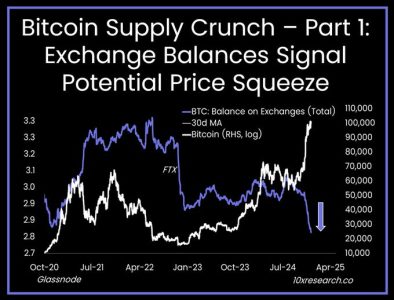

The Bitcoin market may be heading toward a supply squeeze as cryptocurrency exchanges recorded a net outflow of 124,000 BTC over the past 30 days, according to 10x Research. This significant outflow, coupled with sustained demand, could lead to a tightening of Bitcoin supply and upward price pressure.

Major Exchanges Witness Large Bitcoin Outflows

Recent data shows that several top cryptocurrency exchanges have experienced significant reductions in their Bitcoin reserves:

1. Coinbase

- Outflow: 72,000 BTC (nearly 10% of its total reserves).

- Current Balance: 748,000 BTC, maintaining its position as the exchange with the largest BTC reserves.

2. Binance

- Outflow: 29,000 BTC.

- Current Balance: 570,000 BTC.

3. Other Major Players

- Gemini, OKX, and Kraken: Each reported substantial outflows, further contributing to the overall decline in exchange balances.

4. Outlier: Bitfinex

Unlike its peers, Bitfinex recorded a net inflow of 8,500 BTC, bucking the broader trend.

Why Are Bitcoin Outflows Increasing?

The surge in outflows from exchanges can be attributed to several factors:

1. Shift Toward Long-Term Holding

Investors are increasingly moving Bitcoin off exchanges to cold wallets, signaling a preference for long-term holding rather than active trading.

2. Growing Institutional Interest

Institutions continue to accumulate Bitcoin, driven by macroeconomic factors and growing trust in digital assets as a store of value.

3. Regulatory Concerns

Uncertainty surrounding cryptocurrency regulations may be prompting investors to secure their holdings in private wallets.

4. Anticipation of Price Gains

With Bitcoin’s potential supply squeeze, investors may be withdrawing funds in anticipation of future price appreciation.

Potential Impact of a Bitcoin Supply Squeeze

1. Increased Price Pressure

As exchange balances dwindle, reduced liquidity could drive prices higher, particularly if demand remains robust.

2. Stronger Bullish Sentiment

Declining Bitcoin availability on exchanges often correlates with rising bullish sentiment, encouraging further accumulation.

3. Market Volatility

A tightened supply could exacerbate Bitcoin’s price volatility, with sharp upward movements during periods of high demand.

Current Exchange Bitcoin Balances

| Exchange | Previous Balance | Net Change | Current Balance |

|---|---|---|---|

| Coinbase | ~820,000 BTC | -72,000 BTC | ~748,000 BTC |

| Binance | ~599,000 BTC | -29,000 BTC | ~570,000 BTC |

| Gemini | Not disclosed | Significant outflow | Not disclosed |

| Bitfinex | ~125,000 BTC | +8,500 BTC | ~133,500 BTC |

Comparative Trends in Bitcoin Supply

2024 Exchange Outflows

The current 124,000 BTC outflow in the past 30 days marks one of the most significant declines in recent years.

Historical Context

- Similar outflows in 2020 and 2021 preceded significant Bitcoin bull runs, as reduced exchange liquidity drove price increases.

Expert Insights on Bitcoin’s Supply Dynamics

Mena Theodorou, Co-Founder of Coinstash:

“This level of Bitcoin outflow suggests a clear shift toward long-term holding. As supply on exchanges tightens, the probability of price surges increases significantly.”

James Seyffart, Bloomberg Analyst:

“The combination of institutional accumulation and reduced exchange balances paints a bullish outlook for Bitcoin in the coming months.”

Risks Associated with Supply Tightening

While a Bitcoin supply squeeze may boost prices, there are risks to consider:

- Volatility: Tightened liquidity could lead to sharp price swings.

- Market Manipulation: Reduced supply might make the market more susceptible to manipulation by large holders.

- Regulatory Uncertainty: Potential policy changes could impact investor confidence.

Strategies for Navigating the Bitcoin Market

Given the current trends, here are strategies for investors:

1. Monitor Exchange Balances

Keeping an eye on exchange reserves can provide insights into supply trends and market sentiment.

2. Diversify Holdings

While Bitcoin shows strong potential, diversifying into other high-performing cryptocurrencies may mitigate risks.

3. Focus on Long-Term Gains

With institutional adoption and decreasing supply, Bitcoin’s long-term outlook remains positive, making it an attractive option for patient investors.

Conclusion: A Tighter Bitcoin Market Ahead

The significant 124,000 BTC outflow from exchanges underscores a growing trend of long-term holding and institutional accumulation. If this trend continues alongside sustained demand, the Bitcoin market could experience a supply squeeze, leading to upward price momentum and increased market enthusiasm.

While risks like volatility and regulatory challenges persist, the current dynamics present an optimistic outlook for Bitcoin as it moves into 2025.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.