With more users, the value of cryptocurrencies rises, resulting in a positive feedback loop because of the network effect.

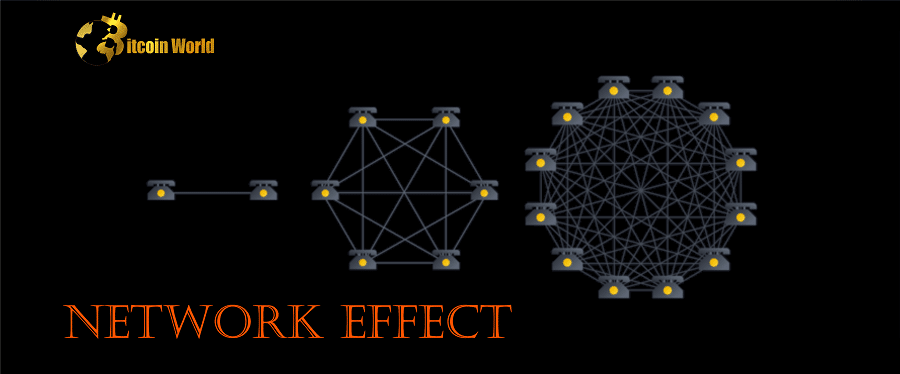

The value of a good or service rises as more people use it, which is known as the “network effect.” When the user base expands, new options for engagement arise, which may improve the advantages and favorable results for each user.

Social media, messaging apps, and marketplaces are just a few of the technologies and platforms whose growth and adoption are fueled by the network effect.

A key idea in the field of cryptocurrencies is the network effect. It generally means that when more people use a cryptocurrency, the value of that money increases. This is because more users lead to more trade volume and liquidity, which raises acceptance and use.

For instance, the Bitcoin network’s massive and growing user base generates a potent network effect that raises its market acceptability, liquidity, and value. When more people use Bitcoin, a self-reinforcing loop starts because as more individuals use it, the value to each individual user increases.

The network effect, which is one of the reasons why early adoption can be so crucial for long-term investment returns, is largely responsible for cryptocurrencies’ success. But, it’s important to keep in mind that the network effect is not a guarantee of success and that other factors, such as technological advancements, competition, news, and market mood, can affect a cryptocurrency’s value and uptake.

The value of nonfungible tokens is heavily impacted by the network effect (NFTs). When more people accept and use NFTs, they become more helpful to each user. A greater user base increases liquidity, demand, and opportunities for buying and rebuying NFTs.

As more individuals utilize NFTs, it is also simpler for musicians, artists, and producers to profit from selling them.

Yet, it’s important to remember that there are other factors that affect the adoption of NFTs in addition to the network effect. The acceptance of NFTs may also be influenced by other elements including user-friendliness, security, and the caliber of the underlying digital asset. In any case, the network effect is a major force behind the development and acceptance of NFTs and is probably going to continue to be significant.

When users and activity on decentralized finance (DeFi) or Web3 apps and networks expand, the network effect starts a cycle of growth and adoption, ultimately increasing the value and utility for all players.

For instance, when more users and liquidity providers sign up, decentralized exchanges (DEXs) like Uniswap and SushiSwap grow more valued, resulting in tighter spreads, deeper order books, and better prices for traders.

Similar to this, when more makers and collectors join, NFT marketplaces like OpenSea and Rarible gain from network effects, resulting in a wider range of valuable and unique goods, increased trade volumes, and greater awareness for the platform.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.