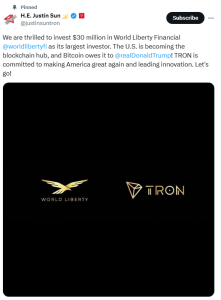

Justin Sun’s TRON Commits $30M to DeFi with World Liberty Financial Investment

Justin Sun, the founder of the TRON network (TRX), announced a $30 million investment in World Liberty Financial (WLFI), a DeFi project associated with the Trump family. The investment signals TRON’s push to strengthen its presence in the DeFi sector while reinforcing the U.S. as a hub for blockchain innovation. Sun’s declaration on X highlights his vision for advancing blockchain technology and fostering partnerships that align with his commitment to innovation.

TRON’s $30M Bet on World Liberty Financial

1. The Investment:

TRON’s $30 million backing of World Liberty Financial marks a strategic move to expand its influence in the Decentralized Finance (DeFi) space.

2. About WLFI:

- WLFI is a DeFi initiative with ties to the Trump family, reflecting the growing synergy between traditional influence and cutting-edge blockchain solutions.

- The project aims to drive decentralized finance adoption while leveraging the Trump family’s network and presence.

3. Justin Sun’s Vision:

In his announcement, Sun shared:

“The U.S. is becoming the blockchain hub, and Bitcoin owes it to @realDonaldTrump! TRON is committed to making America great again and leading innovation. Let’s go!”

The Significance of This Investment

1. Strengthening U.S. Blockchain Leadership:

- Sun’s statement underscores a belief that the U.S. is emerging as a global leader in blockchain innovation.

- Investments like TRON’s in WLFI further solidify the country’s standing in the crypto ecosystem.

2. Expanding TRON’s DeFi Portfolio:

- This partnership broadens TRON’s footprint in DeFi, a sector witnessing explosive growth with Total Value Locked (TVL) exceeding $118 billion globally.

- TRON is positioning itself as a major player in decentralized solutions through strategic collaborations.

TRON and DeFi: A Broader Context

1. TRON’s DeFi Ecosystem:

- TRON’s network is home to various DeFi applications, including lending, staking, and decentralized exchanges.

- Its focus on scalability and low transaction fees has made it a competitive platform for DeFi innovation.

2. DeFi’s Role in Blockchain Growth:

- The DeFi sector continues to attract significant investments, with projects like WLFI showcasing the intersection of blockchain technology and financial services.

- TRON’s investment highlights the sector’s potential to reshape traditional finance.

What This Means for Investors

1. Increased Confidence in TRON:

- The investment signals TRON’s commitment to fostering innovation, likely boosting investor confidence in the TRX ecosystem.

2. Spotlight on WLFI:

- WLFI gains credibility and visibility through this partnership, potentially attracting more stakeholders and users.

3. Potential for Growth:

- Collaborations with high-profile entities and figures, such as the Trump family, could spur significant growth for both TRON and WLFI.

Challenges and Considerations

1. Regulatory Environment:

- While the U.S. is emerging as a blockchain hub, regulatory clarity remains a critical factor for sustained growth in the crypto sector.

2. Public Perception:

- Partnerships involving politically affiliated entities like the Trump family could attract both support and criticism, impacting adoption and reception.

Conclusion

TRON’s $30 million investment in World Liberty Financial highlights its commitment to advancing blockchain and DeFi innovation, with a particular focus on positioning the U.S. as a global leader. This strategic move underscores TRON’s broader ambitions in the DeFi sector and its alignment with influential partners.

As blockchain continues to evolve, partnerships like this one illustrate the growing interplay between technology, finance, and traditional networks, paving the way for the next wave of crypto innovation.

To explore more about TRON’s initiatives and DeFi trends, check out our article on TRON’s role in decentralized finance

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.