With a 4% drop on Sunday to below $56k, the bears overwhelmed the Saturday recovery in Bitcoin and put the entire crypto market back into the bear zone.

Undermining the chances of a recovery week, the increasing supply influences a downfall this Monday in the early Asian trading hours.

Bitcoin is trading at $55,269 with an intraday loss of 1.30% and registers a low at $54,296. With a bearish tone, the altcoins start the week with long liquidations, and the top cryptos are down by 5% or more.

Ethereum, Solana, and Toncoin are down by 5.25%, 7.23%, and 5.45%, respectively, while the meme coins take a massive hit. DOGE, SHIB, and PEPE are down 8.08%, 7.64%, and 12.84%, respectively.

With the Monday Blues hitting the crypto market hard, the anticipation of a bigger crash this week is increasing. Let’s examine our detailed price analysis of top cryptos for a clearer view of the market.

Bitcoin Price Performance

With zero follow-up of the Saturday recovery, the declining trend in Bitcoin continues. Breaking below the $56,000 level, BTC trades at $55,269, with almost a 5% drop in the last 24 hours.

Increasing the bearish influence in the daily chart, the BTC price breaks below the descending trendline. The 4% drop on Sunday creates a bearish engulfing candle and resets the bearish trend in motion.

Amounting to $111M worth of long liquidation in the broader market on Sunday, the trend continues with $75M in the early hours of Monday.

With the price action signaling a downtrend continuation, the long liquidations bolster the bearish traders.

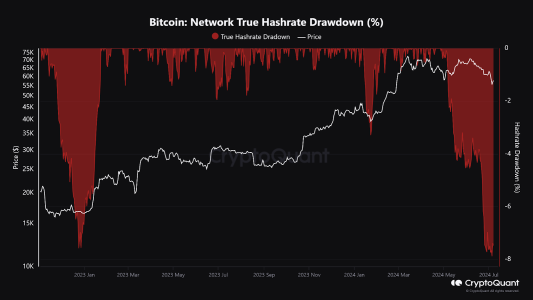

Bitcoin Hashrate Drawdown Reaches Critical Levels

The Bitcoin network’s hashrate drawdown is a measure of dips in mining activity. As per Cryptoquant, the metric has fallen to levels last seen in December 2022.

Historically, such hashrate drawdowns have coincided with major price movements. The December 2022 drawdown preceded a notable bull reversal, suggesting that current conditions could signal a similar price shift.

As Bitcoin’s price crashes, the deep hashrate drawdown might indicate a market bottom or an impending bullish phase.

However, it goes against the ongoing price action movement as the BTC price breaks below the $56,000 mark.

While the next support level stands at $52,000 level, it could be the next bounce pad for the bullish rally to begin towards the $100,000 aim.

Mt. Gox Payout Continues To Induce Market Jitters

Following the collapse of the Mt. Gox crypto exchange in 2014, the recent payout scheme has induced significant fear among investors. After a decade-long wait, the repayment process has begun and quickly brings the fear of a massive supply dump in the coming times.

As per the latest trustee document, Mt. Gox creditors will receive Bitcoin (BTC) or Bitcoin Cash (BCH) in the next 2 weeks or 3 months.

This will depend upon the exchange they have chosen. While Kraken might take up to 3 months, other exchanges like the Bitbank and SBI VC Trade aim to complete payouts within the next 2 weeks.

This payout aims to prevent a major price dump, though the distribution of around $2.71 billion in BTC could still cause market jitters.

Where is Bitcoin Headed This Week?

With the ongoing FUD run in the crypto market, bear-side moves are likely to continue this week.

With Bitcoin breaking under $56,000, the next plausible support stands at the $52,000 mark. Further, the downtrend increases the death cross possibility of the 50D and 200D EMA.

Amplifying the crash, the altcoins could witness a massive dump and bigger liquidations this week.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.