In the vast realm of cryptocurrency, where tens of thousands of altcoins traverse the market’s intricate landscape, crypto enthusiasts may easily overlook the potential gem that could deliver a 100-fold return on investment. The blame for missing out on these opportunities seldom falls on the investors themselves, for keeping abreast of this ever-expanding multitude of coins is no small feat. To address this predicament, an astute Santiment analyst has artfully unearthed six hidden altcoins poised for an exciting rally.

As revealed by the crypto expert in the Santiment publication, these chosen altcoins have not attracted the attention they truly deserve, yet their vibrancy is undeniable. Their vitality resonates through various facets, including transaction volumes, network expansion, large-scale transactions, and more.

“The truly enticing prospects lie within projects that may not have experienced significant price disconnections recently, but their remarkable surge in network activity or the occurrence of significant whale transactions and accumulations hint at potential volatility,” the analyst pointed out.

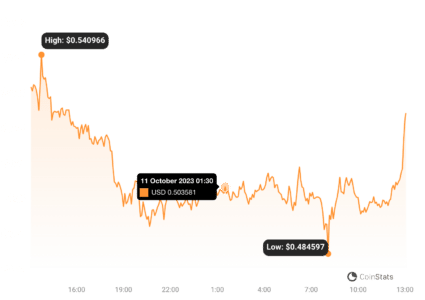

1 – Bancor (BNT) Takes the Lead in the Altcoin Arena

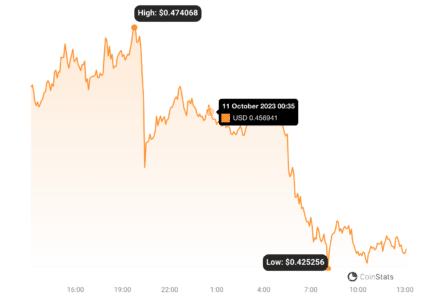

As articulated in the report, the Bancor Network, a permissionless protocol designed to cater to open-source DeFi protocols, has witnessed a substantial surge across its network metrics. This encompasses a surge in transaction volumes, active addresses, network growth, whale transactions, exchange inflows, and age destroyed (Consumed). These telltale signs could be the prelude to an ascent in the price of BNT.

https://coinstats.app/coins/bancor/

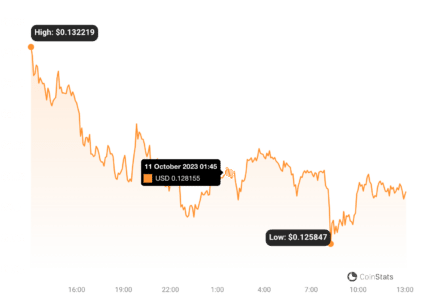

2 – Cartesi (CTSI)

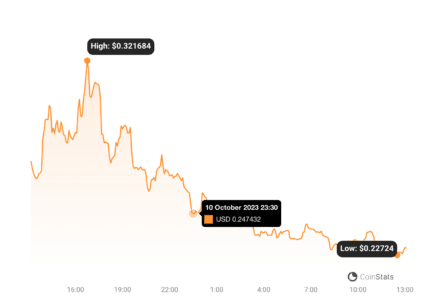

The application-specific rollups network of Cartesi, which features a Linux runtime, mirrors the metrics that have elevated Bancor, suggesting a potential uptick in the native CTSI token. This surge spans “High Transaction Volume, Active Addresses, Whale Transactions, and Age Destroyed (Consumed),” as elucidated in the report.

https://coinstats.app/coins/cartesi/

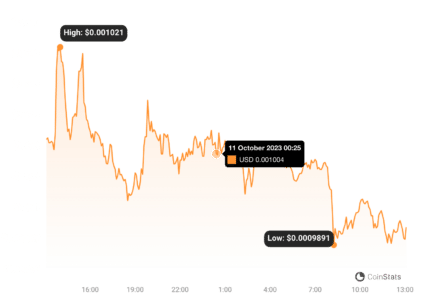

3 – Holo (HOT)

Holo (HOT), built on the Holochain, empowers Peer-To-Peer (P2P) applications and has earned its spot on this exclusive list primarily due to whale transactions. The Santiment report highlights a remarkable increase in whale accumulation among addresses holding between $100,000 and $1 million, as well as a surge in high-value whale transactions, exchange inflows, and age destroyed (Consumed).

https://coinstats.app/coins/holo/

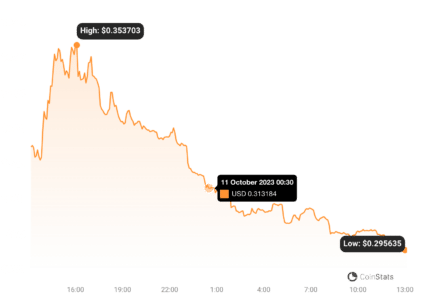

4 – Powerpool (CVP)

The Powerpool (CVP) protocol, focused on governance, mirrors trends reminiscent of Holo (HOT) mentioned above. Similar to Holo, there has been significant accumulation among whales holding $100,000 to $1 million. The analyst’s insight uncovers “High Active Addresses, Network Growth, $100K-$1M Whale Accumulation, and Age Destroyed (Consumed)”.

https://coinstats.app/coins/concentrated-voting-power/

5 – Storj (STORJ)

Storj (STORJ) is a pioneering project with a mission to provide environmentally conscious storage services, helping organizations reduce their carbon footprint and lower their cloud storage expenses. This under-the-radar altcoin has gained attention for the “High Transaction Volume, Active Addresses, Network Growth, Whale Accumulation, and Age Destroyed (Consumed),” as illustrated in the report.

https://coinstats.app/coins/storj/

6 – UniLend (UFT)

Unilend (UFT), a protocol that unifies decentralized finance (DeFi) trading into one accessible platform through smart contracts, has witnessed a surge in activity as well. Earning the sixth position on the list, Unilend’s growth encompasses “High Transaction Volume, Active Addresses, Network Growth, Whale Transactions, $100K-$1M Whale Accumulation, and Exchange Inflow.”

https://coinstats.app/coins/unlend-finance/

In the ever-evolving world of cryptocurrency, these undervalued altcoins, unearthed by the discerning Santiment analyst, offer investors an exciting opportunity to diversify their portfolios and potentially ride the waves of substantial profitability.