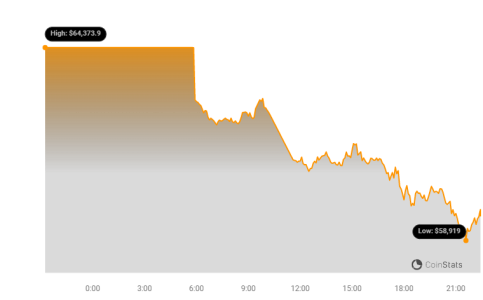

- Bitcoin (BTC) price fell more than 5% to drop below the $60k threshold.

- The declines came after news that Mt.Gox will start repaying its creditors in July, with potential $9 billion sell-off pressure incoming.

Bitcoin price has dropped below the $60,000 threshold after a day of massive sell-off pressure.

BTC reached highs of $71,974 on June 7, but has been in downtrend since. Today’s declines have seen the cryptocurrency break below $60k for the first time since rebounding above this level in early May.

Bitcoin price drops below $60k

On Monday, news that Mt. Gox, a bankrupt crypto exchange that suffered a major hack in 2014, was on the verge of distributing nearly $9 billion in BTC to creditors sparked new selling pressure for Bitcoin.

When hackers stole thousands of Bitcoin from Mt.Gox ten years ago, the price of Bitcoin was around $40. That puts today’s price at an astronomical level since, a factor that could see some recipients of the 141,000 BTC to be repaid elect to sell for profit.

BTC holders worried about the potential bearish flip, have joined the selling spree. BTC’s value plummeted below the $60,000 mark amid this news.

Commenting on BTC price before the dip to under $60k, CryptoQuant’s head of research Julio Moreno observed:

“What’s happening right now with Bitcoin prices is mostly related to a lack of demand growth or momentum from traders, whales, ETFs, etc.”

The last time Bitcoin dropped below $60k, it traded to lows of $56,500 and Moreno believes this could offer the ultimate support level again.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.