Microsoft Opens Voting on Bitcoin Investment Strategy

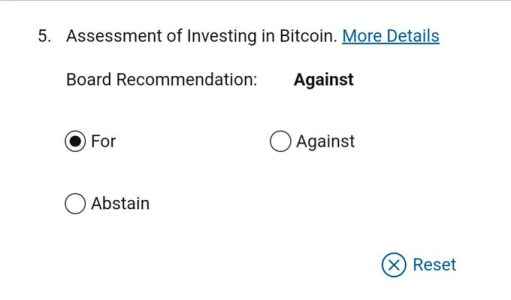

Microsoft, one of the world’s leading technology firms, has initiated a shareholder vote on whether the company should adopt a strategy to invest in Bitcoin. This significant proposal, reported by Bitcoin News on X (formerly Twitter), follows earlier coverage by CoinNess, which highlighted Microsoft’s plan to evaluate Bitcoin investments. The outcome of the vote is scheduled to be announced at the upcoming shareholders’ meeting on December 10, where Microsoft’s board of directors has recommended that shareholders vote against the plan.

Introduction to Microsoft’s Bitcoin Investment Proposal

Overview of the Proposal

In a move that could mark a significant shift in corporate investment strategies, Microsoft has proposed that its shareholders consider adopting a Bitcoin investment strategy. This initiative aims to diversify Microsoft’s investment portfolio by allocating a portion of its capital reserves to Bitcoin, leveraging the cryptocurrency’s potential as a digital asset and hedge against traditional financial market volatility.

Timeline and Voting Process

The voting process for this proposal has officially begun, with shareholders being given the opportunity to cast their votes on the matter. The results of this vote will be disclosed during the December 10 shareholders’ meeting, providing a clear indication of Microsoft’s future stance on cryptocurrency investments.

Microsoft’s Board of Directors Recommends Against the Plan

Board’s Opposition

Despite the growing interest in Bitcoin and its increasing adoption among various corporations, Microsoft’s board of directors has taken a clear stance against the proposed Bitcoin investment strategy. They have recommended that shareholders vote against the plan, citing concerns related to the volatility of Bitcoin, regulatory uncertainties, and the potential impact on Microsoft’s financial stability.

Reasons for Opposition

The board’s recommendation is grounded in several key considerations:

- Volatility: Bitcoin’s price fluctuations can be extreme, posing a significant risk to corporate financials.

- Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies presents challenges in terms of compliance and potential legal liabilities.

- Strategic Focus: The board believes that Microsoft should maintain its focus on core business areas rather than diversifying into highly speculative assets.

Context: Corporate Bitcoin Investments

Trend of Bitcoin Adoption in Corporations

In recent years, numerous corporations have explored Bitcoin as an investment option. Companies like MicroStrategy and Tesla have made headlines with their substantial Bitcoin purchases, viewing the cryptocurrency as a strategic asset for capital appreciation and inflation hedging.

Benefits and Risks

Benefits:

- Diversification: Bitcoin offers a new asset class that can enhance portfolio diversification.

- Inflation Hedge: As a decentralized digital asset, Bitcoin is often seen as a hedge against fiat currency devaluation.

- High Returns: The potential for significant capital gains attracts investors seeking high returns.

Risks:

- Price Volatility: Bitcoin’s unpredictable price movements can lead to substantial losses.

- Regulatory Risks: Unclear or changing regulations can impact Bitcoin’s legality and taxation.

- Security Concerns: The risk of cyberattacks and theft remains a significant concern for Bitcoin holdings.

Implications for Microsoft and the Cryptocurrency Market

Impact on Microsoft

If the majority of shareholders vote in favor of the Bitcoin investment strategy, Microsoft could become one of the largest corporate holders of Bitcoin. This move would:

- Enhance Portfolio Diversification: Reducing reliance on traditional asset classes.

- Increase Exposure to Digital Assets: Positioning Microsoft at the forefront of corporate cryptocurrency adoption.

- Potential Financial Gains: Leveraging Bitcoin’s appreciation for capital growth.

Conversely, a vote against the proposal maintains the status quo, focusing Microsoft’s investments on its core business operations and traditional financial instruments.

Broader Cryptocurrency Market Effects

Microsoft’s potential investment in Bitcoin could have several ripple effects across the cryptocurrency market:

- Increased Legitimacy: Corporate investment from a tech giant like Microsoft would bolster Bitcoin’s legitimacy as a mainstream investment asset.

- Market Confidence: Such a move could inspire other large corporations to consider similar strategies, potentially driving further institutional adoption.

- Price Impact: Increased demand from corporate investments could positively influence Bitcoin’s price.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“Microsoft’s consideration of a Bitcoin investment strategy reflects the growing recognition of cryptocurrencies in mainstream finance. However, the board’s opposition highlights the cautious approach that large corporations must take given the inherent risks associated with digital assets.”

Mark Thompson, Financial Strategist

“The debate within Microsoft underscores the broader tension in corporate finance between traditional investment strategies and the allure of high-growth, albeit volatile, assets like Bitcoin. It will be interesting to see how the shareholders weigh the potential rewards against the risks.”

Sarah Lee, Cryptocurrency Researcher

“If Microsoft decides to invest in Bitcoin, it could signal a pivotal moment for corporate cryptocurrency adoption. This could lead to increased market stability and greater acceptance of Bitcoin as a legitimate asset class.”

Future Outlook

Potential Outcomes of the Vote

- Vote in Favor: Microsoft invests a significant portion of its capital into Bitcoin, potentially leading to increased corporate adoption and influencing market dynamics.

- Vote Against: Microsoft maintains its current investment strategy, focusing on traditional financial instruments and core business operations.

Long-Term Implications

Regardless of the vote’s outcome, Microsoft’s engagement with cryptocurrency discussions highlights the importance of digital assets in future financial strategies. The ongoing dialogue around Bitcoin and other cryptocurrencies is likely to influence how other corporations approach digital investments.

Monitoring Regulatory Developments

As the cryptocurrency landscape evolves, regulatory clarity will play a crucial role in shaping corporate investment strategies. Companies like Microsoft will continue to monitor and adapt to regulatory changes to ensure compliance and mitigate risks associated with digital asset investments.

Conclusion

Microsoft’s initiation of a shareholder vote on a Bitcoin investment strategy marks a significant moment in the intersection of corporate finance and cryptocurrency. While the board of directors has advised against the proposal, the outcome of the vote will provide valuable insights into Microsoft’s future investment directions and the broader acceptance of Bitcoin within the corporate sector.

As the cryptocurrency market continues to mature, the decisions of major corporations like Microsoft will be pivotal in shaping the future trajectory of digital assets. Investors and industry observers alike will closely watch the results of this vote, anticipating its potential impact on both Microsoft’s financial strategy and the broader cryptocurrency ecosystem.

To stay updated on the latest developments in corporate cryptocurrency strategies and market trends, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.