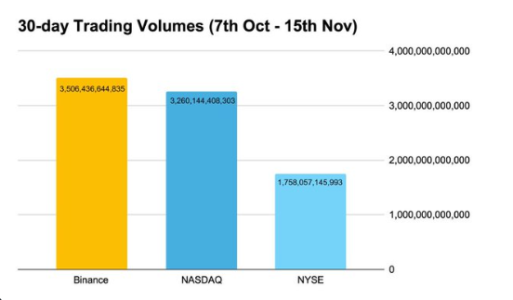

Binance’s Trading Volume Exceeds $3.5 Trillion in 30 Days, Outperforms NASDAQ and NYSE

In a groundbreaking achievement, crypto exchange Binance reported a combined spot and derivatives trading volume of over $3.5 trillion in the past 30 days, from October 7 to November 15, 2024, according to Wu Blockchain. This figure not only represents 50% of the total trading volume across all centralized exchanges (CEXs) but also surpasses the trading volumes of major global stock exchanges like NASDAQ and the New York Stock Exchange (NYSE).

Binance’s Unparalleled Trading Performance

1. Dominating the Crypto Market

Binance has cemented its position as the world’s largest cryptocurrency exchange by volume, maintaining its lead with consistent innovation, a wide range of trading products, and robust liquidity.

- 50% of Total CEX Volume: Binance alone accounts for half of the trading activity across centralized exchanges globally.

- Spot and Derivatives Leadership: Binance’s extensive offerings in both spot and derivatives markets drive its unparalleled trading performance.

2. Surpassing Stock Market Giants

Compared to traditional financial markets, Binance’s trading volume has reached impressive milestones:

- 10% Higher Than NASDAQ: Outperforming the technology-focused stock exchange.

- Twice as High as NYSE: A significant feat considering the NYSE’s stature as a leading traditional market platform.

Key Factors Driving Binance’s Success

1. Advanced Trading Tools

Binance offers a wide array of trading features, including:

- Spot Trading: Direct crypto purchases and sales.

- Derivatives: Futures and options contracts, appealing to professional traders.

- Margin Trading: Enhanced leverage options for advanced strategies.

2. Market Liquidity

With its extensive user base and trading pairs, Binance provides unmatched liquidity, enabling smooth transactions even during periods of high volatility.

3. Global Reach

Binance supports users across multiple regions, offering:

- Localized Payment Options

- Multi-Language Support

- Global Regulatory Adaptation

4. Continuous Innovation

- AI-Powered Trading Tools

- NFT Marketplaces

- Binance Earn for passive income through staking and savings.

Binance in the Context of Global Finance

| Metric | Binance | NASDAQ | NYSE |

|---|---|---|---|

| 30-Day Volume | $3.5 Trillion | ~$3.2 Trillion | ~$1.75 Trillion |

| Market Focus | Cryptocurrency | Technology Stocks | Global Equities |

| Trading Hours | 24/7 | 9:30 AM–4:00 PM ET | 9:30 AM–4:00 PM ET |

Implications for the Crypto Market

1. Increased Credibility

Binance’s massive trading volumes highlight the growing adoption of cryptocurrency as a legitimate asset class.

2. Enhanced Liquidity

The high trading activity provides a stable market environment, attracting both retail and institutional investors.

3. Competitive Edge Over Traditional Markets

With around-the-clock trading and a rapidly expanding user base, Binance showcases the potential of cryptocurrency platforms to rival traditional financial institutions.

Challenges and Criticisms

While Binance’s achievements are impressive, it faces challenges such as:

- Regulatory Scrutiny: Governments worldwide are increasing oversight of cryptocurrency exchanges.

- Market Volatility: Crypto’s inherent price fluctuations can pose risks.

- Operational Risks: Managing high trading volumes demands robust technological infrastructure.

FAQs About Binance’s Trading Volume

1. How much trading volume did Binance record in 30 days?

Binance recorded over $3.5 trillion in combined spot and derivatives trading volume.

2. How does Binance compare to NASDAQ and NYSE?

Binance’s trading volume is 10% higher than NASDAQ and twice as high as NYSE.

3. What factors contributed to Binance’s success?

Key factors include its global reach, advanced trading tools, strong liquidity, and innovative product offerings.

4. What challenges does Binance face?

Binance must navigate regulatory scrutiny, manage market volatility, and maintain operational efficiency to handle large trading volumes.

5. Why is Binance significant for the crypto market?

Binance’s dominance boosts market liquidity, attracts institutional interest, and enhances crypto’s credibility as an asset class.

Conclusion

Binance’s milestone of $3.5 trillion in 30-day trading volume underscores its dominance in the cryptocurrency market and its growing influence in global finance. By outperforming major traditional exchanges like NASDAQ and NYSE, Binance continues to highlight the increasing relevance of cryptocurrencies in modern trading.

As Binance navigates challenges and continues to innovate, it remains a cornerstone of the crypto ecosystem, reshaping how the world views digital assets.

For more insights into cryptocurrency trading, explore Top Crypto Exchanges by Volume and How Binance Became a Market Leader.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.