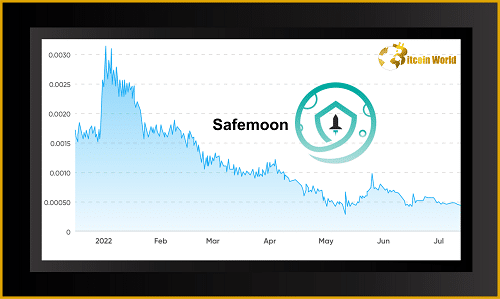

Hold onto your hats, crypto enthusiasts! The Safemoon (SFM) market is currently experiencing a turbulent ride, leaving bullish traders feeling a bit like they’re on a rollercoaster heading straight down. This week’s trading session kicked off with a noticeable price decline, and for those closely watching the charts, it’s raising some serious questions about the future of this particular cryptocurrency. The recent dip below May’s swing low of $0.0002716 has some analysts suggesting this could be more than just a minor setback – could this be the beginning of a more significant downturn for Safemoon?

What’s Happening with the Safemoon Price Right Now?

As we speak, Safemoon is hovering around the $0.000280 mark. Now, before you jump to conclusions, there are a couple of flickering embers of hope, though they need to be approached with caution. The trading volume is currently quite low, which can sometimes precede a trend reversal. Additionally, the SFM price is dancing near a declining parallel channel. Think of this channel like a downward-sloping road – the price is currently traveling along it, but the direction is, undeniably, down.

Decoding the Technical Signals: Are the Bulls Losing Ground?

Let’s delve a bit deeper into what the technical indicators are telling us. The Relative Strength Index (RSI), a popular tool used to gauge the momentum of price movements, has crossed a critical threshold. This boundary was previously acting as a support level for bullish traders, suggesting they had the strength to push the price higher. However, the breach of this level indicates a potential weakening of bullish momentum.

Furthermore, any attempts by the bulls to stage a comeback have been met with resistance from key moving averages. Specifically, the 8-day exponential moving average (EMA) and the 21-day simple moving average (SMA) are acting as dynamic resistance levels. Every time the price tries to climb, these averages seem to push it back down. Imagine these moving averages as ceilings that the price is struggling to break through.

Could Safemoon’s Price Face a Significant Drop?

Putting all these pieces together – the breach of the swing low, the declining parallel channel, the RSI breaking support, and the resistance from moving averages – paints a potentially bearish picture for Safemoon in the short term. Some analysts have even pointed towards a bearish target in the $0.0001100 region. If this scenario plays out, we could be looking at a price drop of approximately 60% from the current levels. That’s a substantial move and one that would undoubtedly impact many traders.

What Could Turn the Tide? A Bullish Reversal Scenario

Of course, the crypto market is known for its volatility and surprises. The bearish outlook isn’t set in stone. What would need to happen for the bulls to regain control? The key lies in overcoming those aforementioned moving averages. If the bulls can muster enough buying pressure to push the price decisively above both the 8-day EMA and the 21-day SMA, the current bearish thesis could be invalidated.

In such a scenario, we could potentially see a rally towards an area of previous price congestion around $0.0003950. This would represent a significant upside, potentially increasing the price of Safemoon by around 50% from its current level. It’s a classic battle between the bulls and the bears, and the next few days could be crucial in determining the victor.

Key Factors Influencing Safemoon’s Price

Beyond the immediate technical indicators, several factors can influence Safemoon’s price. Understanding these can help you make more informed trading decisions:

- Overall Crypto Market Sentiment: Safemoon, like many altcoins, is often influenced by the broader sentiment in the cryptocurrency market. When Bitcoin and Ethereum perform well, it can create a positive tailwind for other cryptocurrencies. Conversely, a downturn in the broader market can drag down even fundamentally sound projects.

- Community Engagement and Development: The strength and activity of the Safemoon community play a significant role. Positive developments, new partnerships, and active community engagement can boost confidence and attract new investors.

- Tokenomics and Utility: The underlying tokenomics of Safemoon, including its burn mechanism and reflection features, can impact its long-term value proposition. Any changes or updates to these mechanisms are closely watched by the community.

- Regulatory Landscape: The evolving regulatory landscape surrounding cryptocurrencies globally can have a significant impact on the price and adoption of various projects, including Safemoon.

Navigating the Safemoon Market: Tips for Traders

The current situation in the Safemoon market highlights the importance of having a well-defined trading strategy and practicing risk management. Here are a few actionable insights:

- Do Your Own Research (DYOR): Never rely solely on the opinions of others. Conduct thorough research on Safemoon, its fundamentals, and the broader market before making any investment decisions.

- Monitor Technical Indicators: Pay attention to key technical indicators like moving averages, RSI, and trading volume to identify potential entry and exit points.

- Manage Your Risk: Only invest what you can afford to lose. Use stop-loss orders to limit potential losses and avoid over-leveraging your positions.

- Stay Informed: Keep up-to-date with the latest news and developments related to Safemoon and the cryptocurrency market in general.

- Consider Dollar-Cost Averaging (DCA): Instead of investing a lump sum, consider spreading your investments over time to mitigate the risk of buying at a market peak.

The Road Ahead for Safemoon: Uncertainty and Opportunity

The immediate future for Safemoon remains uncertain. The current price action suggests a potential for further downside, but the possibility of a bullish reversal shouldn’t be completely dismissed. For traders, this period presents both challenges and opportunities. The key is to remain vigilant, analyze the data, and make informed decisions based on your own risk tolerance and investment strategy.

In Conclusion: Staying Informed in a Volatile Market

The world of cryptocurrency is a dynamic and often unpredictable landscape. The current situation with Safemoon serves as a timely reminder of the importance of staying informed, understanding market indicators, and managing risk effectively. Whether you’re a seasoned crypto veteran or just starting your journey, remember that knowledge is power, especially in the fast-paced world of digital assets. Keep a close eye on the charts, stay tuned for further developments, and always trade responsibly.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.