USDT’s Market Cap Exceeds $120 Billion for the First Time Ever

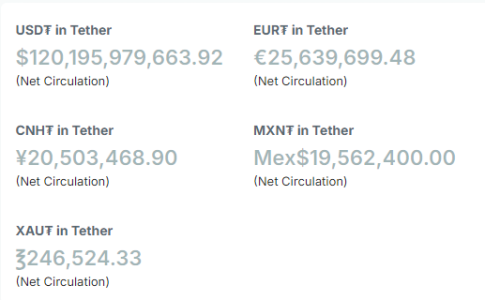

In a landmark achievement for stablecoins, Tether (USDT) has reached a market capitalization of over $120 billion, marking the first time this milestone has been achieved. According to Tether’s official website, the exact figure stands at $120,195,979,663.92. Cointelegraph highlighted this unprecedented surge, noting that an increase in stablecoin supply is often viewed as a precursor to a bull rally in the broader cryptocurrency market. This development suggests that investors are accumulating stablecoins in anticipation of future investments in digital assets.

Understanding USDT and Its Significance

Tether (USDT) is one of the most widely used stablecoins in the cryptocurrency ecosystem. Designed to maintain a stable value by being pegged to a reserve asset, typically the US dollar, USDT provides a reliable medium of exchange and a store of value within the highly volatile crypto market.

Key Characteristics of USDT

- Price Stability: Each USDT is intended to be backed by one US dollar, minimizing price fluctuations.

- Liquidity Provision: USDT facilitates seamless trading and liquidity across various cryptocurrency exchanges.

- Accessibility: It offers a bridge between fiat currencies and digital assets, enabling easier entry and exit points for investors.

- Wide Adoption: USDT is supported by numerous exchanges, wallets, and financial platforms, making it one of the most accessible stablecoins available.

Milestone Achievement: $120 Billion Market Cap

The recent surge in USDT’s market cap to over $120 billion underscores its critical role in the cryptocurrency market. This milestone is not only a testament to USDT’s widespread adoption but also reflects the growing demand for stablecoins as a foundational element of the crypto trading infrastructure.

Factors Contributing to the Surge

- Increased Trading Activity: As cryptocurrency markets grow, the demand for stablecoins like USDT increases to facilitate trading and hedge against volatility.

- Institutional Adoption: More institutional investors are incorporating USDT into their portfolios to manage risk and maintain liquidity.

- Expansion of DeFi Platforms: The rise of decentralized finance (DeFi) has boosted the use of USDT for lending, borrowing, and other financial services.

- Geopolitical and Economic Uncertainty: In times of economic instability, investors often turn to stablecoins for a secure and stable store of value.

Implications for the Cryptocurrency Market

The achievement of a $120 billion market cap for USDT has several significant implications for the broader cryptocurrency ecosystem:

1. Indicator of Market Sentiment

An increase in stablecoin supply often signals that investors are positioning themselves for future bullish trends. By accumulating USDT, traders prepare to enter the market when favorable conditions arise, potentially driving a bull rally.

2. Enhanced Liquidity and Market Efficiency

With a substantial market cap, USDT enhances liquidity across cryptocurrency exchanges. This increased liquidity leads to more efficient price discovery and smoother trading experiences, reducing the impact of large trades on market prices.

3. Facilitation of DeFi Growth

Stablecoins like USDT are integral to the growth of DeFi platforms, providing the necessary liquidity for various financial products and services. The surge in USDT’s market cap supports the expansion of lending platforms, decentralized exchanges, and yield farming opportunities.

4. Regulatory Scrutiny and Transparency

As USDT’s market cap grows, it attracts more regulatory attention. Ensuring transparency in Tether’s reserves and adherence to regulatory standards becomes increasingly important to maintain investor trust and market integrity.

Expert Insights

Dr. Emily Carter, Blockchain Analyst

“The milestone of USDT exceeding a $120 billion market cap is a clear indicator of the stablecoin’s pivotal role in the cryptocurrency ecosystem. It highlights the growing reliance on stablecoins for trading, hedging, and participating in DeFi activities. However, it also underscores the need for greater transparency and regulatory compliance to sustain this growth.”

Mark Thompson, Financial Strategist

“Investors accumulating USDT are likely positioning themselves for significant market movements. The stablecoin’s liquidity and stability make it an ideal tool for managing exposure to volatile assets. As USDT continues to dominate the stablecoin market, its influence on overall crypto market dynamics will only increase.”

Future Outlook

The continued growth of USDT’s market cap suggests a robust and expanding role for stablecoins in the cryptocurrency market. Key trends to watch include:

1. Increased Institutional Participation

Institutional investors are expected to further embrace stablecoins like USDT for their investment strategies, enhancing market depth and stability.

2. Advancements in DeFi and Blockchain Technology

Innovations in DeFi and blockchain technology will likely drive the adoption of USDT in new financial products and services, broadening its use cases and utility.

3. Regulatory Developments

Ongoing regulatory developments will shape the future of USDT and stablecoins in general. Clearer guidelines and compliance standards will be essential for maintaining investor confidence and ensuring sustainable growth.

4. Global Economic Trends

Global economic conditions, including inflation rates and geopolitical tensions, will influence the demand for stablecoins as investors seek secure and stable investment vehicles.

Challenges and Considerations

Despite its success, USDT faces several challenges that need to be addressed to maintain its market position:

1. Reserve Transparency

Ensuring that Tether Ltd. maintains transparent and verifiable reserves is crucial for sustaining trust among investors and regulators.

2. Regulatory Compliance

Adhering to evolving regulatory standards across different jurisdictions remains a significant challenge for USDT and other stablecoins.

3. Market Competition

The stablecoin market is becoming increasingly competitive, with new entrants and existing players continuously innovating to capture market share.

4. Technological Security

Maintaining robust security measures to protect against hacks and cyber threats is essential to safeguard USDT holdings and user funds.

Conclusion

The $120 billion milestone for USDT marks a significant achievement in the stablecoin and broader cryptocurrency landscape. As USDT continues to play a vital role in providing liquidity, stability, and efficiency to the market, its influence on the crypto ecosystem is set to grow further. However, addressing challenges related to transparency, regulatory compliance, and market competition will be essential for sustaining this momentum and ensuring the long-term success of stablecoins in the evolving financial landscape.

To stay updated on the latest trends and developments in the cryptocurrency market, explore our article on latest news, where we cover significant events and their impact on digital assets.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.