Altcoin Season Index Stays Neutral at 50, Indicating Market Balance

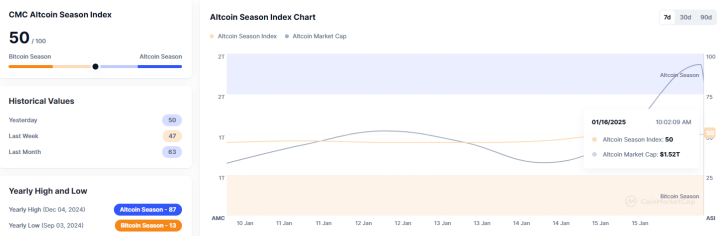

The Altcoin Season Index, a widely followed metric provided by CoinMarketCap (CMC), registered 50 as of 01:02 UTC on January 16, 2025, unchanged from the previous day. This neutral reading suggests a balanced market, where neither Bitcoin nor altcoins dominate performance.

What Is the Altcoin Season Index?

The Altcoin Season Index measures market trends by analyzing the performance of the top 100 coins (excluding stablecoins and wrapped tokens) relative to Bitcoin over the past 90 days:

- Altcoin Season: At least 75% of altcoins outperform Bitcoin.

- Bitcoin Season: 25% or fewer altcoins outperform Bitcoin.

- Neutral Zone: A reading near 50 signals equilibrium, where altcoins and Bitcoin perform similarly.

Current Market Insights

1. Neutral Sentiment at 50

- Balanced Performance: A value of 50 indicates that altcoins and Bitcoin are performing on par, with neither asset class dominating market activity.

- No Clear Trend: The market is not decisively leaning toward Bitcoin Season or Altcoin Season.

2. Altcoin and Bitcoin Dynamics

- Altcoins Holding Steady: Many altcoins have maintained performance levels relative to Bitcoin, keeping the index in a neutral range.

- Bitcoin Resilience: Bitcoin continues to anchor the market, contributing to the balanced sentiment.

What Does Neutrality Mean for the Market?

1. Market Stability

- A neutral index suggests a period of consolidation, where prices are stabilizing after recent volatility.

2. Opportunities for Both Bitcoin and Altcoin Investors

- Bitcoin: Continued relevance as a dominant market force.

- Altcoins: Potential to outperform Bitcoin if momentum shifts in their favor.

3. Investor Caution

- Neutral conditions often precede significant market shifts, requiring vigilance and adaptability from traders and investors.

Historical Context of the Altcoin Season Index

| Date | Index Value | Market Context |

|---|---|---|

| Jan 15, 2025 | 50 | Neutral market sentiment. |

| Dec 15, 2024 | 42 | Bitcoin dominance rising. |

| Nov 15, 2024 | 56 | Altcoins showing strength. |

Factors Influencing the Neutral Index

1. Bitcoin Dominance

- Steady Market Share: Bitcoin’s market share has remained consistent, preventing significant shifts toward altcoins.

2. Altcoin Performance

- Mixed Results: While some altcoins are outperforming, others are lagging, keeping the index balanced.

3. Macro Market Conditions

- Investor Sentiment: Neutrality in the index often reflects cautious optimism in the broader crypto market.

- Regulatory Factors: Uncertainty surrounding regulations may be influencing investor behavior, leading to balanced activity.

Potential Scenarios for the Coming Weeks

| Scenario | Expected Market Movement |

|---|---|

| Shift Toward Bitcoin Season | A rally in Bitcoin price could lower the index, favoring Bitcoin dominance. |

| Shift Toward Altcoin Season | Increased altcoin activity, particularly in DeFi or GameFi sectors, could raise the index. |

| Continued Neutrality | Consolidation across both Bitcoin and altcoins may keep the index steady. |

Conclusion

The Altcoin Season Index’s neutral position at 50 highlights a balanced crypto market where Bitcoin and altcoins are performing in near equilibrium. While this signals stability, it also suggests potential for future shifts. Investors should monitor market trends closely, as periods of neutrality often precede significant directional movements.

For now, both Bitcoin and altcoins present opportunities, depending on individual investment strategies and market developments.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.