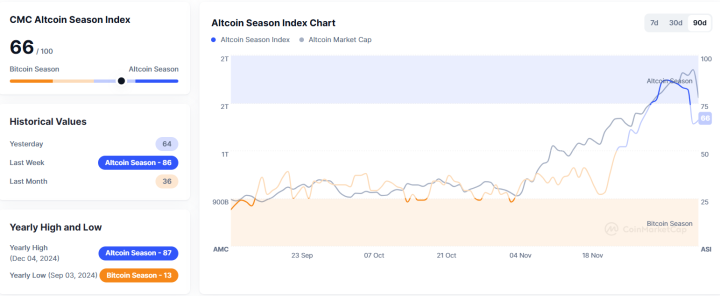

As of December 10, 2024, the Altcoin Season Index, a key metric for gauging market trends in the cryptocurrency sector, rose by two points to 66, according to CoinMarketCap (CMC). This reading confirms that the market remains in an Altcoin Season, a period characterized by altcoins outperforming Bitcoin.

The index measures the performance of the top 100 cryptocurrencies (excluding stablecoins and wrapped tokens) over the past 90 days. For the market to qualify as an Altcoin Season, at least 75% of these coins must have outperformed Bitcoin. With a score of 66, the market is solidly in altcoin territory, reflecting strong momentum across a diverse range of assets.

What Is the Altcoin Season Index?

The Altcoin Season Index is a sentiment and performance indicator that tracks the relative strength of altcoins compared to Bitcoin. The index ranges from 1 to 100:

- 1-25: Signals Bitcoin Season, where Bitcoin significantly outperforms most altcoins.

- 26-74: Represents a mixed or neutral market with no clear dominance.

- 75-100: Denotes Altcoin Season, where most altcoins outperform Bitcoin.

Calculation Methodology

The index is calculated by evaluating the performance of the top 100 coins (excluding stablecoins and wrapped tokens) on CoinMarketCap over the past 90 days. The metric provides a daily snapshot of market sentiment, offering traders insights into shifting trends.

Implications of an Altcoin Season

The Altcoin Season Index hitting 66 indicates that altcoins are gaining significant traction relative to Bitcoin. This shift in momentum carries several implications for the cryptocurrency market:

1. Increased Market Diversification

Altcoin Season reflects a growing appetite among traders for assets beyond Bitcoin, often driven by unique use cases or technological advancements in the altcoin space.

2. Opportunity for Gains

Historically, altcoin rallies have delivered higher percentage returns than Bitcoin during bullish periods, offering traders opportunities for significant gains.

3. Risk of Overextension

While the potential for profit is high, altcoins are typically more volatile than Bitcoin. Traders should remain cautious of rapid market reversals.

Factors Driving the Current Altcoin Season

Several key factors contribute to the ongoing Altcoin Season, as reflected by the rising index:

1. DeFi and GameFi Growth

Altcoins powering decentralized finance (DeFi) platforms and blockchain-based gaming ecosystems have seen increased adoption, driving their outperformance.

2. Layer-2 and Interoperability Solutions

Projects focusing on scalability and cross-chain compatibility, such as Polygon (MATIC) and Cosmos (ATOM), are gaining traction, bolstering altcoin performance.

3. Institutional Interest

Growing institutional involvement in cryptocurrencies extends beyond Bitcoin, with funds and firms exploring altcoins for diversification.

4. Social Media Hype

Social media platforms like X (formerly Twitter) and Reddit have played a pivotal role in promoting niche altcoins, amplifying their visibility and price action.

How Altcoin Season Affects Market Participants

The Altcoin Season Index is a valuable tool for traders and investors seeking to navigate shifting market conditions.

1. For Retail Traders

Altcoin Season often attracts retail investors looking for high returns in emerging projects. However, the increased volatility of altcoins requires careful risk management.

2. For Institutional Investors

Institutions may use Altcoin Season to explore assets with specific utilities or long-term potential, balancing risk with strategic diversification.

3. For Developers and Projects

The heightened interest in altcoins during this period can drive attention and capital to blockchain projects, accelerating their development and adoption.

Historical Trends: Lessons from Previous Altcoin Seasons

Analyzing past Altcoin Seasons provides valuable context for understanding the current market dynamics:

2017 Altcoin Boom

- Catalyst: The ICO (Initial Coin Offering) frenzy drove massive interest in altcoins.

- Outcome: Many altcoins outperformed Bitcoin but faced severe corrections during the subsequent bear market.

2021 Altcoin Rally

- Catalyst: The rise of DeFi, NFTs, and smart contract platforms like Ethereum.

- Outcome: Altcoins like Solana (SOL) and Cardano (ADA) achieved significant gains, but volatility remained a risk.

Current Trends (2024)

- Focus: Layer-2 solutions, interoperability, and real-world applications dominate the altcoin narrative.

- Opportunity: A more mature market and institutional interest may provide greater stability compared to previous cycles.

Strategies for Navigating Altcoin Season

While Altcoin Season presents opportunities for traders, it also requires a strategic approach to mitigate risks:

1. Focus on Fundamentals

Invest in projects with strong use cases, robust development teams, and active communities. Avoid speculative coins with unclear value propositions.

2. Diversify Your Portfolio

Spread investments across multiple altcoins to reduce the risk of overexposure to a single asset. Include a mix of large-cap and emerging coins.

3. Monitor Bitcoin’s Performance

Bitcoin’s dominance remains a key indicator of market trends. A sudden rise in Bitcoin dominance could signal the end of Altcoin Season.

4. Use Stop-Loss Orders

Implement stop-loss orders to protect against sudden downturns, especially in highly volatile altcoins.

5. Stay Informed

Leverage tools like the Altcoin Season Index and market analytics platforms to stay ahead of trends.

Potential Risks of Altcoin Season

Despite the opportunities, traders should remain aware of the risks associated with Altcoin Season:

1. High Volatility

Altcoins are more susceptible to sharp price swings, which can lead to significant losses for unprepared traders.

2. Market Overextension

An extended Altcoin Season can result in inflated valuations, increasing the likelihood of a market correction.

3. Rug Pulls and Scams

The altcoin market often attracts bad actors during bullish phases. Conduct thorough due diligence before investing in lesser-known projects.

The Road Ahead: Will the Index Continue to Rise?

The Altcoin Season Index’s current level of 66 suggests strong momentum for altcoins, but its trajectory will depend on several factors:

- Bitcoin Dominance: A sustained decrease in Bitcoin’s market share could fuel further altcoin gains.

- Macroeconomic Conditions: Global economic stability and regulatory clarity will influence market sentiment.

- Technological Developments: Breakthroughs in blockchain scalability, interoperability, and adoption could sustain altcoin performance.

Conclusion

The Altcoin Season Index’s rise to 66 confirms a period of strong momentum for altcoins, reflecting increasing interest and outperformance relative to Bitcoin. For traders and investors, this period presents a wealth of opportunities but also demands caution and strategic planning to navigate its inherent risks.

By understanding the factors driving Altcoin Season and employing sound strategies, market participants can position themselves to capitalize on the current trends while mitigating potential downsides.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.