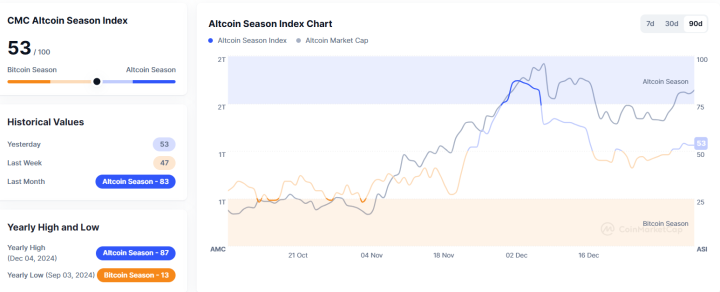

The Altcoin Season Index remains unchanged at 53, according to data from CoinMarketCap (CMC). This level suggests that the market is still in Altcoin Season, where a significant portion of top cryptocurrencies outperform Bitcoin.

As the index hovers above 50, traders and investors may interpret this as a balanced yet favorable environment for altcoin investment, with opportunities to capitalize on the diverse gains of altcoins.

Understanding the Altcoin Season Index

The Altcoin Season Index is a metric designed to gauge the relative performance of altcoins against Bitcoin:

- Scale: Ranges from 1 (Bitcoin Season) to 100 (Altcoin Season).

- Altcoin Season Defined: Occurs when 75% or more of the top 100 altcoins outperform Bitcoin over the last 90 days.

- Bitcoin Season Defined: Occurs when 25% or fewer of the top 100 altcoins outperform Bitcoin over the same period.

Key Metrics Excluded from the Index

- Stablecoins: Tokens like USDT and USDC, as they do not exhibit volatility.

- Wrapped Tokens: Excluded to avoid skewing results due to their direct Bitcoin or Ethereum peg.

Altcoin Season Index at 53: Key Insights

1. Balanced Market Dynamics

- The index’s position at 53 indicates a neutral zone, with neither Bitcoin nor altcoins dominating entirely.

- Traders may see this as an opportunity to diversify their portfolios across both asset classes.

2. Sustained Altcoin Strength

- While not fully in “Altcoin Season,” a score above 50 suggests strong performance by a majority of altcoins relative to Bitcoin.

3. Bitcoin’s Role Remains Significant

- A score in the 50s highlights Bitcoin’s continued influence on the market, with its dominance maintaining a crucial role in market trends.

Historical Trends in the Altcoin Season Index

| Date | Index Score | Market Sentiment |

|---|---|---|

| July 2021 | 20 | Strong Bitcoin dominance. |

| November 2021 | 72 | Altcoins surged amid Bitcoin gains. |

| March 2024 | 63 | Altcoin-led bull market began. |

| January 2025 | 53 | Balanced growth in Bitcoin and altcoins. |

What Does This Mean for Traders?

1. Portfolio Diversification

- A balanced index suggests that traders should consider allocating investments to both Bitcoin and altcoins.

- Blue-Chip Altcoins: Established projects like Ethereum (ETH) and Solana (SOL) are strong candidates.

- Emerging Altcoins: Innovative tokens in DeFi, AI, and RWA categories may offer higher risk-reward ratios.

2. Monitor Bitcoin Dominance

- Bitcoin dominance can shift rapidly, influencing the Altcoin Season Index.

- Staying updated on dominance metrics ensures better timing for entering or exiting positions.

3. Manage Risk in Altcoin Investments

- Altcoins are typically more volatile than Bitcoin.

- Use stop-loss orders to protect against sudden market corrections.

FAQs

What is the Altcoin Season Index?

The Altcoin Season Index measures the performance of altcoins compared to Bitcoin over the last 90 days, providing insights into market trends.

How is the Altcoin Season Index calculated?

It analyzes the top 100 altcoins’ performance against Bitcoin, excluding stablecoins and wrapped tokens.

What does a score of 53 mean?

A score of 53 suggests a neutral zone, with slight strength in altcoins. This is not a full Altcoin Season but indicates balanced market dynamics.

How should I adjust my crypto portfolio during this phase?

Consider diversifying your investments between Bitcoin and altcoins, focusing on both established projects and high-growth altcoin sectors.

When is it officially Altcoin Season?

Altcoin Season occurs when at least 75% of the top 100 altcoins outperform Bitcoin over the last 90 days.

Conclusion

The Altcoin Season Index’s steady position at 53 reflects a balanced crypto market, offering opportunities for both Bitcoin and altcoin investors. While not fully in Altcoin Season, the market environment suggests strength in altcoin performance, making this a pivotal moment for portfolio diversification.

Traders should continue monitoring Bitcoin dominance and altcoin performance to capitalize on evolving trends while managing risk effectively.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.