Cardano (ADA) is making waves in the crypto market again! After a period of sideways movement, ADA’s price has suddenly sprung to life, hitting levels we haven’t seen in almost a year. If you’re an investor keeping an eye on Cardano, you’re probably asking yourself: is this the breakout we’ve been waiting for, or should we be bracing for a pullback? Let’s dive into the details and see what’s fueling this surge and what it means for ADA’s future.

Cardano’s Price Soars: A Blast from the Past?

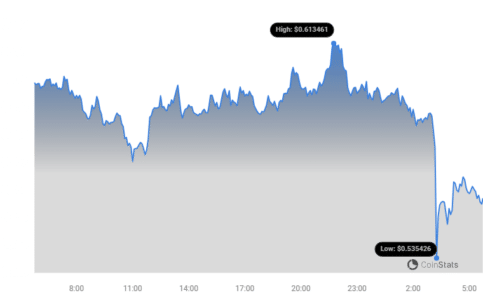

Cardano’s daily chart is looking undeniably bullish. Over the past few days, ADA has experienced a significant price jump, turning heads across the crypto sphere. Just how significant? Let’s break it down:

- Impressive Surge: In just the last three days, Cardano’s value has jumped by more than 25%! That’s a substantial move in a short period.

- New Highs: As of now, ADA is trading around $0.59, marking an almost 2% increase today alone. This price point is significant because, according to data from Santiment, ADA hasn’t consistently traded at these levels since June 2022.

This rapid ascent naturally raises questions. Is this rally sustainable? Are we looking at the start of a longer-term uptrend, or is a price correction on the horizon?

Adding to the bullish picture, technical indicators are flashing bright green. The Relative Strength Index (RSI), a tool used to measure the momentum and magnitude of recent price changes, is approaching a staggering 90 for ADA. What does this mean?

- Strong Bullish Momentum: An RSI near 90 signals an extremely strong bullish trend, indicating intense buying pressure.

- Overbought Territory: However, such high RSI values also often suggest that an asset is becoming overbought. This can sometimes precede a price correction as the market seeks equilibrium.

Further reinforcing the bullish narrative is the Moving Average Convergence Divergence (MACD). The MACD is another momentum indicator that shows the relationship between two moving averages of a security’s price. In ADA’s case, the MACD is strongly supporting the current upward trend, suggesting that the bullish momentum is not just a short-term blip.

See Also: Cardano (ADA) Price Is Waxing Strong Above The $0.40 Resistance, Is This ADA Rally?

Key Metrics Paint a Positive Picture for ADA

Beyond price charts and technical indicators, several key on-chain metrics are also pointing towards a healthy uptrend for Cardano. Let’s take a closer look:

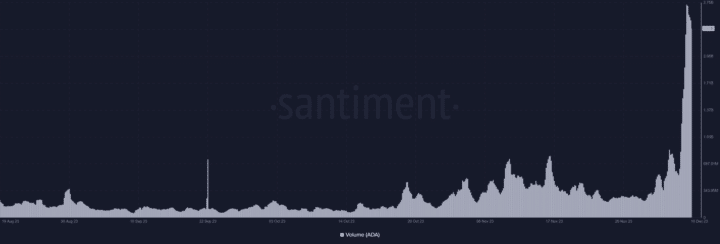

Volume Surge: Is Investor Interest Exploding?

Analyzing Cardano’s trading volume from Santiment reveals a dramatic increase. The daily trading volume has skyrocketed to levels unseen in months. On December 9th, it peaked at over $2.7 billion. Even as we write this, the volume has already surpassed $2.4 billion for the current day. Why is this significant?

- Strong Correlation: High trading volume often accompanies significant price movements, especially in cryptocurrencies. The current surge in volume strongly supports the validity of ADA’s price increase.

- Healthy Market Sign: Increased volume indicates heightened investor interest and participation, suggesting that this price movement is driven by genuine market activity.

Active Addresses: Are More Users Engaging with Cardano?

Another crucial metric to consider is the number of active addresses on the Cardano network. Looking at the 7-day trend, we see a clear uptrend. Since December 4th, approximately 88,000 new active addresses have been added to the network. This impressive growth brings the total number of active addresses to nearly 300,000.

- Network Growth: An increase in active addresses suggests growing adoption and usage of the Cardano network.

- Potential for Future Growth: More active users can translate to increased transaction volume and potentially further price appreciation as demand for ADA increases.

Social Dominance: Is Cardano Back in the Spotlight?

Social dominance, which measures the percentage of cryptocurrency discussions focused on a particular asset, is also on the rise for Cardano. On December 9th, Cardano’s social dominance reached around 3.7%. While it has slightly dipped to around 2.9% recently, it still indicates that ADA is a significant topic of conversation within the crypto community, occupying nearly 3% of all crypto discussions.

- Increased Awareness: Higher social dominance can reflect growing public interest and awareness in Cardano, potentially attracting new investors.

- Market Sentiment: While social dominance doesn’t directly dictate price, it can be an indicator of overall market sentiment and attention towards an asset.

The confluence of rising price, volume, active addresses, and social dominance paints a decidedly positive picture for Cardano at the moment.

See Also: Is Solana’s Jito (JTO) Token Taking Us On A Massive Rollercoaster?

Trader Sentiment Shifts: From Exuberance to Cautious Optimism?

While the metrics largely point to a bullish scenario, there are subtle shifts in trader sentiment that are worth noting. The Cardano funding rate on Coinglass, which reflects the sentiment of perpetual contract traders, reveals a nuanced picture.

On December 9th, the funding rate climbed to around 0.04%, indicating strong bullish sentiment and a willingness to pay to hold long positions. However, as of now, it has decreased to approximately 0.02%. What does this slight decrease suggest?

- Cooling Optimism: The slight drop in the funding rate could indicate a tempering of extreme bullishness. While most traders are still optimistic about further price increases, some are starting to exercise caution.

- Healthy Market Correction?: A decrease from peak bullishness can actually be a healthy sign, potentially reducing the risk of an overheated market and a sharp correction.

The Bottom Line: ADA’s Bull Run and Investor Strategy

Cardano’s recent price surge is backed by strong technical indicators and positive on-chain metrics. The increased volume, active addresses, and social dominance all suggest genuine interest and growing adoption. However, the slightly decreased funding rate and the high RSI also hint at the possibility of a price correction in the short term.

For investors, what does this mean?

- Potential Opportunity: The bullish momentum could present a buying opportunity, especially for those who believe in Cardano’s long-term potential.

- Caution Advised: The high RSI and potential shift in trader sentiment warrant caution. It might be prudent to avoid FOMO (Fear Of Missing Out) and consider a more measured approach.

- Risk Management: As always in crypto, risk management is crucial. Consider diversifying your portfolio and not investing more than you can afford to lose.

Ultimately, whether to buy, hold, or sell ADA depends on your individual investment strategy and risk tolerance. However, staying informed about market trends, key metrics, and trader sentiment, as we’ve discussed here, is crucial for making informed decisions in the dynamic world of cryptocurrency.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.