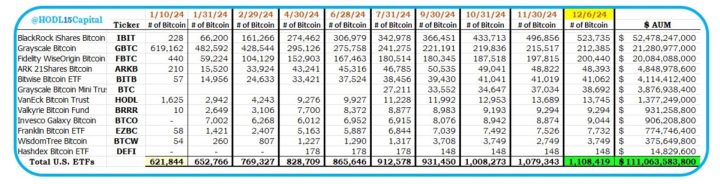

In the rapidly evolving landscape of cryptocurrency investments, Exchange-Traded Funds (ETFs) have emerged as a pivotal vehicle for institutional and retail investors seeking exposure to digital assets without the complexities of direct ownership. A recent disclosure by crypto investor HODL15Capital on X (formerly known as Twitter) has shed light on a significant milestone: U.S. spot Bitcoin ETFs collectively hold over 1.1 million Bitcoin, valued at an impressive $111 billion in assets under management (AUM). This development underscores the growing institutional adoption of Bitcoin and signals a transformative phase for the cryptocurrency market.

Understanding Spot Bitcoin ETFs

What are Spot Bitcoin ETFs?

A Spot Bitcoin ETF is an investment fund traded on stock exchanges that directly holds Bitcoin as its underlying asset. Unlike futures-based ETFs, which derive their value from Bitcoin futures contracts, spot ETFs provide investors with direct exposure to Bitcoin’s current market price. This direct holding mechanism ensures that the ETF’s performance closely mirrors the actual price movements of Bitcoin, offering a more transparent and straightforward investment avenue.

The Mechanics of Spot Bitcoin ETFs

Spot Bitcoin ETFs operate by holding Bitcoin in custody on behalf of their investors. The ETF issues shares that represent fractional ownership of the total Bitcoin held in the fund. Investors can buy and sell these shares on traditional stock exchanges, just like they would with any other ETF or stock. This structure allows for seamless integration of Bitcoin into conventional investment portfolios, eliminating the need for investors to manage digital wallets, private keys, or navigate cryptocurrency exchanges directly.

Regulatory Approval and Significance

The approval of spot Bitcoin ETFs by regulatory bodies like the U.S. Securities and Exchange Commission (SEC) marks a significant milestone in the mainstream acceptance of cryptocurrencies. Regulatory approval not only legitimizes Bitcoin as an investment asset but also paves the way for broader institutional participation. It provides a regulated framework that ensures investor protection, transparency, and compliance with financial standards, making Bitcoin accessible to a wider range of investors, including those who were previously hesitant due to regulatory uncertainties.

The Milestone: 1.1 Million Bitcoin Held by U.S. Spot ETFs

Breakdown of the Holdings

As of December 6, 2024, U.S. spot Bitcoin ETFs have amassed a total of 1,108,419 Bitcoin, with an estimated total value of $111 billion. This figure represents a substantial portion of the total Bitcoin in circulation and signifies a major influx of institutional capital into the cryptocurrency market.

Comparative Analysis with Past Data

To contextualize this milestone, it’s essential to examine the historical trajectory of Bitcoin ETFs:

- Launch of First Bitcoin ETFs: The first Bitcoin ETFs were launched in Canada in early 2021, providing Canadian investors with regulated exposure to Bitcoin. The U.S. followed suit later, with the SEC approving spot Bitcoin ETFs in late 2023, albeit with stringent regulatory conditions.

- Growth Over Time: Since their inception, Bitcoin ETFs have experienced exponential growth. From a modest AUM at launch, the combined holdings have surged to over 1.1 million Bitcoin within a relatively short period, reflecting robust investor interest and confidence in the asset class.

- Institutional Adoption: The steady increase in Bitcoin holdings by ETFs indicates a broader trend of institutional adoption. Major financial institutions, including BlackRock, Fidelity, and Vanguard, have launched their Bitcoin ETF products, attracting significant investments from pension funds, endowments, and other large-scale investors.

