Event Organizers Charged with Fraud for Allegedly Posing as ‘Satoshi’

In a startling development within the cryptocurrency community, Mr. Anderson and Stephen Mollah, organizers behind an event promoting the much-anticipated “Satoshi’s Identity Reveal” scheduled for October 31, 2024, have been charged with fraud. According to reports from cryptocurrency news outlet db on X (formerly Twitter), the individuals were recently released on bail after facing serious allegations of misrepresentation, with Mollah specifically accused of posing as Satoshi Nakamoto, the pseudonymous creator of Bitcoin.

Introduction to the Fraud Charges

Who are Mr. Anderson and Stephen Mollah?

Mr. Anderson and Stephen Mollah have been notable figures within the cryptocurrency space, primarily known for organizing events and projects that claim to advance or revolutionize Bitcoin. Over the years, they have been involved in various “Bitcoin 2.0” initiatives, promising enhancements and new functionalities to the original Bitcoin protocol. However, their recent activities have drawn legal scrutiny, culminating in fraud charges related to their attempts to unveil Satoshi Nakamoto’s true identity.

Overview of the Fraud Allegations

The core of the allegations against Mr. Anderson and Stephen Mollah revolves around their fraudulent representation of themselves as key figures in the Bitcoin community, with Mollah specifically impersonating Satoshi Nakamoto. This deception not only undermines the credibility of legitimate Bitcoin initiatives but also exploits the intrigue surrounding Bitcoin’s elusive creator for personal gain.

Details of the Fraudulent Activities

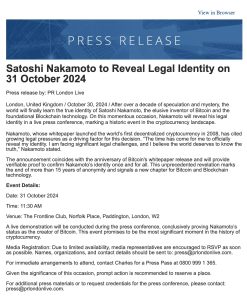

The “Satoshi’s Identity Reveal” Event

The event titled “Satoshi’s Identity Reveal” was marketed as a groundbreaking announcement that would finally disclose the true identity of Bitcoin’s creator. Promoted through various channels, including social media platforms and cryptocurrency forums, the event garnered significant attention and anticipation within the community. However, investigations revealed that Mollah falsely claimed to be Satoshi Nakamoto, leveraging the mysterious persona to attract participants and funding.

Legal Proceedings and Charges

Following an investigation by law enforcement agencies, Mr. Anderson and Stephen Mollah were charged with fraud for their deceptive practices. The charges include:

- Misrepresentation: Claiming to be associated with Satoshi Nakamoto and misleading the public about their identities.

- Fraudulent Promotion: Organizing events under false pretenses to solicit investments and participation.

- Identity Theft: Illegally assuming the identity of a real individual (Satoshi Nakamoto) to deceive others.

Both individuals were released on bail, with court dates set to address the severity of their actions and the potential impact on the cryptocurrency community.

Impact on the Cryptocurrency Community

Erosion of Trust

The fraudulent actions of Mr. Anderson and Stephen Mollah have significantly eroded trust within the cryptocurrency community. Trust is a cornerstone of decentralized financial systems, and such high-profile fraud cases can deter new investors and participants from engaging with legitimate projects.

Regulatory Implications

This case underscores the need for stringent regulatory oversight within the cryptocurrency sector. Regulators may implement more robust measures to prevent identity fraud and ensure that event organizers and project leaders maintain transparency and authenticity in their dealings.

Effect on Bitcoin’s Reputation

Bitcoin, as the leading cryptocurrency, relies heavily on its reputation for security and decentralization. Incidents like these can tarnish Bitcoin’s image, making it vulnerable to skepticism and reduced adoption among mainstream investors.

Similar Incidents and Patterns

History of Fraud in Cryptocurrency

The cryptocurrency space has seen numerous fraud cases over the years, ranging from Ponzi schemes to fake ICOs (Initial Coin Offerings). These incidents highlight the challenges in regulating a decentralized and rapidly evolving market.

Patterns of Identity Fraud

Impersonating influential figures or creating fictitious identities to gain trust and manipulate markets is a recurring theme in cryptocurrency fraud. The anonymity and borderless nature of digital currencies make them attractive for such deceptive practices.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“The charges against Mr. Anderson and Stephen Mollah are a stark reminder of the vulnerabilities within the cryptocurrency ecosystem. As the market continues to grow, it is imperative that both regulators and community members remain vigilant to protect against fraudulent activities.”

Mark Thompson, Financial Strategist

“Identity fraud undermines the foundational principles of trust and transparency in blockchain technology. This case will likely prompt a reevaluation of how events and projects are vetted within the crypto space to prevent similar occurrences in the future.”

Sarah Lee, Cryptocurrency Researcher

“While decentralized systems offer numerous benefits, they also pose unique challenges in terms of security and accountability. Strengthening these aspects is crucial for the sustained growth and legitimacy of cryptocurrencies like Bitcoin.”

Legal and Regulatory Responses

Upcoming Court Proceedings

Mr. Anderson and Stephen Mollah are scheduled to appear in court to address the fraud charges. The outcomes of these proceedings will set precedents for how similar cases are handled in the future, potentially influencing regulatory frameworks.

Potential Regulatory Changes

In response to this incident, regulatory bodies may introduce stricter guidelines for event organizers and cryptocurrency projects. These could include:

- Identity Verification: Mandatory verification processes for individuals representing themselves as key figures in crypto projects.

- Transparency Requirements: Clear disclosure of organizers’ backgrounds and affiliations to prevent misinformation.

- Penalties for Fraud: Enhanced penalties for fraudulent activities to deter potential offenders.

Implications for Future Crypto Projects

Enhanced Due Diligence

Crypto projects and event organizers will need to implement more rigorous due diligence processes to verify the authenticity of individuals and ensure the legitimacy of their initiatives. This could involve third-party audits and transparent disclosure of project details.

Community Vigilance

The cryptocurrency community must remain vigilant and skeptical of sensational claims, especially those that promise significant revelations or breakthroughs. Educating users about the risks of fraud and promoting best practices for verifying information can help mitigate such threats.

Strengthening Security Measures

Implementing advanced security measures, such as decentralized identity verification and blockchain-based authentication, can enhance the integrity of crypto projects and protect against identity fraud.

Conclusion

The fraud charges against Mr. Anderson and Stephen Mollah for allegedly posing as Satoshi Nakamoto highlight significant challenges within the cryptocurrency ecosystem. As the community grapples with the implications of this case, it becomes increasingly clear that robust regulatory frameworks, enhanced security measures, and heightened community vigilance are essential for safeguarding the integrity and trust that underpin the crypto market.

As the court proceedings unfold, stakeholders across the cryptocurrency landscape will closely monitor the developments, seeking to reinforce the principles of transparency and authenticity that are vital for the continued growth and adoption of digital assets.

To stay updated on the latest developments in cryptocurrency fraud and regulatory measures, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.