In its latest report, blockchain intelligence platform CryptoQuant predicts that Ethereum (ETH) could surpass $5,000 if current demand trends persist. The analysis highlights strong investor interest, expanding network activity, and record-breaking Ethereum ETF holdings as key drivers of this potential price surge.

Key Factors Driving Ethereum’s Potential $5K Price

1. Rising Demand for Ethereum

The surge in investor demand for Ethereum is evident in several metrics:

- Ethereum ETFs: U.S. spot Ethereum ETFs have grown their holdings from 3.095 million ETH in July 2024 to a record 3.41 million ETH by year-end.

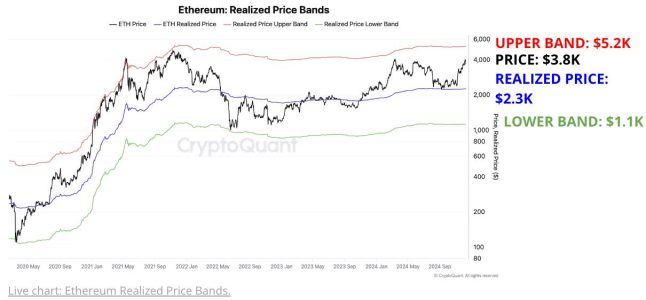

- New Investors: More investors are entering the market, buying Ethereum at higher prices, pushing the realized price—a metric reflecting the average purchase price—closer to $5,200.

2. Increased Network Activity

Ethereum’s network activity has seen consistent growth throughout 2024:

- Daily Transactions: Ethereum handles between 6.5 and 7.5 million daily transactions, a significant jump from the 5 million average in 2023.

- DeFi and NFTs: Continued growth in decentralized finance (DeFi) and NFT applications contributes to higher transaction volumes and increased demand for ETH.

3. Historical Price Trends

CryptoQuant notes that the realized price of ETH aligns closely with its previous all-time high of $5,200 during the 2021 bull run. This metric serves as a price ceiling, which is expected to rise as demand continues to grow.

The Role of Ethereum ETFs

The launch of spot Ethereum ETFs in July 2024 has been a game-changer for institutional adoption:

- Institutional Inflows: ETFs provide a simplified route for institutional investors to gain exposure to ETH without direct ownership, driving up demand.

- Record Holdings: ETF holdings reaching 3.41 million ETH reflect increased confidence in Ethereum as a long-term asset.

Ethereum’s Growing Ecosystem

Ethereum’s ecosystem continues to expand, supporting its bullish price outlook:

1. Layer-2 Scaling Solutions

Layer-2 platforms like Arbitrum and Optimism are increasing Ethereum’s transaction throughput, reducing fees, and driving adoption.

2. DeFi and DApp Growth

The Ethereum network remains the backbone of the DeFi sector, with billions in total value locked (TVL) and growing demand for decentralized applications (DApps).

3. Ethereum’s Shift to Proof of Stake (PoS)

The transition to Proof of Stake has reduced Ethereum’s energy consumption and increased staking participation, enhancing network security and incentivizing long-term holding.

Comparative Metrics: 2023 vs. 2024

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Daily Transactions | ~5 million | 6.5–7.5 million | +30–50% |

| ETH ETF Holdings | Not available | 3.41 million ETH | Record high |

| Realized Price | ~$3,200 | ~$5,200 | +62.5% |

CryptoQuant’s Price Prediction

CryptoQuant predicts that Ethereum’s price could surpass $5,000 in early 2025, contingent on sustained demand and network growth. The realized price serves as a key indicator for this target, suggesting the ceiling will rise as more investors buy ETH at higher prices.

Challenges to Consider

Despite the bullish outlook, certain risks could impact Ethereum’s price trajectory:

1. Regulatory Uncertainty

Global regulatory developments could affect the adoption of Ethereum ETFs and DeFi platforms.

2. Market Volatility

Cryptocurrency prices remain highly volatile, with potential for sharp corrections.

3. Competition from Other Chains

Layer-1 competitors like Solana and Cardano are gaining traction, posing challenges to Ethereum’s dominance.

Expert Opinions on Ethereum’s Future

Ilya Kalchev, Nexo Analyst:

“Ethereum’s strong fundamentals, coupled with growing ETF adoption, set the stage for a breakout above $5,000.”

Michael Saylor, Bitcoin Advocate:

“While Bitcoin remains the ultimate store of value, Ethereum’s utility-driven demand is fueling its growth.”

Conclusion: Ethereum on Track for $5K

With rising demand, expanding network activity, and record ETF inflows, Ethereum is well-positioned to surpass $5,000 in the near future. CryptoQuant’s analysis underscores the importance of Ethereum’s growing ecosystem and its pivotal role in the crypto economy.

As institutional interest deepens and new investors enter the market, Ethereum’s price ceiling is expected to rise, setting the stage for continued growth in 2025 and beyond.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.