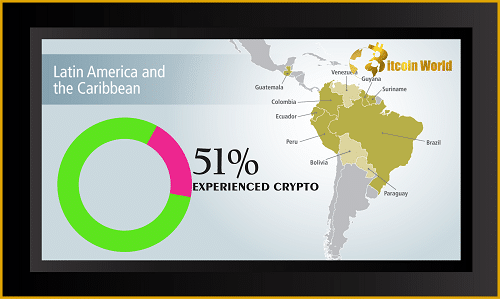

Hold on to your hats, crypto enthusiasts! The latest buzz from Mastercard’s New Payments Index poll reveals a fascinating trend brewing south of the border. It seems Latin America and the Caribbean (LAC) aren’t just watching the cryptocurrency revolution unfold – they’re actively participating. A whopping over fifty percent of consumers in the region have already interacted with cryptocurrencies. That’s a significant number, hinting at a major shift in how people perceive and use digital assets.

Why the Crypto Enthusiasm in Latin America and the Caribbean?

Mastercard’s extensive survey, engaging with over 35,000 individuals, paints a clear picture. A remarkable 51% of respondents in LAC confirmed they’ve engaged in at least one crypto-related activity in the past year. But what exactly are they doing with crypto?

- Making Payments with Stablecoins: Interestingly, more than a third of those surveyed have actually used stablecoins to make payments. This suggests a growing trust and practical application of these digital currencies for everyday transactions.

- Optimism About Digital Assets: The sentiment is overwhelmingly positive, with 54% expressing optimism about the future of digital assets. This positive outlook could be fueled by various factors, including a desire for more accessible and efficient financial solutions.

- Yearning for Flexibility: A significant 66% of respondents expressed a desire for greater flexibility in using both crypto and traditional payment methods interchangeably. Imagine seamlessly switching between your bank account and your crypto wallet – that’s the kind of integration people are hoping for.

- Knowledge is Key: The survey also highlighted a crucial point: 77% of respondents stated they would be more inclined to use crypto if they understood it better. This underscores the importance of education and accessible information in fostering wider adoption.

- Trust in Traditional Backing: Interestingly, 67% indicated they’d be willing to make or receive payments in cryptoassets if those tokens were backed by traditional finance (tradfi). This suggests a need for reassurance and stability in the nascent crypto space.

Latin America: A Crypto Outlier?

While the enthusiasm in Latin America and the Caribbean is palpable, the survey suggests the region stands out on the global stage. Worldwide, only a little over a third of respondents indicated they were likely to try paying with crypto in the coming year. Furthermore, fewer than six in ten globally felt more secure about crypto if it were issued or backed by a reputable organization. This highlights the unique appetite for crypto adoption in LAC.

The Rise of Digital Payments

Beyond crypto, the survey also confirms the growing trend of digital payments in Latin America. An impressive 95% of respondents intend to use digital payment methods in the next year. Adding to this digital shift, almost a third reported reducing their cash usage over the past year.

Digital Payments: The Bigger Picture

This surge in digital payments hasn’t gone unnoticed by major players. Mastercard’s competitor, Visa, has been actively investing in the region, recently launching various crypto cards in Brazil and Argentina in collaboration with local blockchain companies. This move reflects the increasing demand from Latin Americans for easier access to the crypto world.

As one industry expert noted, Latin Americans are increasingly interested in cryptocurrencies and are actively seeking solutions that simplify their entry into the crypto ecosystem. Mastercard, understanding this evolving landscape, is focusing on developing technologies that promote digital inclusion and build partnerships to ensure interoperability and robust support.

What Does This Mean for the Future?

The findings of Mastercard’s survey paint an exciting picture for the future of finance in Latin America and the Caribbean. The region is demonstrating a strong inclination towards digital assets, driven by a desire for greater financial flexibility and access. However, the need for education and trust-building remains crucial for sustained growth. As more individuals gain a better understanding of cryptocurrencies and as the industry continues to mature with robust backing and regulation, we can expect even greater adoption in this vibrant and digitally-savvy region. Keep an eye on Latin America – it’s shaping up to be a key player in the global crypto revolution!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.