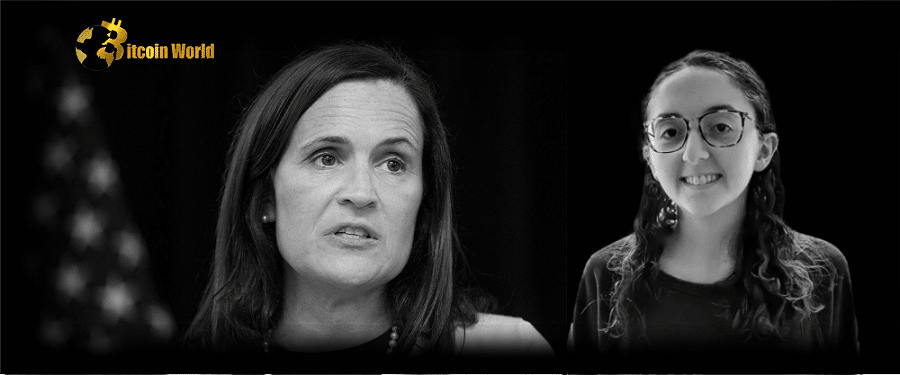

Stephanie Avakian and a team of WilmerHale lawyers will defend the former Alameda Research CEO.

According to a December 10 Bloomberg article, a former senior crypto regulator with the United States Securities and Exchange Commission (SEC) would defend Caroline Ellison, the ex-Alameda Research CEO, in an ongoing federal investigation.

Stephanie Avakian and a team of WilmerHale lawyers will represent Ellison. Avakain is the current head of the law firm’s Securities and Financial Services section. She was an Enforcement Division director at the SEC, where she increased cryptocurrency monitoring by filing actions against Robinhood and Ripple Lab.

According to the website of the legal firm, “Ms. Avakian was in charge of the Division’s 1,400 professionals and employees. During her four years as Division Director, the SEC filed over 3,000 enforcement cases, won judgments and decrees totaling more than $17 billion in fines and disgorgement, and restored nearly $3.6 billion to investors who had been victimized.”

Her biography on the law firm’s website also said that “Insider trading, financial fraud and disclosure breaches, auditor and accounting difficulties, market structure, asset management, and the Foreign Corrupt Practices Act were all addressed by Ms. Avakian’s directive. She also oversaw the Enforcement Division in addressing cutting-edge market challenges such as initial coin offerings, digital assets, and cybersecurity.”

Several investigations are continuing, and at least seven class action lawsuits have been filed against FTX Group and its executives, according to Cointelegraph. Prosecutors from the US Attorney’s Office in Manhattan and California’s Department of Financial Protection and Innovation are looking into the insolvent crypto exchange and its subsidiaries.

Federal prosecutors have also initiated an investigation into whether former FTX CEO Sam Bankman-Fried was responsible for the Terra ecosystem’s demise. Prosecutors are investigating if Bankman-enterprise Fried’s purposely induced a deluge of “sell” orders on Terra’s algorithmic stablecoin TerraUSD Classic as part of a larger investigation into FTX’s own collapse (USTC). According to The New York Times, Alameda Research was responsible for the bulk of USTC sell orders.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.