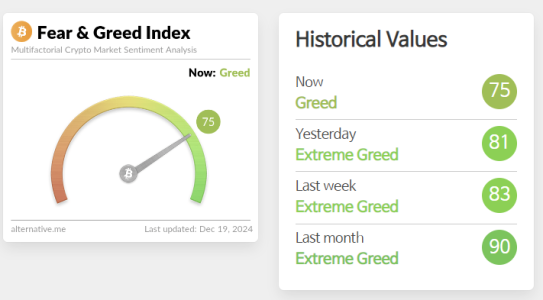

The Crypto Fear & Greed Index, a popular gauge of market sentiment, has fallen to 75, signaling a shift from the “Extreme Greed” zone to the “Greed” zone. The index, provided by software development platform Alternative, measures emotions and attitudes in the cryptocurrency market on a scale from 0 (Extreme Fear) to 100 (Extreme Greed).

As of December 19, 2024, the index is down six points from the previous day, reflecting weakened sentiment amidst market fluctuations. The decline comes at a time when the crypto market is facing mixed signals, with factors like volatility and social media sentiment contributing to this shift.

What Is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is a composite metric designed to capture the emotional landscape of the cryptocurrency market. It provides insight into whether investors are overly fearful or greedy, helping them make more informed trading decisions.

How It Works:

The index is calculated using six key factors, each weighted differently:

- Volatility (25%): Examines current volatility and maximum drawdowns in Bitcoin and compares them with recent averages.

- Market Momentum/Volume (25%): Tracks trading volume and market momentum in comparison to historical trends.

- Social Media (15%): Analyzes mentions, hashtags, and engagement across platforms like Twitter.

- Surveys (15%): Incorporates investor surveys, though this component is less frequently updated.

- Bitcoin Dominance (10%): Measures Bitcoin’s share of the overall cryptocurrency market cap.

- Google Trends (10%): Tracks search trends and query volumes for cryptocurrency-related terms.

What Does a Score of 75 Indicate?

With the index now standing at 75, it indicates a market leaning toward “Greed.”

- Greed Zone (50–74): Reflects moderate optimism among investors, with a tendency for higher risk-taking behavior.

- Extreme Greed Zone (75–100): Signals potential overvaluation and an overheated market, often a precursor to corrections.

This shift from “Extreme Greed” to “Greed” suggests that while optimism remains high, market participants are becoming more cautious.

What Caused the Shift?

1. Volatility and Market Trends

- Increased Volatility: Recent fluctuations in Bitcoin and Ethereum prices have tempered market exuberance.

- Lower Momentum: A slowdown in trading volume has contributed to reduced bullish sentiment.

2. Social Media and Sentiment Analysis

- Decreased Engagement: Social media activity surrounding major cryptocurrencies has dipped, reflecting tempered enthusiasm.

3. External Factors

- Regulatory Developments: Ongoing discussions about U.S. crypto regulation and global monetary policies may have influenced investor sentiment.

Why Is the Fear & Greed Index Important?

The Crypto Fear & Greed Index serves as a valuable tool for understanding market psychology:

- Greed Indicates Overconfidence: High scores often coincide with market tops, where excessive optimism leads to potential corrections.

- Fear Suggests Undervaluation: Low scores signal widespread caution or panic, which can present buying opportunities for contrarian investors.

By tracking changes in the index, traders can gauge whether the market is leaning toward irrational exuberance or excessive fear.

Recent Market Behavior

The current reading of 75 aligns with broader trends observed in the cryptocurrency market:

- Bitcoin Dominance: Bitcoin’s dominance remains strong but has slightly declined as investors explore altcoins.

- ETH and Altcoins: Ethereum and other altcoins have seen mixed performance, contributing to a less unified market sentiment.

- Institutional Activity: Despite strong interest, institutional buying has slowed, adding to the cautious tone.

FAQs

What is the Crypto Fear & Greed Index?

It is a composite metric that measures emotions and sentiments in the cryptocurrency market on a scale from 0 (Extreme Fear) to 100 (Extreme Greed).

What does a score of 75 mean?

A score of 75 places the market in the “Greed” zone, indicating optimism among investors but with growing caution.

Why did the index drop from 81 to 75?

The decline reflects reduced trading momentum, increased volatility, and subdued social media engagement.

How is the Fear & Greed Index calculated?

The index uses six factors: volatility (25%), market momentum/volume (25%), social media (15%), surveys (15%), Bitcoin dominance (10%), and Google Trends (10%).

Why is the Fear & Greed Index important?

It provides insights into market psychology, helping traders identify potential buying or selling opportunities based on sentiment extremes.

What does the “Extreme Greed” zone signify?

The “Extreme Greed” zone indicates potential overvaluation and market exuberance, often a precursor to corrections.

Conclusion

The Crypto Fear & Greed Index dropping to 75 highlights a market that remains optimistic but is starting to exhibit caution. While the “Greed” zone still signals investor confidence, the decline from “Extreme Greed” suggests a more measured sentiment as volatility and other factors temper enthusiasm.

Traders and investors can use the index to navigate the crypto market more effectively, balancing risk-taking with an awareness of prevailing market conditions.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.