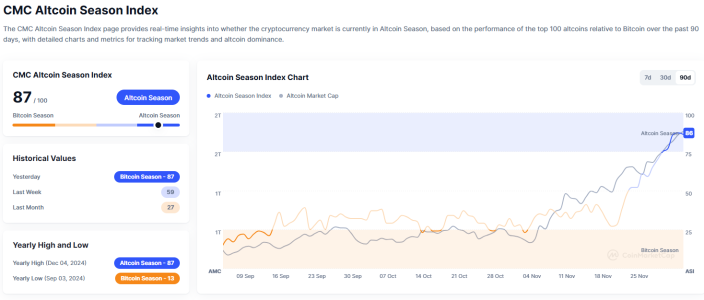

The Altcoin Season Index maintained its position at 87 as of 00:30 UTC on December 5, according to data from cryptocurrency price tracker CoinMarketCap (CMC). This unchanged score confirms that the market is firmly in Altcoin Season, where a significant majority of altcoins have outperformed Bitcoin over the past 90 days.

The index, which tracks the performance of the top 100 coins excluding stablecoins and wrapped tokens, provides valuable insight into market trends, helping investors gauge whether altcoins or Bitcoin dominate the market.

Understanding the Altcoin Season Index

How the Index Works

The Altcoin Season Index assigns a score ranging from 1 to 100, with daily updates reflecting changes in market performance.

- Altcoin Season (Score > 75): At least 75% of the top 100 altcoins outperform Bitcoin over 90 days.

- Bitcoin Season (Score < 25): Fewer than 25% of the top 100 altcoins outperform Bitcoin.

The current score of 87 highlights that altcoins are significantly outpacing Bitcoin, signaling strong investor interest in alternative cryptocurrencies.

Factors Driving Altcoin Season

Several factors contribute to the current Altcoin Season:

1. Diversification by Investors

As Bitcoin reaches all-time highs, many investors are shifting focus to altcoins for higher potential returns.

2. Innovative Blockchain Use Cases

Projects focused on decentralized finance (DeFi), non-fungible tokens (NFTs), and layer-2 solutions are gaining traction, boosting altcoin performance.

3. Lower Entry Points

Altcoins often have lower price points compared to Bitcoin, making them more accessible to retail investors looking to enter the crypto market.

Performance Highlights in Altcoin Season

1. DeFi Projects Lead the Way

Altcoins tied to DeFi platforms, such as Ethereum (ETH), Solana (SOL), and Avalanche (AVAX), have shown significant price growth, driven by increasing adoption of decentralized applications.

2. Meme Coins and Speculative Tokens

Meme-based cryptocurrencies like Dogecoin (DOGE) and Shiba Inu (SHIB) have also seen renewed interest, supported by active online communities and speculative trading.

3. Layer-2 Scaling Solutions

Optimism (OP) and Arbitrum (ARB) have gained traction as they offer scalable solutions for Ethereum-based projects, enhancing their appeal among developers and investors alike.

Implications of a Prolonged Altcoin Season

The continued dominance of altcoins has several implications for the broader cryptocurrency market:

1. Increased Market Volatility

Altcoins tend to exhibit higher price volatility compared to Bitcoin, leading to rapid gains or losses. Investors should remain cautious and manage risks effectively.

2. Broader Ecosystem Growth

Altcoin Season often coincides with the development and adoption of new blockchain technologies, which can expand the overall market.

3. Potential Market Corrections

A prolonged focus on altcoins may lead to overvaluation, increasing the likelihood of corrections once Bitcoin regains dominance.

Altcoin vs. Bitcoin Season: A Comparative Look

| Metric | Altcoin Season (87) | Bitcoin Season (< 25) |

|---|---|---|

| Market Sentiment | Bullish on altcoins | Bullish on Bitcoin |

| Investor Focus | Diversified into top altcoins | Concentrated on Bitcoin |

| Volatility | High due to speculative trading | Moderate |

| Technology Growth | Innovation in blockchain use cases | Steady |

How to Navigate Altcoin Season

For traders and investors, Altcoin Season offers both opportunities and risks. Here are some strategies to consider:

1. Diversify Investments

Invest across a range of altcoins to mitigate risk and capture potential gains. Focus on projects with strong fundamentals and real-world use cases.

2. Monitor Bitcoin Dominance

Keep an eye on Bitcoin’s dominance index, as a reversal could signal the end of Altcoin Season.

3. Stay Informed

Regularly track the Altcoin Season Index and other market indicators to adjust strategies as needed.

Expert Insights on the Current Altcoin Season

CoinMarketCap Analysts

Analysts at CoinMarketCap highlight the continued outperformance of altcoins, particularly in sectors like DeFi and blockchain infrastructure. They caution, however, that market conditions can shift rapidly.

CryptoQuant Observations

CryptoQuant notes that institutional investors have begun exploring altcoins as part of broader diversification strategies, further fueling the current trend.

Conclusion

The Altcoin Season Index remaining at 87 reaffirms the market’s strong preference for altcoins, with 75% of top cryptocurrencies outperforming Bitcoin. This period of altcoin dominance reflects growing investor interest in blockchain innovation and diversification.

While Altcoin Season presents lucrative opportunities, investors must remain vigilant about potential risks, including heightened volatility and market corrections. As the crypto ecosystem evolves, staying informed and adopting a balanced investment approach will be key to navigating this dynamic phase.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.