The world of investment is rapidly evolving, and Republic is at the forefront of this change. By selecting Avalanche as the blockchain for its Republic Note tokenized investment fund, Republic is making a bold move towards global scalability and accessibility. But what does this mean for investors and the future of finance? Let’s dive in.

Republic Note: Tokenizing the Future of Investment

Republic Note is not just another cryptocurrency; it’s a security token designed to allow investors to earn returns from a diverse portfolio of over 750 private assets. Think of it as a digital key unlocking access to a world of investment opportunities previously unavailable to the average investor.

- Democratizing Investment: Republic Note aims to break down barriers and make investment more accessible to a global audience.

- Diverse Portfolio: With exposure to over 750 private assets, investors can diversify their holdings and potentially mitigate risk.

- Significant Interest: The pre-sale participation of over $30 million demonstrates the strong demand for this innovative investment vehicle.

Andrew Durgee, President of Republic, emphasizes Avalanche’s crucial role in enabling Republic Note to reach a global investor base. But why Avalanche?

Why Avalanche? The Power of Subnets

Avalanche’s unique architecture, particularly its ability to create controllable subnets, is a game-changer for regulated industries. These subnets are essentially customizable side chains that allow Republic to optimize for regulatory compliance – a critical factor when dealing with digital securities.

Here’s a breakdown of Avalanche’s key features:

- Scalability: Avalanche’s high throughput and low latency make it ideal for handling a large volume of transactions.

- Customizability: Subnets allow for tailored solutions that meet specific regulatory requirements.

- Security: Avalanche’s consensus mechanism ensures the security and integrity of the network.

Read Also: HSBC and Ant Group Collaborate on Tokenized Deposits: A New Frontier in Banking

Republic’s Profit-Sharing Model: How it Works

Republic Note’s profit-sharing approach is a key differentiator. The platform plans to distribute up to 25% of its dividend pool to token holders, aligning the interests of Republic with those of its investors. It’s a win-win situation.

Key details about the Republic Note:

- Profit Sharing: Up to 25% of the dividend pool will be distributed to token holders.

- Pre-Sale Price: The token was priced at $0.36 during the pre-sale round.

- Total Supply: The total supply is capped at 800 million tokens.

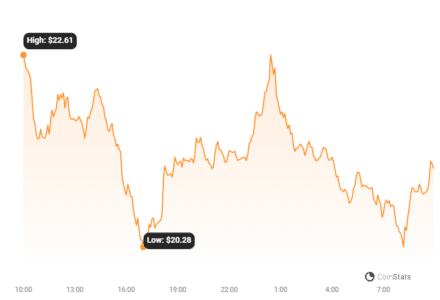

Can Republic Note Boost AVAX Price?

The launch of Republic Note on Avalanche could have a positive impact on AVAX price. The partnership between Republic and Ava Labs, coupled with Republic Note’s innovative profit-sharing model, could instill confidence in AVAX investors and potentially mitigate further price declines.

Consider this:

- Strategic Partnership: The collaboration between Republic and Ava Labs signals a strong commitment to the Avalanche ecosystem.

- Investor Confidence: Republic Note’s unique value proposition could attract new investors to AVAX.

- Market Recovery: The announcement of Republic Note has already led to a slight recovery in AVAX price.

AVAX price experienced a dip to $20.28 before the announcement, subsequently recovering by approximately 3% to $21.23 following the news.

The Bottom Line: Republic’s decision to launch Republic Note on Avalanche is a significant development for both platforms. It represents a step towards a more accessible and equitable financial future, potentially boosting AVAX price and revolutionizing the way we invest.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.