What the Altcoin Season Index Means for Bitcoin and the Broader Crypto Market

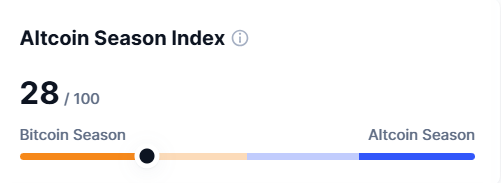

The Altcoin Season Index, a key metric that gauges the relative performance of altcoins compared to Bitcoin (BTC), has risen by two points to 28 as of November 6, 2024, according to CoinMarketCap (CMC). This score continues to signal Bitcoin Season, where BTC’s dominance is strong and only a minority of altcoins are outperforming the leading cryptocurrency. Currently, the index remains far below the threshold for an Altcoin Season, which would require at least 75% of the top 100 coins to outperform Bitcoin.

With an Altcoin Season Index score of 28, the market leans heavily in favor of Bitcoin, which has outperformed most other assets over the past 90 days. This trend reflects investors’ preference for Bitcoin as a relatively stable, dominant asset, underscoring its robust presence within the crypto market. Here’s a closer look at what the Altcoin Season Index indicates and its implications for Bitcoin and altcoins.

What is the Altcoin Season Index?

The Altcoin Season Index is a measurement tool that tracks the performance of the top 100 cryptocurrencies on CoinMarketCap, excluding stablecoins and wrapped tokens, relative to Bitcoin over a specified period. The index uses a scale from 1 to 100:

- Bitcoin Season: A score below 25 indicates that BTC is outperforming the majority of altcoins.

- Altcoin Season: A score above 75 suggests that at least 75% of altcoins are outperforming BTC.

The current score of 28 is close to the Bitcoin Season range, meaning only a small portion of altcoins have outperformed Bitcoin in recent months. This score points to a dominance in investor preference for BTC, particularly as market sentiment has favored the stability and security of the largest cryptocurrency.

Reasons Behind Bitcoin’s Continued Dominance Over Altcoins

Several factors are supporting Bitcoin’s dominance in the current market, as reflected by the Altcoin Season Index:

- Institutional Interest and Inflows: Bitcoin remains the primary choice for institutional investors due to its reputation as a store of value, often dubbed “digital gold.” With the launch of multiple Bitcoin ETFs, particularly in the U.S., institutional interest has driven significant inflows into BTC, which has helped maintain its market strength.

- Market Uncertainty and Risk Aversion: During times of economic or market uncertainty, investors tend to favor assets with lower perceived risks. Bitcoin’s established position and limited supply make it a safer choice for investors compared to the volatility of altcoins, leading to sustained demand for BTC.

- Slow Altcoin Performance: Many altcoins, particularly those outside the top 10, have struggled to maintain consistent performance. Regulatory scrutiny and challenges in gaining traction have limited their growth, making BTC a more attractive investment for those seeking reliability.

- ETF Accessibility and Mainstream Adoption: Bitcoin ETFs have expanded access for investors who may not be comfortable with direct crypto purchases, but altcoin ETFs remain limited or non-existent in many markets. This has channeled more capital toward Bitcoin, reinforcing its dominance.

These factors underscore Bitcoin’s appeal as a stable investment option, particularly as altcoins struggle to compete in terms of market perception and institutional trust.

Implications of a Low Altcoin Season Index for Crypto Investors

The Altcoin Season Index at 28 signals a continued preference for Bitcoin over altcoins, which has several implications for investors:

- Investor Caution Toward Altcoins: A low Altcoin Season Index suggests that altcoins may currently be viewed as higher-risk investments, causing many investors to consolidate around Bitcoin. For investors, this environment could signal a temporary pullback from speculative altcoin positions until market sentiment shifts.

- Focus on Blue-Chip Cryptos: In Bitcoin Season, top-tier altcoins like Ethereum may still hold appeal, but investors often avoid lower-cap coins. Blue-chip assets are favored for their liquidity, stability, and established networks, providing a safer alternative to riskier altcoins.

- Potential for Future Altcoin Upside: For those with high risk tolerance, a low Altcoin Season Index could also represent a buying opportunity for select altcoins at lower prices, with the expectation that altcoin season may eventually return as market conditions shift.

In this scenario, investors need to weigh the risk of holding or accumulating altcoins, given the continued strength of Bitcoin.

Historical Context: Bitcoin Season vs. Altcoin Season Trends

Historically, the crypto market cycles between Bitcoin Season and Altcoin Season based on market sentiment, regulatory developments, and innovation in blockchain technology. Bitcoin typically leads during periods of market consolidation or when external factors drive investors toward safer, more established assets.

- Bitcoin Seasons often coincide with periods of regulatory uncertainty, economic instability, or strong institutional interest in BTC.

- Altcoin Seasons emerge when new projects gain traction, technological advancements fuel enthusiasm, or risk appetite rises, leading to greater speculation in smaller-cap assets.

The shift between these seasons can occur quickly, especially in response to developments like technological upgrades, regulatory changes, or new product launches that capture market attention.

What Could Trigger a Shift to Altcoin Season?

For the Altcoin Season Index to rise above 75, the market would need to see a significant shift favoring altcoin performance. Potential catalysts for such a shift include:

- Technological Advancements in Altcoin Projects: New developments in blockchain technology, such as scalability improvements or successful launches of decentralized finance (DeFi) and Web3 projects, could attract interest back to altcoins.

- Regulatory Clarity for Altcoins: Clear and supportive regulatory frameworks could enhance investor confidence in altcoins, allowing projects to attract more mainstream investment.

- Market Shift in Risk Appetite: During bullish market cycles, risk tolerance typically increases, leading investors to pursue higher returns through altcoins. A rally in crypto markets or broader economic recovery could encourage this shift.

- Ethereum and Layer-2 Scaling Solutions: Ethereum’s success, along with layer-2 scaling solutions that improve functionality and lower transaction costs, could boost altcoin sentiment, especially if adoption expands to DeFi and NFT sectors.

If any of these factors occur, the Altcoin Season Index could trend higher, indicating increased demand for altcoins relative to Bitcoin.

Conclusion

The Altcoin Season Index’s rise to 28, signaling continued Bitcoin dominance, reflects the crypto market’s preference for BTC in an environment focused on stability, institutional trust, and mainstream adoption. With Bitcoin viewed as a safe and accessible option, particularly for new and institutional investors, altcoins are facing increased competition to attract capital.

While the current index suggests that we remain in Bitcoin Season, future shifts in technology, regulation, and investor sentiment could eventually bring altcoins back into the spotlight. For now, however, Bitcoin’s robust presence underscores its appeal as a leading cryptocurrency, consolidating its position amid cautious investor sentiment.

To stay informed on the latest market trends and shifts between Bitcoin and altcoin seasons, explore our article on latest news, where we discuss the factors shaping crypto performance and investor preferences.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.