Drivers Behind the Growth

Several factors have contributed to the surge in Bitcoin holdings by U.S. spot ETFs:

- Institutional Confidence: Institutional investors view Bitcoin as a hedge against inflation and currency devaluation, driving substantial inflows into ETFs that provide exposure without the need for direct ownership.

- Regulatory Clarity: The SEC’s approval of spot Bitcoin ETFs has provided the necessary regulatory framework, reducing uncertainties and encouraging more investors to participate.

- Market Maturity: As the cryptocurrency market matures, with improved infrastructure, security, and liquidity, Bitcoin ETFs become a more attractive and reliable investment option.

- Diversification Benefits: ETFs offer diversification benefits, allowing investors to integrate Bitcoin into their portfolios alongside traditional assets like stocks, bonds, and commodities.

Implications for the Cryptocurrency Market

Enhanced Liquidity and Market Stability

The substantial holdings of Bitcoin by ETFs enhance the overall liquidity of the cryptocurrency market. Increased liquidity facilitates smoother trading, reduces price volatility, and ensures that large transactions can be executed without significant market disruptions. This stability is crucial for attracting more institutional and retail investors, fostering a more resilient and robust market environment.

Price Appreciation Potential

The inflow of $111 billion into spot Bitcoin ETFs exerts upward pressure on Bitcoin prices. As ETFs purchase large quantities of Bitcoin to meet investor demand, the increased demand coupled with limited supply can drive significant price appreciation. Historically, similar inflows have led to bullish trends, contributing to rapid price surges during periods of high institutional investment.

Institutional Legitimacy and Mainstream Acceptance

The growing presence of Bitcoin ETFs signifies a broader institutional acceptance of cryptocurrencies. As more reputable financial institutions manage substantial Bitcoin holdings, the stigma surrounding digital assets diminishes, promoting mainstream acceptance. This legitimization can lead to further institutional participation, enhancing the overall credibility and stability of the cryptocurrency ecosystem.

Impact on Alternative Investments

The rise of Bitcoin ETFs presents both opportunities and challenges for alternative investment vehicles. Traditional hedge funds, private equity firms, and venture capital funds may increasingly incorporate Bitcoin into their portfolios to align with institutional trends and capitalize on the growth potential of digital assets. Conversely, alternative investments that fail to adapt to the evolving market dynamics may face reduced attractiveness and competitiveness.

Institutional Adoption and Market Dynamics

The Role of Major Financial Institutions

Leading financial institutions have been at the forefront of Bitcoin ETF adoption. Firms like BlackRock, Fidelity, and Invesco have launched their own Bitcoin ETF products, leveraging their extensive client bases and financial expertise to attract substantial investments. These institutions bring credibility, operational efficiency, and robust risk management practices to the cryptocurrency market, fostering greater trust and confidence among investors.

Strategic Investment Strategies

Institutional investors employ various strategies to maximize the benefits of Bitcoin ETFs:

- Hedging Portfolios: Institutions use Bitcoin ETFs to hedge against macroeconomic risks, such as inflation and currency depreciation, ensuring portfolio resilience during economic downturns.

- Diversification: Incorporating Bitcoin ETFs into diversified portfolios enhances overall returns and reduces risk exposure by providing access to a high-growth asset class.

- Strategic Allocation: Institutions allocate a portion of their assets to Bitcoin ETFs based on their risk tolerance, investment horizon, and financial goals, optimizing portfolio performance.

Competitive Landscape

The Bitcoin ETF market is becoming increasingly competitive as more financial institutions enter the space. Differentiating factors among ETFs include fee structures, asset management strategies, and the extent of institutional backing. This competition drives innovation, leading to the development of more sophisticated investment products that cater to diverse investor needs and preferences.

Potential for Further Growth

Given the current momentum, the Bitcoin ETF market is poised for continued growth. Factors such as broader regulatory acceptance, increasing institutional confidence, and technological advancements in the cryptocurrency space will likely drive further inflows into Bitcoin ETFs. As the market matures, Bitcoin ETFs may become a standard component of institutional and retail investment portfolios, fostering sustained growth and stability.

