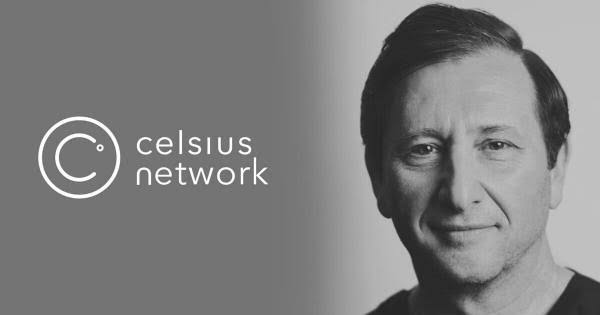

Is Bitcoin the future of payments, or is it better suited for something else? Alex Mashinsky, the CEO of crypto lending platform Celsius, has a strong opinion on this, and it might surprise you. While Bitcoin is the king of cryptocurrencies and a revolutionary asset, Mashinsky believes it falls short as a practical payment method. Let’s dive into his reasoning and understand why he thinks the US dollar still reigns supreme when it comes to everyday transactions.

Bitcoin vs. The Dollar: A Tale of Two Currencies According to Celsius CEO

In a recent interview on Coin Stories, Alex Mashinsky didn’t hold back his views on Bitcoin’s payment capabilities. He drew a stark contrast between Bitcoin and the US dollar, highlighting their strengths and weaknesses in different roles. Here’s the crux of his argument:

- The Dollar: Payment King, Value Flounder

Mashinsky sees the US dollar as an exceptional payment tool. Think about it – it’s widely accepted, relatively stable in daily use (though inflation is a concern for long-term value), and transactions are generally quick and easy. However, he points out its Achilles’ heel: the dollar is a “horrible store of value.” Why? Inflation erodes its purchasing power over time. Your dollars saved today will likely buy less in the future.

- Bitcoin: Value Champion, Payment Pauper

On the flip side, Mashinsky champions Bitcoin as a “phenomenal store of value.” Its scarcity (limited to 21 million coins) and decentralized nature are key factors driving its potential to hold and even increase in value over the long term. But when it comes to payments? He believes Bitcoin is “a pretty bad form of payment.”

In his own words:

“I’d much rather be in a scenario where the dollar remains as the… reserve currency but Bitcoin continues to do very well… The dollar is a phenomenal form of payment. It’s a horrible store of value and… Bitcoin is a phenomenal store value, but it’s a pretty bad form of payment.”

Why Bitcoin Fails as a Payment Method: Mashinsky’s Key Points

Mashinsky doesn’t just make a blanket statement; he backs it up with compelling reasons. Let’s break down why he believes using Bitcoin for payments is a path to regret:

- The Tesla Regret: A Costly Transaction

Remember when Elon Musk briefly allowed Tesla purchases with Bitcoin? Mashinsky uses this as a prime example of why Bitcoin payments can be a bad idea. He argues:

“If you fell for Elon Musk’s deal where he gave you a Tesla for two or three Bitcoins, obviously you hate driving that Tesla because you would in a second go back and take those… three Bitcoins and return the Tesla, which lost value during the same period of time.”

Imagine buying a Tesla for 2 Bitcoin when Bitcoin was at its peak. If Bitcoin’s price then surged, you’d likely regret spending those Bitcoins, feeling like you significantly undervalued your crypto holdings for a depreciating asset like a car.

- The 10-Year Regret Rule: Bitcoin’s Appreciation Hurts Past Purchases

Mashinsky extends this logic beyond just Teslas. He suggests that almost any purchase made with Bitcoin in the past decade would be viewed with regret today:

“Anything you bought with Bitcoin in the last 10 years, you rather have the Bitcoin back… and would have paid in US dollars. That’s really the crux of the matter that you… cannot use it as a form of payment or cannot use it in a way… that makes you happy about the transaction.”

Think about buying a coffee with Bitcoin in 2012. That small amount of Bitcoin could be worth a significant sum today! This price appreciation, while fantastic for Bitcoin holders, makes it psychologically painful to use for everyday purchases.

Store of Value vs. Medium of Exchange: Understanding the Difference

Mashinsky’s argument boils down to the fundamental functions of money:

| Function of Money | US Dollar (as per Mashinsky) | Bitcoin (as per Mashinsky) |

| Store of Value | Weak – Inflation erodes value | Strong – Scarcity and potential for appreciation |

| Medium of Exchange (Payment) | Strong – Widely accepted, stable for daily use | Weak – Price volatility, potential for regret |

Essentially, a good store of value should maintain or increase its purchasing power over time. A good medium of exchange (or payment method) should be stable and convenient for everyday transactions.

Is Mashinsky Right About Bitcoin and Payments?

Mashinsky’s perspective is certainly thought-provoking and resonates with many in the crypto space. Bitcoin’s volatility is a real hurdle for widespread payment adoption. Imagine your daily coffee costing different amounts in Bitcoin every hour! For most people, this unpredictability is a major deterrent.

However, the narrative around Bitcoin and payments is constantly evolving. The Lightning Network, for example, is a layer-2 solution built on top of Bitcoin that aims to enable faster and cheaper transactions, potentially making Bitcoin more viable for payments in the future.

Whether Bitcoin will eventually become a mainstream payment method remains to be seen. For now, Alex Mashinsky makes a compelling case for its primary role as a store of value, suggesting that holding onto your Bitcoin might be more rewarding than spending it, at least for the time being.

Galaxy Interactive Rises Additional $325M Fund For Metaverse and Next Gen…>>

Related Posts – Bank DBS’s Crypto Business Grows Massively Due To Growing Demand From Investors

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.