The recent legal victory in the Grayscale lawsuit provided Bitcoin’s price with a much-needed lift, albeit temporary, as the cryptocurrency quickly surrendered its gains. BTC’s current trading range is cautious at hovering above a local resistance level.

Resistance Wanes as Support Weakens

In contrast to recent trends, Bitcoin’s resilience to price drops appears weakened. On-chain data highlights a precarious situation, with BTC teetering around a danger zone that might lead to a potential 10 to 15% decline from its current level. The absence of robust support beneath the $25,400 threshold raises concerns. Analysts, such as Ali Charts, suggest that from its current $25,800 range, Bitcoin might experience a decline to approximately $23,340.

“Bitcoin’s on-chain data suggests vulnerability below the $25,400 level. A breach below this could trigger a swift correction to $23,340.”

Volatility and Pending SEC Decision

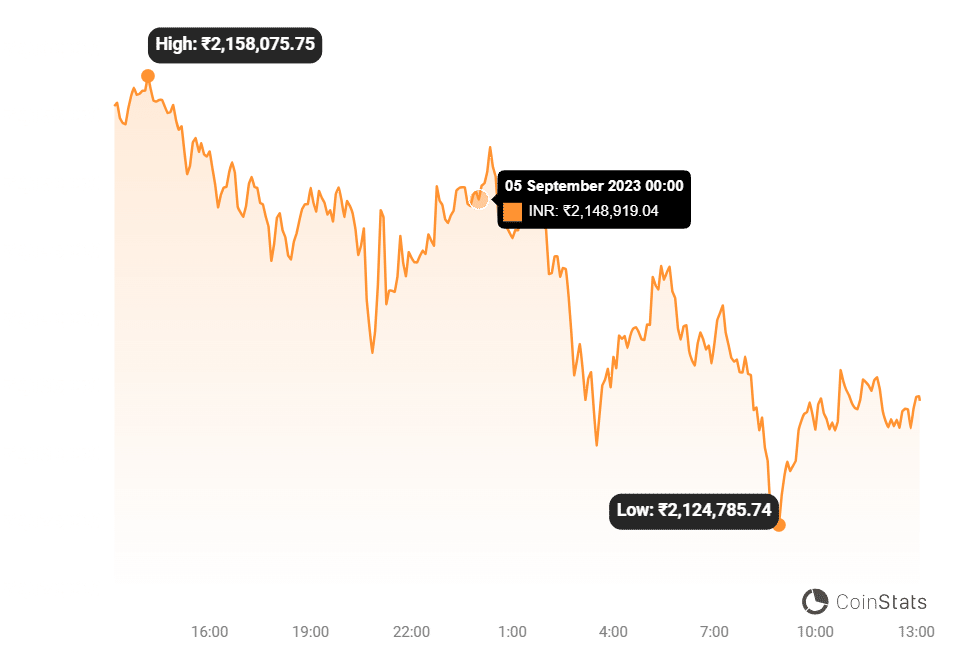

Recent market performance demonstrates notable volatility, with a weekly low of $25,680 and a high of $28,130. Mid-October 2023 could bring another wave of volatility, coinciding with the approaching U.S. Securities and Exchange Commission (SEC) deadline for decisions on several spot Bitcoin ETF applications, including those from BlackRock, Invesco, and WisdomTree. The SEC’s postponement on August 31, 2023, has generated anticipation as the crypto community awaits regulatory clarity.

https://coinstats.app/coins/bitcoin/

Grayscale Ruling: Uncharted Territory

On the other side of the spectrum, the aftermath of the Grayscale lawsuit judgment prompts contemplation on the stance the federal regulatory agency will adopt. The court’s approval of converting Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF raises questions about the regulatory direction. As the cryptocurrency ecosystem watches closely, the implications of this judgment resonate across the industry, shaping the trajectory of future developments.

Bitcoin’s journey post-Grayscale lawsuit victory has been marked by volatility, uncertainty, and the intricate interplay between regulatory decisions and market dynamics. As the cryptocurrency navigates through the current trading range and braces for potential further declines, the community’s attention remains divided between price action and regulatory shifts, seeking insights into the path that Bitcoin’s trajectory will ultimately take

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.