Regulatory Considerations and Challenges

The SEC’s Stance on Bitcoin ETFs

The approval of spot Bitcoin ETFs by the SEC marks a significant regulatory milestone. However, regulatory scrutiny remains a critical factor influencing the growth and sustainability of Bitcoin ETFs. The SEC continues to monitor the cryptocurrency market closely, ensuring that ETFs adhere to stringent regulatory standards designed to protect investors and maintain market integrity.

Compliance and Transparency

Bitcoin ETFs must comply with various regulatory requirements, including:

- Anti-Money Laundering (AML) and Know Your Customer (KYC): ETFs must implement robust AML and KYC protocols to prevent illicit activities and ensure transparent operations.

- Custodial Standards: Ensuring secure and reliable custody solutions for holding Bitcoin is essential to safeguard investor assets and maintain trust.

- Reporting and Disclosure: Regular reporting and transparent disclosure practices are mandatory to provide investors with accurate and timely information about ETF holdings, performance, and risk factors.

Potential Regulatory Changes

As the cryptocurrency market evolves, regulatory frameworks are likely to undergo significant changes. Potential developments include:

- Enhanced Regulatory Oversight: The SEC may introduce more comprehensive regulations to address emerging risks and challenges associated with Bitcoin ETFs, including market manipulation, insider trading, and fraud.

- Global Regulatory Harmonization: Coordinated efforts among international regulatory bodies could lead to standardized regulations for Bitcoin ETFs, facilitating cross-border investments and reducing regulatory arbitrage.

- Innovative Compliance Solutions: Advancements in blockchain analytics and regulatory technology (RegTech) can enhance compliance and transparency, ensuring that Bitcoin ETFs meet evolving regulatory standards.

Impact of Regulatory Developments on Bitcoin ETFs

Regulatory changes can have profound effects on Bitcoin ETFs:

- Positive Developments: Favorable regulations can boost investor confidence, attract more institutional investments, and drive further growth in Bitcoin ETF holdings.

- Negative Developments: Stricter regulations or unfavorable policies can constrain the growth of Bitcoin ETFs, limit investor participation, and create operational challenges for asset managers.

Market Sentiment and Investor Behavior

The Psychology Behind the Crypto Fear & Greed Index

Market sentiment plays a pivotal role in the cryptocurrency market, influencing price movements, investment decisions, and overall market dynamics. The Crypto Fear & Greed Index serves as a barometer for investor sentiment, categorizing the market’s emotional state based on factors like volatility, trading volume, social media activity, and more.

Current Sentiment: Extreme Greed

With the Crypto Fear & Greed Index currently at 78, the market remains in the ‘Extreme Greed’ zone. This high sentiment level reflects strong investor confidence, robust buying activity, and an overall bullish outlook. Extreme greed often precedes significant price movements, either upward due to continued investment inflows or downward as market corrections ensue.

Implications of Extreme Greed for Bitcoin ETFs

- Increased Investment Activity: High sentiment levels can drive more investments into Bitcoin ETFs, amplifying the inflow of capital and boosting AUM.

- Price Momentum: Continued extreme greed can sustain Bitcoin’s price momentum, encouraging further ETF investments and potentially leading to new all-time highs.

- Risk of Overvaluation: Prolonged periods of extreme greed can lead to overvaluation, increasing the risk of market corrections that may impact Bitcoin ETFs negatively.

Balancing Sentiment with Fundamentals

While market sentiment provides valuable insights, it’s essential to balance emotional factors with fundamental analysis. Investors and asset managers should assess the underlying value, technological advancements, regulatory developments, and macroeconomic trends to make informed investment decisions, rather than solely relying on sentiment indicators.

