Bitcoin’s Short-Term Rally Likely as Coinbase Premium Nears Golden Cross

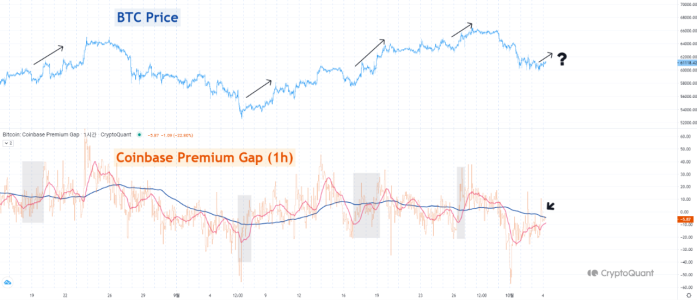

Recent analysis by CryptoQuant contributor @Yonsei_dent indicates a potential short-term rally for Bitcoin as the Coinbase Premium Index approaches a golden cross on the 1-hour timeframe. This technical indicator, derived from the daily and weekly moving averages (MA), suggests that Bitcoin prices may experience upward momentum when the daily MA crosses above the weekly MA—a formation known as a golden cross. As the gap between these averages narrows, Bitcoin appears poised for a rally, even as prices recently corrected from $66,000 to around $61,000.

Understanding the Coinbase Premium Index and Golden Cross

The Coinbase Premium Index measures the price difference between Bitcoin on Coinbase and other major exchanges, providing insight into U.S. demand for Bitcoin. When this index is positive, it suggests that U.S. investors are paying a premium for Bitcoin on Coinbase, often a signal of strong demand.

A golden cross occurs when a shorter-term moving average crosses above a longer-term moving average, indicating a potential bullish reversal. In this case, @Yonsei_dent has observed that when the daily MA on the Coinbase Premium Index crosses above the weekly MA, it often precedes a short-term rally in Bitcoin prices. Historical data shows that this pattern can lead to significant price increases, driven by renewed demand from U.S. investors.

Current Market Indicators

According to @Yonsei_dent, the Coinbase Premium Index has temporarily surged past the weekly MA, with the daily MA close behind. This narrowing gap indicates that the golden cross is imminent, suggesting that Bitcoin could experience a short-term price increase as the market responds to this technical signal. The recent correction from $66,000 to around $61,000 has not dampened investor interest, as U.S. demand for Bitcoin remains strong.

The fact that the Coinbase Premium has rebounded and is now approaching this bullish crossover is a promising sign for Bitcoin bulls. This renewed interest could signal a buying opportunity for traders looking to capitalize on short-term gains.

Historical Context of Golden Crosses in Bitcoin

Golden crosses have historically been viewed as bullish indicators, particularly on higher timeframes, where they have preceded substantial rallies. On shorter timeframes, like the 1-hour chart, the effect is usually more short-lived but still significant enough for traders to take note.

In past instances, when the Coinbase Premium Index has formed a golden cross, Bitcoin prices have typically seen a short-term spike. This pattern suggests that market participants are likely to view the current setup as a positive signal, potentially leading to increased buying pressure and a quick price recovery.

Increasing U.S. Demand for Bitcoin

The resurgence of the Coinbase Premium indicates a renewed interest in Bitcoin among U.S. investors. This demand could be driven by various factors, including macroeconomic conditions, institutional interest, and regulatory developments that favor crypto adoption in the United States. As the index reflects a premium on Coinbase, it serves as a barometer of local demand, signaling that U.S. investors are willing to pay more for Bitcoin.

With U.S. demand on the rise, this increased activity on Coinbase could help drive Bitcoin prices higher, especially as the market anticipates the formation of the golden cross.

Conclusion

The approaching golden cross on the Coinbase Premium Index signals a potential short-term rally for Bitcoin. While Bitcoin recently pulled back to $61,000, the narrowing gap between the daily and weekly MAs suggests that a bullish reversal may be imminent. As historical data has shown, these golden cross formations often lead to price gains, supported by increased U.S. demand reflected in the Coinbase Premium.

For traders and investors, this technical setup presents a strategic opportunity to consider Bitcoin as a short-term play, as the market appears poised for a rally. As always, staying informed about market indicators and technical analysis is crucial for making sound investment decisions.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.