Binance CEO Changpeng Zhao (CZ) has spoken out against what he calls “wrong narratives.” Some in the crypto community have portrayed him as a savior, but he has pushed back against this.

The crypto industry was rocked by FTX’s demise. The domino effect of the FTX infection keeps people guessing about crypto’s future.

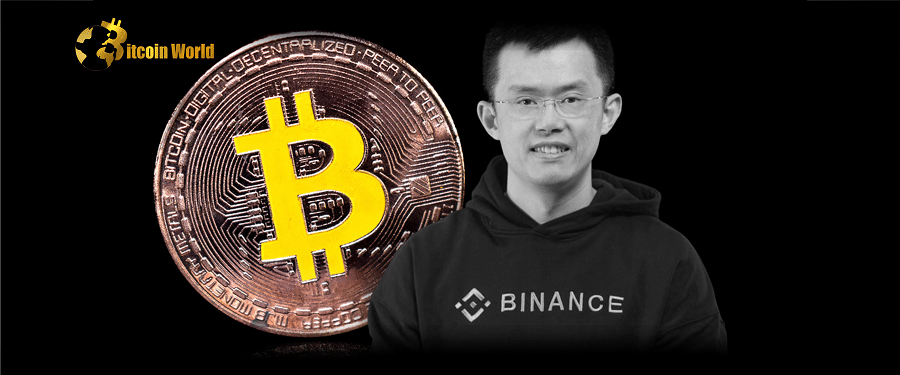

Bitcoin’s price plummeted below the $18,000 mark as a result of the turmoil, raising concerns about the long-term health of large centralized exchanges like Binance. Binance CEO Changpeng (CZ) Zhao became more visible in the media during this catastrophe, and was even hailed by some in the market as the “savior of crypto.” In spite of the current uncertainty, though, does crypto really call for a savior?

Tech behemoths like the Digital Currency Group (DCG) ran into trouble because of the FTX virus’s widespread spread. Genesis, a lending division owned by DCG, is fighting to avoid insolvency. Other exchanges also froze withdrawals around this time, and one of them, BlockFi, even declared bankruptcy.

Company layoffs have been widespread as companies attempt to weather the bear market.

In an effort to challenge Binance’s hegemony, FTX emerged as a serious contender. After the demise of FTX, however, Binance emerged as a leading exchange.

Among all centralized exchange (CEX) volumes, 77% have been recorded by Binance.

To mitigate the domino effect of FTX and aid financially strapped but otherwise promising projects, Zhao has announced a $1 billion industry recovery fund.

Some have called Changpeng Zhao a savior, while others have called him “self-serving and monopolizing the market for his own benefit.”

While addressing some ‘false narratives’ on Twitter, CZ said, “that’s the beauty of decentralization; crypto doesn’t need saving.”

Some locals, however, have brought up the fact that nobody sees him as a savior and that he is on par with Sam Bankman-Fried. To many, Changpeng Zhao’s praise of decentralization is hypocritical given that he operates a centralized cryptocurrency exchange. Some employees seem okay with it, even hoping that the CEO will play the hero.

Bitcoin has had a rough ride ever since it was first created. The price of bitcoin has experienced bear markets in 2013, 2017, and 2020, with corrections of 80% or more each time. When the pioneer cryptocurrency exchange Mt. Gox was hacked in 2014, it collapsed and 650,000 Bitcoin were lost. A severe bear market in cryptocurrencies ensued as a result.

The crypto market dropped from $20,000 to $3,000 in 2017 due to multiple bans in China. The 2020 COVID-19 pandemic also resulted in a sudden economic collapse. Almost 500 times, Bitcoin’s death has been declared as a result of such market fluctuations.

The bear market of 2022 has been a little different than others. This time around, it’s mostly due to multiple over-leveraged exchanges collapsing at once and weak global macroeconomic conditions. Cryptocurrency, however, has proven resilient over time, emerging from each “crypto winter” stronger than before.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.