$3.4 Billion in BTC Options Set to Expire on November 15: What It Means for Bitcoin’s Price

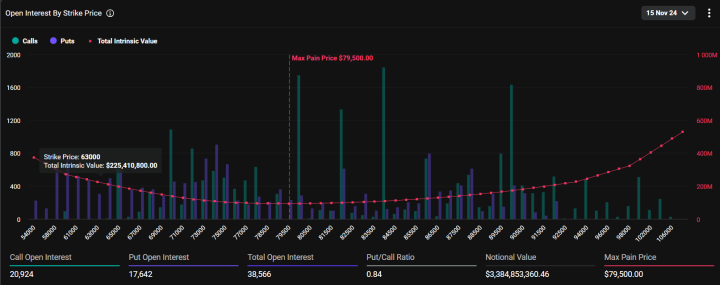

On November 15, approximately $3.4 billion worth of Bitcoin (BTC) options will expire, with a max pain price of $79,500. According to Deribit, a leading crypto options exchange, the put/call ratio for these options is 0.84, indicating that call options outnumber puts, reflecting bullish sentiment among traders. At the same time, Ethereum (ETH) options worth $581 million are also set to expire, with a max pain price of $3,000.

As options expiration approaches, this high volume of expiring contracts could impact BTC’s price volatility, especially around the max pain price—a price level where the largest number of options expire out-of-the-money, causing financial losses for most option holders.

Key Terms to Understand the Impact of Options Expiry

- Put/Call Ratio: The put/call ratio of 0.84 for BTC options suggests a higher number of calls (bullish bets) than puts (bearish bets). This metric often signals market sentiment, with a lower ratio typically indicating optimism.

- Max Pain Price: The max pain price represents the price at which the greatest number of options expire out-of-the-money, maximizing financial losses for options holders. For BTC, the max pain price is $79,500, while for ETH, it’s $3,000.

- Open Interest: High open interest in options often indicates elevated market activity and the potential for greater price volatility as expiration approaches.

These metrics help gauge the potential impact of options expiry on market movement, providing insight into trader sentiment and possible price reactions.

Why Options Expiry Dates Matter to the Crypto Market

Options expiries, especially those involving large contract volumes, can significantly influence Bitcoin’s price dynamics:

- Increased Volatility: Options expirations often cause short-term price fluctuations, as traders adjust positions to minimize losses or take profits, especially if prices are near the max pain level.

- Price Manipulation Potential: High open interest around a specific price point (such as $79,500) may lead to efforts by certain market participants to influence prices toward that level to maximize financial benefits.

- Market Sentiment Indicator: With a put/call ratio below 1, current sentiment appears bullish. This suggests that traders are optimistic about BTC’s short-term price direction, though max pain dynamics could still influence volatility.

Bitcoin’s Max Pain Price of $79,500: What to Expect

For Bitcoin, the max pain price of $79,500 is a key level to watch as expiration approaches. If BTC’s price gravitates around this level, the impact on traders could be substantial:

- Bullish Implications: With the put/call ratio showing more calls than puts, bullish sentiment could push BTC above the max pain level. If BTC remains above $79,500, call option holders are likely to benefit, potentially adding upward pressure.

- Bearish Pressure Near Max Pain: Conversely, if BTC drops toward $79,500, traders holding put options may gain the upper hand, creating downward pressure as options expiration approaches.

Ethereum Options Expiry and Its Impact on ETH Price

In addition to Bitcoin, Ethereum options worth $581 million will also expire on November 15, with a put/call ratio of 0.93 and a max pain price of $3,000. This situation could affect ETH’s short-term price, particularly if prices hover around the max pain point:

- Neutral Sentiment: The near-equal put/call ratio suggests a balanced sentiment, with slightly more calls than puts, reflecting mild optimism.

- Potential for Volatility: If ETH remains close to $3,000, heightened volatility may result as option holders try to maximize positions near the max pain level.

How Options Expirations Influence Bitcoin and Ethereum Prices

Options expirations can create notable market volatility in several ways:

- Impact on Spot Prices: Traders often adjust their spot positions to hedge or capitalize on options positions, which can cause BTC and ETH prices to converge toward the max pain price.

- Short-Term Price Swings: Close to expiration, significant volumes of buying or selling pressure may arise, creating short-term price movements, especially in highly speculative environments like crypto.

- Position Adjustment: Some traders may roll over positions (extend expiration) to the next contract cycle, leading to shifts in open interest for the upcoming period and possible price adjustments.

What Investors Should Watch on Expiry Day

For investors, the high volume of expiring BTC and ETH options means it’s essential to monitor the following factors on November 15:

- Price Movements Around Max Pain: Keep an eye on whether BTC and ETH prices move closer to $79,500 and $3,000, respectively, as these levels may act as magnet points.

- Open Interest Changes: Significant shifts in open interest following expiry could indicate renewed positions in upcoming contracts, signaling market sentiment for the next month.

- Volume and Volatility Spikes: Expirations often bring volume spikes and price swings, which may present buying or selling opportunities based on the observed trends.

Conclusion

With $3.4 billion in Bitcoin options and $581 million in Ethereum options set to expire on November 15, the crypto market is poised for a potentially volatile session. The max pain prices of $79,500 for BTC and $3,000 for ETH represent key levels to watch, as prices near these points could influence trader sentiment and spark short-term price movements. As the expiration approaches, market participants should stay alert to volatility around these levels and consider how max pain dynamics might impact their strategies.

For more insights into options trading and its influence on crypto markets, check out our article on understanding crypto options and their impact on market trends.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.