Bitcoin Demand Surges Post-Correction: A Sign of Strength?

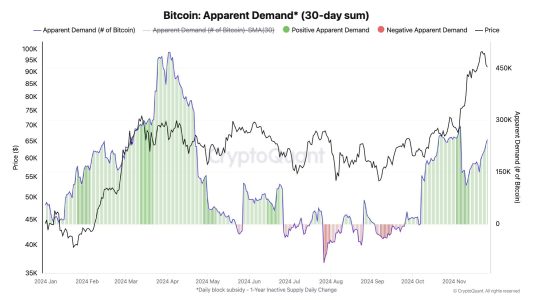

Bitcoin’s resilience shines again as demand for the cryptocurrency grows following its latest price correction. According to CryptoQuant analyst Julio Moreno, this demand uptick could signal renewed interest among investors and traders, highlighting Bitcoin’s enduring appeal even amid market volatility.

Moreno shared his insights on X (formerly Twitter), emphasizing that sustained growth in Bitcoin demand will be crucial for the cryptocurrency to regain upward momentum and potentially surpass its previous highs.

Bitcoin’s Post-Correction Behavior: What the Numbers Tell Us

The cryptocurrency market is no stranger to corrections, and Bitcoin’s recent price dip was no exception. However, analysts like Moreno see these corrections as opportunities for long-term growth rather than setbacks.

- Increased Demand: On-chain metrics point to a noticeable rise in Bitcoin inflows to wallets and exchanges.

- Buyer Confidence: New wallets being created and existing wallets accumulating more Bitcoin suggest growing investor confidence.

- Price Stability: Following the correction, Bitcoin’s price has shown signs of stabilizing, which often precedes upward movement.

This behavior reinforces Bitcoin’s status as a maturing asset class, attracting both institutional and retail participants.

Sustained Demand Growth: The Catalyst for Price Recovery

Moreno emphasized the importance of sustained demand growth in driving Bitcoin’s price higher. This growth is typically fueled by a combination of factors:

- Institutional Interest: Large-scale investors and institutions often view corrections as prime buying opportunities.

- Retail Adoption: Increased accessibility and education about Bitcoin continue to attract new retail investors.

- Market Sentiment: Positive sentiment around Bitcoin’s long-term potential, including its role as a hedge against inflation, boosts demand.

Without consistent demand, short-term rallies may falter. However, a steady influx of buyers—especially during corrections—can create a strong foundation for future price appreciation.

Historical Context: Corrections as Opportunities

Bitcoin’s price history is marked by periods of sharp corrections, often followed by significant rebounds.

- 2018-2019: After a prolonged bear market, Bitcoin regained momentum, leading to its record-breaking run in 2020-2021.

- March 2020: A rapid correction during the pandemic paved the way for a massive bull run fueled by institutional adoption.

- Current Cycle: The latest correction appears to follow this historical pattern, with rising demand setting the stage for a potential recovery.

For seasoned investors, these corrections are not signs of weakness but opportunities to accumulate Bitcoin at discounted prices.

Market Drivers: Why Bitcoin Demand Is Growing

Several factors are contributing to the current surge in Bitcoin demand:

- Macro Environment: Concerns about inflation and economic uncertainty drive investors toward Bitcoin as a hedge.

- Halving Anticipation: With Bitcoin’s next halving event approaching, many investors expect reduced supply to lead to price increases.

- Technological Advancements: Improvements in Bitcoin infrastructure, including scalability and security, enhance its appeal.

- Adoption by Enterprises: Major companies integrating Bitcoin into their payment systems or treasuries also fuel demand.

These factors combine to create a positive feedback loop, where rising demand supports higher prices, attracting even more investors.

Expert Opinions on Bitcoin’s Outlook

Julio Moreno is not alone in his optimism about Bitcoin’s prospects. Other market analysts have echoed similar sentiments, pointing to on-chain metrics that suggest healthy network activity:

- Glassnode Data: Recent reports show a rise in active addresses, an indicator of increased user engagement.

- Exchange Reserves: A decline in Bitcoin held on exchanges suggests that investors are moving their holdings to long-term storage, signaling confidence in future price growth.

- Institutional Reports: Companies like BlackRock and Fidelity continue to express interest in Bitcoin ETFs, further legitimizing the asset.

Challenges to Sustained Growth

While the outlook for Bitcoin appears promising, challenges remain:

- Regulatory Uncertainty: Ongoing debates around cryptocurrency regulation in key markets like the U.S. and Europe can create headwinds.

- Market Volatility: Bitcoin’s inherent volatility may deter risk-averse investors.

- Competition: The rise of alternative cryptocurrencies and blockchain technologies could divert attention and resources.

Addressing these challenges will require coordinated efforts from the cryptocurrency community, including enhanced education, transparency, and innovation.

Conclusion: Bitcoin Poised for Recovery?

Bitcoin’s ability to bounce back after corrections is a testament to its resilience and growing market maturity. The recent surge in demand, as highlighted by CryptoQuant analyst Julio Moreno, underscores the cryptocurrency’s enduring appeal among both institutional and retail investors.

As Bitcoin continues to evolve, sustained demand growth will be crucial in driving its price higher and reinforcing its position as a leading asset in the financial landscape.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.