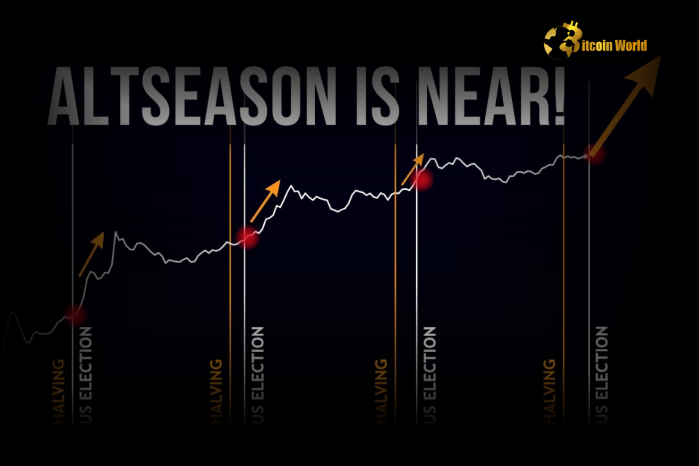

Altcoin Season Nears as Non-Bitcoin Cryptos Begin to Outperform BTC

Recent market activity shows that altcoin season may be on the horizon as non-Bitcoin cryptocurrencies start to outperform Bitcoin (BTC). In the past 90 days, 15 of the top 50 altcoins have surpassed BTC’s performance, pushing the Altcoin Season Index up to 31—closer to the 75% threshold that signifies a full altcoin season. According to BeInCrypto, this trend could mark the beginning of a shift in market dynamics, with altcoins poised for potential gains if current indicators hold.

What is Altcoin Season?

Altcoin season refers to a period when altcoins, or cryptocurrencies other than Bitcoin, outperform BTC in terms of price gains. This typically occurs when investor focus shifts from Bitcoin to alternative digital assets, driving up their value and market share. During a full altcoin season, at least 75% of the top 50 cryptocurrencies outpace Bitcoin’s performance over a specified period, reflecting strong demand and increased market activity in the altcoin sector.

The Altcoin Season Index, a metric used to gauge market conditions, currently sits at 31. While this is below the threshold for a confirmed altcoin season, the gradual rise suggests growing momentum in the altcoin market.

Key Factors Driving Altcoin Performance

Several factors are influencing altcoin performance and contributing to the nearing of an altcoin season:

- Bitcoin’s High Price and Dominance: Bitcoin’s recent surge to new highs has attracted a lot of attention, leading to an increase in its market dominance (currently at 60.61%). As Bitcoin stabilizes, however, some investors are shifting focus to altcoins, seeking higher growth opportunities and diversified holdings.

- TOTAL2 Index Growth: The TOTAL2 index, which measures the market capitalization of all cryptocurrencies excluding Bitcoin, is showing signs of a breakout. A sustained rise in the TOTAL2 index is often associated with increased investor interest in altcoins, suggesting that funds may be flowing into non-Bitcoin assets.

- Ethereum and Layer 2 Projects: Ethereum, the leading altcoin, and Layer 2 scaling solutions continue to drive activity in the altcoin sector. Ethereum’s role in decentralized finance (DeFi) and its ongoing transition to a proof-of-stake model are attracting more attention to the ecosystem, boosting interest in Ethereum and related projects.

- DeFi and NFT Market Growth: The growing popularity of decentralized finance (DeFi) and non-fungible tokens (NFTs) is fueling demand for altcoins. Many DeFi and NFT projects operate on blockchains other than Bitcoin, increasing the appeal of altcoins as users and investors explore new opportunities.

- Improved Market Infrastructure: With enhanced accessibility to altcoins through platforms like decentralized exchanges (DEXs) and regulated financial products, investors can engage more easily with the altcoin market. This infrastructure growth provides better liquidity and stability for altcoin trading, supporting sustained interest.

These factors contribute to the anticipation of an altcoin season, with investors watching closely for continued momentum in the altcoin space.

Altcoin Season Indicators to Watch

To assess whether an altcoin season is truly on the way, certain indicators can offer valuable insights:

- Altcoin Season Index Threshold: The Altcoin Season Index must reach 75% for a confirmed altcoin season. Currently at 31, the index is inching upward as more altcoins outperform Bitcoin. A sustained rise in the index could confirm an upcoming shift.

- Market Cap Growth in TOTAL2 Index: The TOTAL2 index measures the combined market capitalization of altcoins, excluding Bitcoin. When this index breaks out, it indicates that altcoins are capturing more value, often a precursor to a full altcoin season.

- BTC Dominance Rate: Bitcoin’s dominance currently sits around 60.61%, a high figure that reflects strong market focus on BTC. However, if Bitcoin’s dominance rate begins to decline, it could indicate a rotation of capital into altcoins, supporting the onset of altcoin season.

- Trading Volumes on Altcoin Exchanges: Increased trading volume on exchanges with strong altcoin listings, particularly decentralized exchanges, suggests heightened interest in non-Bitcoin assets. A consistent rise in volume can indicate a shift in market sentiment toward altcoins.

Tracking these indicators helps investors gauge whether the altcoin market will continue its current trajectory and reach full altcoin season.

Potential Benefits and Risks of Altcoin Season

An altcoin season presents both opportunities and risks for investors. Here’s what to consider as altcoin season nears:

Benefits

- Higher Growth Potential: Altcoins often exhibit more volatile price movements than Bitcoin, which can lead to substantial gains during an altcoin season.

- Portfolio Diversification: Altcoins offer investors a chance to diversify their holdings, reducing reliance on Bitcoin’s performance alone.

- Exposure to Innovation: Many altcoins power emerging sectors like DeFi, NFTs, and Layer 2 scaling solutions, providing exposure to cutting-edge technologies.

Risks

- Increased Volatility: Altcoins are typically more volatile than Bitcoin, making them susceptible to sharp price swings. This volatility can lead to rapid gains but also steep losses.

- Regulatory Uncertainty: Many altcoins operate in a regulatory gray area, and any regulatory changes could affect their price stability and accessibility.

- Liquidity Concerns: Smaller altcoins may face liquidity issues, making it difficult to execute large trades without affecting prices.

Investors seeking to participate in altcoin season should balance the potential rewards with these risks, ensuring they have a strategy that aligns with their financial goals and risk tolerance.

What an Altcoin Season Could Mean for the Crypto Market

The approach of an altcoin season has broader implications for the cryptocurrency market as a whole. If altcoins begin to capture more value, it could drive diversification within the crypto space, giving smaller projects increased visibility and attracting new investors to alternative assets. This rotation could also bring more liquidity and innovation into sectors like DeFi, NFTs, and cross-chain platforms, strengthening the overall market.

Moreover, an altcoin season often reflects a maturing market structure where investors recognize the potential of assets beyond Bitcoin. As altcoins gain traction, the cryptocurrency ecosystem becomes more complex, with specialized assets catering to different use cases and investor preferences.

Conclusion

The data suggests that altcoin season may be approaching, with non-Bitcoin cryptos starting to outperform BTC and the Altcoin Season Index rising to 31. If these trends continue, the altcoin market could experience increased momentum, signaling new opportunities for investors looking to diversify beyond Bitcoin.

As the crypto landscape evolves, an altcoin season could drive innovation and engagement across the market, reinforcing the role of alternative assets in the digital economy. However, investors should remain mindful of the risks associated with altcoin investments and closely monitor key indicators to make informed decisions.

For more insights on altcoin trends and emerging opportunities in crypto, check out our latest news covering the developments in DeFi, NFTs, and altcoin market performance.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.