Bitcoin Futures Open Interest Hits Record High of $40 Billion

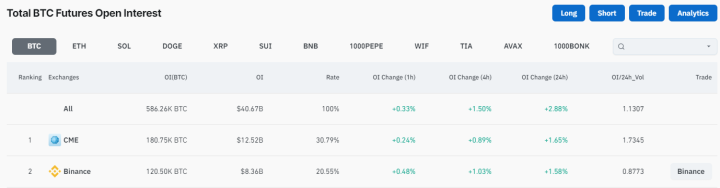

The open interest (OI) for Bitcoin futures has reached an all-time high, standing at 586,260 BTC, equivalent to $40.67 billion, according to CoinGlass. This record level of open interest, representing a 2.88% increase over the past 24 hours, highlights growing interest and activity within the cryptocurrency derivatives market. Notably, the Chicago Mercantile Exchange (CME) holds the largest share of open interest, with 180,750 BTC, followed by Binance with 120,500 BTC.

What is Open Interest in Bitcoin Futures?

Open interest (OI) refers to the total number of outstanding futures contracts that are yet to be settled. It provides a measure of the total amount of capital being used in a particular market and is a key indicator of market activity, sentiment, and investor commitment.

Importance of Open Interest

- Market Sentiment: Rising open interest often signals growing investor confidence and increased market activity.

- Liquidity Indicator: High open interest is associated with greater market liquidity, which helps in efficient price discovery and smooth trade execution.

- Risk Assessment: Changes in open interest can provide insights into market dynamics, such as whether new money is flowing into the market or existing traders are exiting their positions.

Record-Breaking $40 Billion in Bitcoin Futures Open Interest

The current $40.67 billion in open interest is the highest ever recorded for Bitcoin futures, indicating a significant rise in trading activity and investor interest in the cryptocurrency market.

Breakdown of Open Interest by Platform

- Chicago Mercantile Exchange (CME): 180,750 BTC

CME, a leading platform for institutional investors, holds the largest share of open interest, reflecting growing institutional engagement in Bitcoin futures. - Binance: 120,500 BTC

Binance follows as a major player in the derivatives market, contributing significantly to the total open interest. - Other Platforms: The remaining interest is distributed across various exchanges, including Bybit, OKX, and Deribit, which collectively contribute to the rising open interest in Bitcoin futures.

Factors Contributing to Rising Open Interest

1. Growing Institutional Adoption

The increase in open interest is partly due to growing institutional adoption of Bitcoin. Platforms like CME have seen increased participation from hedge funds, asset managers, and other institutional investors who are looking to gain exposure to Bitcoin while managing their risk through regulated futures products.

2. Market Sentiment

The record open interest suggests rising optimism among traders and investors regarding Bitcoin’s future price action. As the leading cryptocurrency continues to show resilience, more participants are opening positions to either hedge against or capitalize on potential price movements.

3. Expanding Derivatives Market

The cryptocurrency derivatives market has grown significantly, providing traders with more tools to manage risk, speculate, and hedge their positions. The rise in open interest reflects the broader trend of increased activity in crypto futures and options trading.

4. Economic Uncertainty and Inflation Concerns

Increased interest in Bitcoin futures also correlates with rising economic uncertainty and concerns about inflation. Investors are looking to Bitcoin as a potential hedge against inflation, and futures contracts provide an avenue for gaining exposure without directly holding the asset.

Implications for the Cryptocurrency Market

The surge in Bitcoin futures open interest to a record $40 billion has several implications for the broader cryptocurrency market:

1. Increased Liquidity and Stability

High open interest typically results in increased liquidity, making it easier for traders to enter and exit positions without significantly impacting the price. This liquidity can contribute to more stable market conditions and efficient price discovery.

2. Potential for Increased Volatility

While high open interest can signal increased market confidence, it also introduces the potential for heightened volatility. As futures contracts approach expiration, traders may adjust their positions, leading to increased price swings, particularly if significant liquidation events occur.

3. Institutional Influence

The dominance of CME in open interest suggests that institutional players are increasingly shaping the dynamics of the Bitcoin futures market. Institutional influence can lead to greater market maturity and legitimacy, attracting more participants and investment.

4. Bullish Sentiment Indicator

Rising open interest is often seen as a bullish indicator, suggesting that more participants are positioning for upward price movement. This sentiment could lead to a positive feedback loop, driving further price appreciation and market activity.

Expert Opinions

Dr. Laura Chen, Cryptocurrency Analyst

“The record-breaking open interest in Bitcoin futures is a testament to the growing sophistication and depth of the cryptocurrency market. Institutional players are becoming more active, and their participation is contributing to both liquidity and market stability. However, traders should be mindful of potential volatility, especially around futures expiration dates.”

Mark Thompson, Financial Strategist

“The surge in open interest is a clear indication that investors are increasingly viewing Bitcoin as a legitimate asset class. The presence of major players like CME highlights the institutional demand for Bitcoin exposure, which could have long-term positive effects on market growth and investor confidence.”

Future Outlook for Bitcoin Futures

The record high in open interest suggests that Bitcoin futures will continue to play a crucial role in the evolving cryptocurrency market. Key trends to watch include:

1. Increased Product Offerings

Exchanges are likely to expand their offerings of cryptocurrency derivatives, including new futures contracts and options, to meet growing demand from both retail and institutional investors.

2. Further Institutional Adoption

As more traditional financial institutions recognize the potential of Bitcoin as an asset class, their participation in futures markets is expected to grow, further driving open interest and contributing to market maturity.

3. Regulatory Developments

Regulatory clarity is essential for the continued growth of Bitcoin futures. Positive regulatory developments could enhance investor confidence and lead to increased participation in the market.

4. Integration with Traditional Finance

The integration of Bitcoin futures into traditional financial systems, such as the inclusion in pension funds and exchange-traded funds (ETFs), could significantly expand the market’s reach and influence.

Conclusion

The record-breaking $40 billion in Bitcoin futures open interest marks a significant milestone for the cryptocurrency market, reflecting growing interest from both retail and institutional investors. With CME leading the charge, the surge in open interest highlights the increasing role of traditional finance in the crypto space and the rising confidence in Bitcoin’s long-term potential.

As the market continues to evolve, Bitcoin futures will play a critical role in providing liquidity, facilitating price discovery, and enabling sophisticated trading strategies. However, participants should remain vigilant regarding the potential for increased volatility, especially as futures contracts approach expiration. The continued collaboration between crypto-native platforms and traditional financial institutions will be essential in shaping a resilient and inclusive financial landscape for the future.

To stay updated on the latest trends and developments in the cryptocurrency market, explore our article on latest news, where we cover significant events and their impact on digital assets.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.