MicroStrategy Holds 1.17% of Total Bitcoin Supply

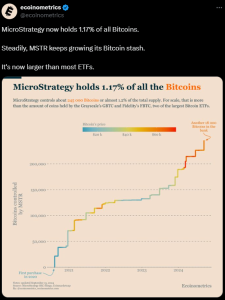

MicroStrategy, a prominent business intelligence firm with a strong focus on Bitcoin development, has amassed approximately 245,000 Bitcoin (BTC), representing 1.17% of the total Bitcoin supply of 21 million. This notable accumulation was reported by Ecoinometrics on X (formerly Twitter), highlighting MicroStrategy’s continued commitment to increasing its Bitcoin holdings.

Key Points About MicroStrategy’s Bitcoin Holdings

1. Significant Bitcoin Accumulation:

- MicroStrategy’s Bitcoin holdings are substantial, accounting for over 1% of the total Bitcoin supply. With 245,000 BTC in its portfolio, the firm’s Bitcoin reserves are larger than those held by many spot Bitcoin exchange-traded funds (ETFs).

2. Ongoing Accumulation Strategy:

- The firm has consistently increased its Bitcoin holdings, demonstrating a strategic approach to acquiring and holding the cryptocurrency. This accumulation aligns with MicroStrategy’s long-term strategy to leverage Bitcoin as a key asset.

3. Comparison with Bitcoin ETFs:

- MicroStrategy’s holdings surpass those of most Bitcoin spot ETFs, which typically hold a fraction of the total Bitcoin supply. This positions MicroStrategy as one of the largest institutional holders of Bitcoin.

Impact on the Bitcoin Market

1. Market Influence:

- MicroStrategy’s significant Bitcoin holdings impact market dynamics, reflecting institutional confidence in Bitcoin’s value. The firm’s large position could influence Bitcoin’s liquidity and market behavior.

2. Institutional Adoption:

- The firm’s strategy underscores the growing institutional adoption of Bitcoin. MicroStrategy’s holdings demonstrate a commitment to Bitcoin beyond short-term trading, contributing to its perception as a long-term investment asset.

3. Price Implications:

- As a major holder, MicroStrategy’s buying and selling activities can affect Bitcoin’s price. The firm’s continued accumulation could potentially exert upward pressure on Bitcoin’s value, given its large share of the supply.

Future Outlook

1. Continued Accumulation:

- MicroStrategy is expected to maintain or even increase its Bitcoin holdings, depending on market conditions and strategic goals. This ongoing accumulation reinforces its role as a significant player in the Bitcoin market.

2. Market Trends:

- The firm’s actions will likely continue to be closely watched by market participants. Changes in MicroStrategy’s Bitcoin holdings could serve as indicators of broader market trends or shifts in institutional investment strategies.

3. Institutional Influence:

- As institutional interest in Bitcoin grows, firms like MicroStrategy will play a crucial role in shaping market trends and influencing Bitcoin’s adoption and valuation.

Conclusion

MicroStrategy’s holding of 1.17% of the total Bitcoin supply underscores its significant role in the cryptocurrency market. By maintaining a substantial position in Bitcoin, the firm exemplifies institutional confidence and long-term commitment to the digital asset. As Bitcoin continues to evolve, MicroStrategy’s strategy will be a key factor in understanding broader market trends and institutional adoption of cryptocurrency.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.