoin’s capped supply of 21 million coins is a fundamental aspect of its value proposition. As demand increases and supply growth slows down due to halving, basic economics suggests price appreciation.

Interesting Market Dynamics: Trading Volume and Holder Behavior

Interestingly, despite the price surge and nearing all-time highs, Bitcoin’s daily trading volume has actually decreased by 5%. What does this tell us? It suggests that many traders are choosing to hold onto their Bitcoin rather than sell, anticipating further price increases. This “hodling” behavior further reduces the available supply in the market, potentially amplifying the impact of demand.

The Halving Effect: A Potential Supply Shock?

As we approach the fourth Bitcoin halving, the market is keenly watching how these trends will play out. If the current demand levels persist, the halving-induced supply shock could indeed have a significant impact on Bitcoin’s price. Reduced new supply meeting consistent or increasing demand is a recipe for potential price jumps.

Navigating the Crypto Landscape: Important Disclaimer

Before you jump into any investment decisions, remember this:

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

The crypto market is known for its volatility, and while the current outlook is bullish, it’s crucial to do your own research and understand the risks involved.

In Conclusion:

Bitcoin’s journey towards a new all-time high is exciting to witness. Fueled by institutional adoption, upcoming supply reduction from the halving, and strong holder sentiment, the cryptocurrency is demonstrating remarkable resilience and growth potential. Whether it will reach $73k soon and continue its ascent to $100k remains to be seen, but the current indicators are undeniably positive. Keep watching this space – it’s going to be an interesting ride!

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.