Are you curious about the next big thing in the world of finance? For those keeping a close eye on the cryptocurrency landscape, a new contender is emerging: Central Bank Digital Currencies (CBDCs). Imagine the technology powering Bitcoin, but with the stability and trust of your national bank. That’s the potential of CBDCs, and it’s a topic that’s generating a lot of buzz among governments and financial institutions worldwide.

Why the Shift Towards CBDCs?

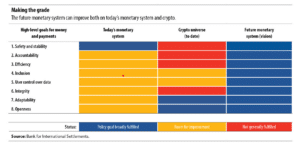

Think of the current financial system as a well-established but sometimes clunky machine. Governments around the globe are exploring CBDCs as a way to make this machine run smoother and more efficiently. A recent article by the International Monetary Fund (IMF) highlights this very point, emphasizing that the technological prowess of cryptocurrency, combined with the bedrock of trust provided by central banks, is crucial for building a robust financial ecosystem. Essentially, it’s about taking the best of both worlds.

As BIS executives Jon Frost and Hyun Song Shin, along with IMF Deputy Managing Director Agustin Carstens, put it: “Digital technologies promise a bright future for the monetary system.” This isn’t just wishful thinking; it’s a recognition of the potential to modernize how we handle money.

And it’s not just talk. A Bank for International Settlements (BIS) analysis from June suggests that cryptocurrencies, in their underlying technology, actually outperform traditional fiat systems when it comes to achieving the broader goals of a future monetary system. This is a significant statement, coming from a body that represents the world’s central banks.

What are the Hurdles to CBDC Adoption?

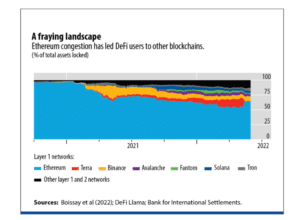

While the potential is exciting, it’s important to acknowledge the challenges. The BIS executives point to issues like “bottleneck congestion” in decentralized finance (DeFi) and the reliance on volatile assets as key obstacles preventing widespread adoption of existing cryptocurrencies. These are the kinks that need to be ironed out for digital currencies to truly go mainstream.

What Benefits Could CBDCs Bring?

The integration of cryptocurrency technology into CBDCs could unlock a range of advantages for both individuals and businesses. Think about it:

- Enhanced Efficiency: CBDCs could streamline payment processes, making transactions faster and potentially cheaper.

- Increased Financial Inclusion: By providing a digital form of central bank money, CBDCs could offer access to financial services for those currently underserved by traditional banking.

- Innovation in Payments: The underlying technology allows for programmable money and smart contracts, opening up new possibilities for how we transact.

- Cross-Border Payments: Imagine seamless and cost-effective international money transfers. CBDCs could potentially make this a reality.

How Could Tokenization Play a Role?

The article also highlights the importance of cutting-edge technologies like tokenization. What does this mean? Essentially, it involves representing different fiat currencies digitally. Imagine being able to easily make payments in various currencies without the complexities and fees associated with traditional foreign exchange. This could be a game-changer for both consumers and business owners operating internationally.

The Future of Finance: What to Expect?

So, what does all this mean for the future? While the development and implementation of CBDCs are still in their early stages, the direction is clear. Central banks are seriously exploring how to leverage the power of digital currencies to improve the financial system. Here are a few key takeaways:

- Collaboration is Key: The successful implementation of CBDCs will require collaboration between central banks, technology providers, and the private sector.

- Focus on Security and Privacy: Ensuring the security and privacy of digital currencies is paramount. Robust frameworks and technologies will be essential.

- Gradual Implementation: We’re unlikely to see a sudden switch to CBDCs. Instead, expect a gradual rollout and integration with existing systems.

In Conclusion: Are CBDCs the Next Evolution of Money?

The conversation around CBDCs is no longer a hypothetical exercise. Major financial institutions and international bodies like the IMF and BIS are actively exploring and advocating for their potential. By combining the innovation of cryptocurrency with the stability of central banking, CBDCs offer a compelling vision for the future of money. While challenges remain, the potential benefits for efficiency, inclusion, and innovation are hard to ignore. Keep an eye on this space – the future of how we transact is being shaped right now.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.