- Tranchess v3 launch introduces leveraged and fixed staking rewards for stETH positions.

Tranchess, a liquid staking-focused DeFi protocol, has shipped its v3 interaction, introducing new yield products for stETH holders.

On Feb. 15, Tranchess announced the launch of its v3 protocol, debuting two new features developed alongside Lido, the team behind the stETH liquid staking token (LST).

We’re excited to announce the launch of Tranchess V3 – LSTFi Expansion, working alongside @lido to provide full $stETH compatibility which gives users a brand new ability to gain on network rewards in MULTIPLES!

Read on…👀

1/6 pic.twitter.com/K5cmgqJFkb

— Tranchess (@Tranchess) February 15, 2024

Tranchess‘s Turbo Yield ETH (turYETH) product allows users to access leveraged exposure to steETH, bolstering the staking rewards earned by holders.

Its Stable Yield ETH (staYETH) offering also offers fixed-rate staked ETH rewards for up to one year, allowing holders to sidestep the volatility of staking reward fluctuations as new validators come online.

Tranchess also offers a liquidity pool pairing wstETH and staYETH, allowing liquidity providers to earn fees on trades executed via the pool.

See Also: Binance Labs Announces First Batch Of Sixth-Season (S6) Incubation Projects

“We’re excited to announce the launch of Tranchess V3, LSTFi Expansion,” Tranchess said. “We focused on building vertically, unlocking LST utility surpassing simple collateralization.”

Tranchess also hinted that early adopters will be rewarded for adopting the new products, stating that more will be announced soon regarding “incentives, rewards, and programs” for early users.

Tranchess is hoping the new features rolled out alongside its v3 iteration will attract new users and grow the protocol’s market share.

The total value locked (TVL) in Tranchess has consistently trended between $42M and $75M since September 2022, with its TVL currently sitting at $58.8M.

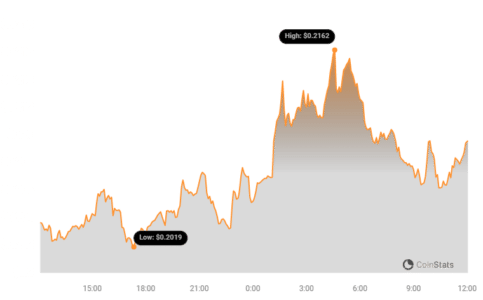

Its CHESS token is also trading at $0.2069, having gained 20% since Tranchess announced v3’s imminent launch on Feb. 6, according to Coinstats data.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.