The Future of Bitcoin ETFs and Institutional Investments

Projected Growth Trajectory

Given the current holdings and market trends, Bitcoin ETFs are expected to continue their upward trajectory. Factors such as increasing institutional adoption, technological innovations, and favorable regulatory developments will likely drive further growth in Bitcoin ETF holdings and AUM.

Potential for New ETF Products

As the market matures, we can anticipate the introduction of more specialized Bitcoin ETF products, catering to different investor needs and preferences. Examples include:

- Thematic ETFs: Focused on specific aspects of the Bitcoin ecosystem, such as mining, blockchain technology, or environmental sustainability.

- Leveraged ETFs: Designed for investors seeking amplified exposure to Bitcoin’s price movements through the use of leverage.

- Multi-Crypto ETFs: Offering exposure to a basket of cryptocurrencies, including Bitcoin, Ethereum, and other major digital assets, providing diversified investment options within a single ETF.

Integration with Traditional Financial Systems

Bitcoin ETFs will increasingly integrate with traditional financial systems, bridging the gap between conventional finance and the cryptocurrency market. This integration can facilitate seamless investment processes, enhance liquidity, and promote greater acceptance of digital assets among mainstream investors.

Technological Advancements and Infrastructure Development

Continued advancements in blockchain technology, cybersecurity, and financial infrastructure will enhance the operational efficiency and security of Bitcoin ETFs. Innovations such as decentralized finance (DeFi) protocols, improved custodial solutions, and real-time tracking systems will further bolster the attractiveness and reliability of Bitcoin ETFs as a preferred investment vehicle.

Global Expansion and Cross-Border Investments

As regulatory frameworks evolve and Bitcoin ETFs gain global acceptance, cross-border investments in Bitcoin ETFs will become more prevalent. International investors seeking exposure to Bitcoin will leverage U.S. spot ETFs as a reliable and regulated investment option, driving global capital flows into the cryptocurrency market.

Conclusion

The U.S. spot Bitcoin ETFs holding over 1.1 million Bitcoin, valued at $111 billion, marks a significant milestone in the institutional adoption of cryptocurrencies. This development underscores the growing confidence of major financial institutions in Bitcoin as a viable and strategic investment asset. The substantial investment inflows into spot Bitcoin ETFs enhance market liquidity, drive price appreciation, and contribute to the overall stability of the cryptocurrency ecosystem.

BlackRock’s aggressive investment in Bitcoin ETFs and the ongoing support from other leading asset managers reflect a transformative shift in how traditional finance interacts with digital assets. Regulatory approvals, technological advancements, and the maturation of the cryptocurrency market continue to propel Bitcoin ETFs into the mainstream investment landscape.

However, this growth trajectory is not without challenges. Regulatory uncertainties, market volatility, and the potential for overvaluation pose significant risks that must be navigated with strategic foresight and robust risk management practices. Balancing market sentiment with fundamental analysis will be crucial for investors and asset managers to sustain growth and mitigate risks associated with extreme greed and speculative investments.

As the cryptocurrency market continues to evolve, Bitcoin ETFs will play an increasingly pivotal role in shaping the future of digital finance. By providing a regulated, accessible, and transparent investment vehicle, Bitcoin ETFs bridge the gap between traditional finance and the burgeoning world of cryptocurrencies, paving the way for broader adoption and integration of digital assets into global financial systems.

For investors seeking to capitalize on the growth potential of Bitcoin while maintaining exposure to a regulated investment vehicle, U.S. spot Bitcoin ETFs represent a compelling option. As these ETFs continue to attract substantial investments and expand their holdings, they will undoubtedly influence the trajectory of Bitcoin’s market dynamics and the overall landscape of institutional investments in the cryptocurrency space.

To stay informed about the latest developments and gain deeper insights into the cryptocurrency market, continue exploring our comprehensive coverage and expert analyses. The intersection of traditional finance and digital innovation offers a wealth of opportunities for strategic investments, technological advancements, and transformative growth within the global financial ecosystem.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.